Key Takeaways:

- Ford Motor Company reports $1 billion in EBIT for Q1 2025, outperforming projections.

- Despite successful vehicle launches, revenue decreased to $41 billion due to planned downtimes.

- Ford suspends full-year guidance amid tariff-related uncertainties.

Ford Motor Company (NYSE: F) has made headlines by achieving a robust $1 billion in Earnings Before Interest and Taxes (EBIT) for the first quarter of 2025, exceeding market expectations. However, while the company celebrated successful vehicle launches and an expanded market share, revenue dipped to $41 billion. This decline was attributed to planned downtimes, signaling a potential area of investor concern. Additionally, uncertainties related to tariffs have compelled Ford to suspend its full-year guidance, leaving investors pondering the company's strategic direction for the remainder of the year.

Wall Street Analysts Forecast

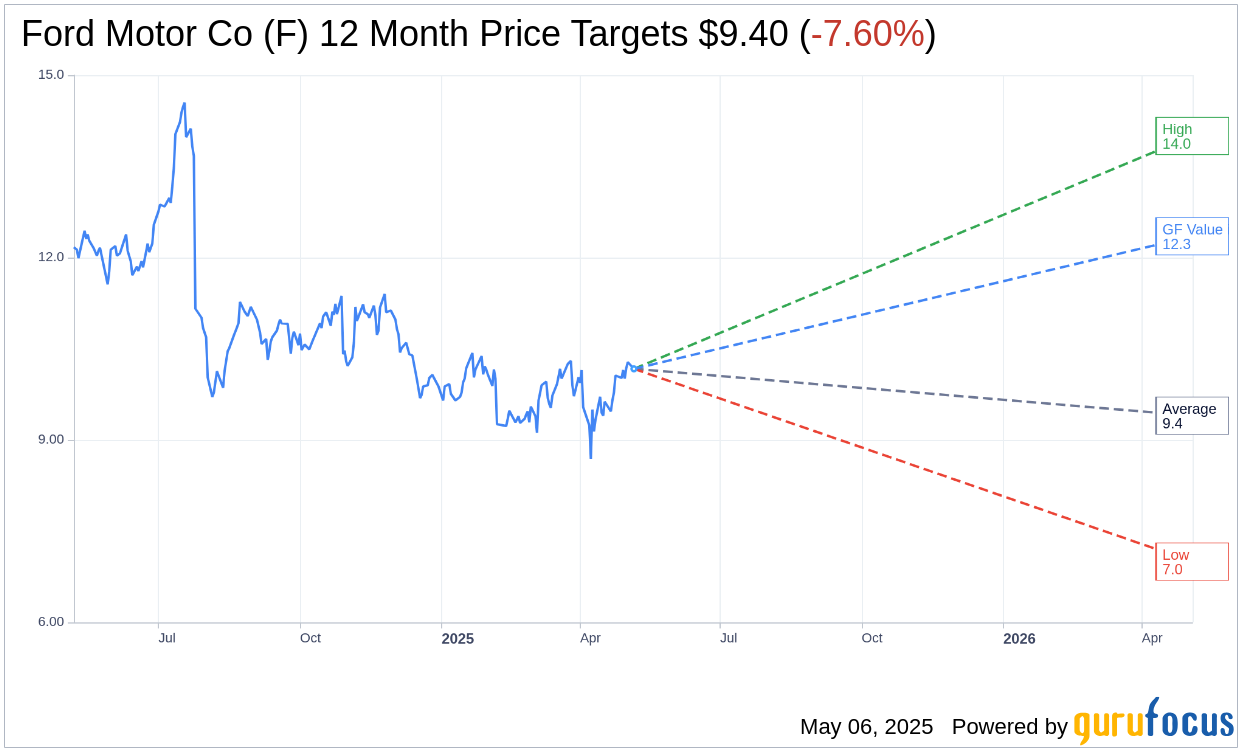

Currently, 24 analysts have provided one-year price targets for Ford Motor Co (F, Financial). The average target price is set at $9.40, with estimates ranging from a high of $14.00 to a low of $7.00. This suggests a potential downside of 7.60% from the present stock price of $10.17. For a more in-depth analysis, investors can refer to the Ford Motor Co (F) Forecast page.

The consensus from 27 brokerage firms places Ford Motor Co (F, Financial) with an average brokerage recommendation of 3.1, which corresponds to a "Hold" rating. In this scale, a rating of 1 indicates a Strong Buy, whereas 5 suggests a Sell.

GuruFocus GF Value Perspective

According to GuruFocus estimates, the GF Value of Ford Motor Co (F, Financial) in a year is projected at $12.35. This implies a promising upside potential of 21.44% from the current stock price of $10.17. The GF Value reflects GuruFocus' fair value estimation, derived from historical trading multiples, past business growth, and future performance projections. For additional insights and comprehensive data, visit the Ford Motor Co (F) Summary page.