On May 6, 2025, Avient Corp (AVNT, Financial) released its 8-K filing detailing its first-quarter results for 2025. The company, known for manufacturing and selling chemical and plastic-based products, operates in two main segments: Color, Additives and Inks, and Specialty Engineered Materials. Avient Corp's diverse product portfolio serves industries such as food packaging, construction, transportation, cosmetics, and healthcare, with a significant portion of its revenue generated in the United States.

Performance Overview and Challenges

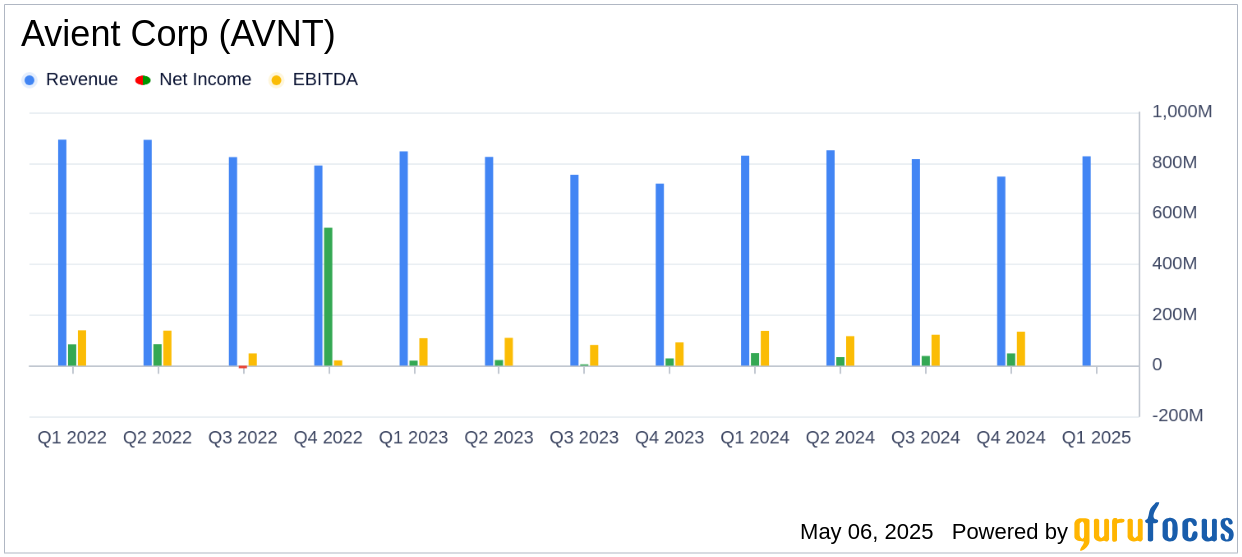

Avient Corp reported first-quarter sales of $826.6 million, slightly below the previous year's $829.0 million. Despite this, the company achieved a 2% organic sales growth, excluding foreign exchange impacts. The GAAP earnings per share (EPS) for the quarter was a loss of $0.22, a significant decline from the $0.54 profit in the prior year. This was primarily due to special items, including a $0.82 impact from an impairment related to the cessation of the S/4HANA ERP system development.

Adjusted EPS stood at $0.76, aligning with the company's guidance and reflecting a 4% growth over the previous year, excluding foreign exchange impacts. This performance is crucial as it demonstrates the company's resilience in a volatile macroeconomic environment, marked by evolving trade policies and fluctuating demand in key markets.

Financial Achievements and Industry Implications

Avient Corp's ability to maintain adjusted EPS growth and expand adjusted EBITDA margins by 20 basis points to 17.5% is noteworthy. This achievement underscores the company's strategic focus on cost control and investment in growth vectors, which are vital for sustaining competitiveness in the chemicals industry. The company's strong performance in Asia and Latin America, with organic sales growth of 9% and 17% respectively, highlights its successful regional strategies.

Key Financial Metrics and Analysis

The income statement reveals a gross margin of $263.2 million, down from $278.2 million in the previous year, primarily due to increased selling and administrative expenses. Operating income plummeted to $0.7 million from $94.0 million, reflecting the impact of special items and increased costs.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Sales | $826.6 million | $829.0 million |

| GAAP EPS | ($0.22) | $0.54 |

| Adjusted EPS | $0.76 | $0.76 |

From a balance sheet perspective, Avient Corp's total assets remained stable at approximately $5.81 billion. The company's cash position decreased to $456.0 million from $544.5 million at the end of 2024, influenced by cash used in operating and investing activities.

Commentary and Future Outlook

I'm pleased with our team's execution this quarter to deliver these results in a volatile and changing macro-economic backdrop," said Dr. Ashish Khandpur, President and Chief Executive Officer, Avient Corporation.

Looking ahead, Avient Corp anticipates continued demand volatility, particularly in consumer and transportation markets. However, opportunities in packaging, defense, and healthcare sectors are expected to drive growth. The company maintains its full-year adjusted EPS guidance of $2.70 to $2.94, reflecting confidence in its strategic initiatives and operational performance.

Avient Corp's commitment to debt reduction, with plans to pay down $100 to $200 million by year-end, further strengthens its financial position. This strategic focus on balance sheet optimization and cost management is crucial for navigating the current economic landscape and achieving long-term growth objectives.

Explore the complete 8-K earnings release (here) from Avient Corp for further details.