Key Highlights:

- Advanced Micro Devices (AMD, Financial) faces potential revenue loss linked to export restrictions but remains a focal point for investors.

- Analyst projections indicate a significant upside potential for AMD stock in the coming year.

- Consensus ratings suggest AMD's stock is expected to "Outperform" in the market.

Advanced Micro Devices (AMD) is poised to release its quarterly earnings report amidst mounting concerns over international trade policies affecting the semiconductor industry. The company has highlighted that restrictions on chip exports could lead to a significant $800 million loss if licensing hurdles are not overcome. Investors are eagerly awaiting further insights and guidance from the company's management.

Wall Street Analysts' Projections

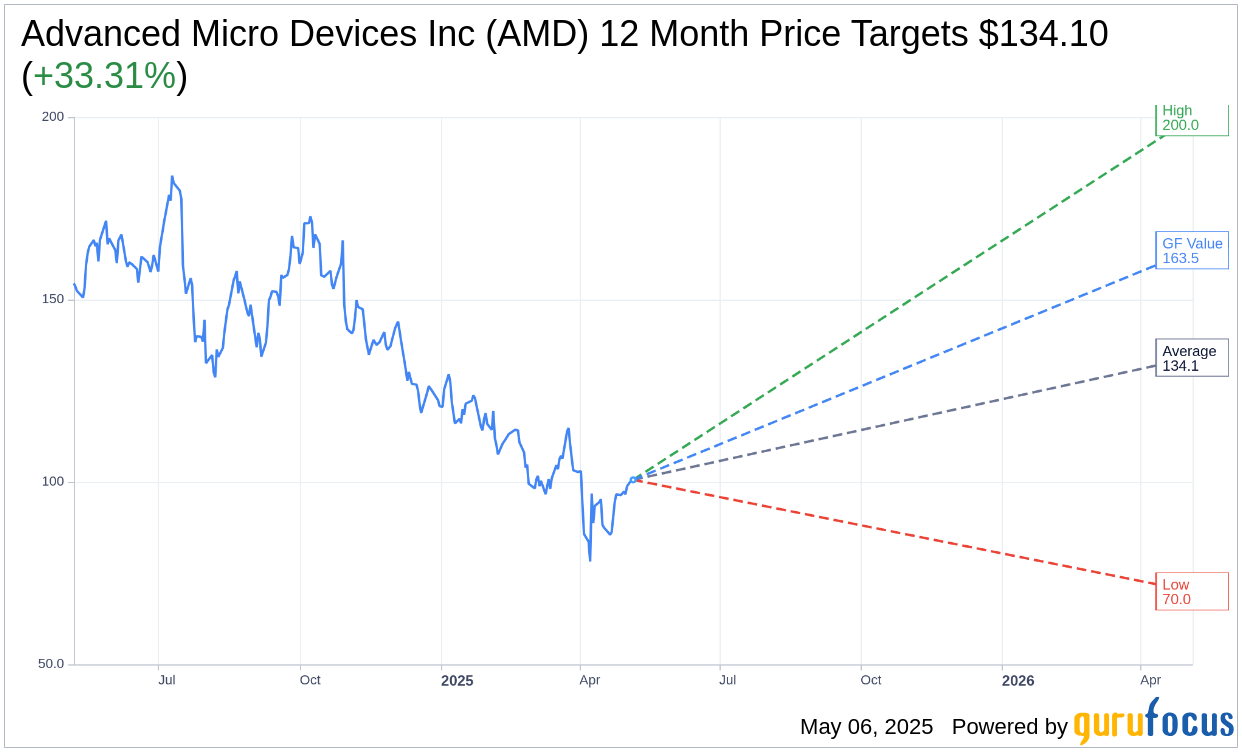

Based on the analyses provided by 40 financial experts, the consensus one-year price target for Advanced Micro Devices Inc (AMD, Financial) stands at $134.10. This includes a high projection of $200.00 and a low estimate of $70.00. These figures hint at a potential upside of 33.31% from AMD's current stock price of $100.59. Investors seeking more in-depth data can visit the Advanced Micro Devices Inc (AMD) Forecast page on GuruFocus.

In addition to price projections, the consensus recommendation from 51 brokerage firms places AMD at an average brokerage recommendation score of 2.3. This score corresponds to an "Outperform" rating on a scale from 1 (Strong Buy) to 5 (Sell), indicating a positive outlook for AMD in the stock market.

Evaluating GF Value and Upside Potential

According to GuruFocus estimates, the prospective GF Value for Advanced Micro Devices Inc (AMD, Financial) is projected to reach $163.53 within a year. This forecast suggests an impressive upside potential of 62.57% from the current trading price of $100.59. The GF Value metric is derived from an analysis of historical trading multiples, business growth patterns, and future performance projections. For a comprehensive overview, investors may refer to the Advanced Micro Devices Inc (AMD) Summary page on GuruFocus.