ENLT anticipates a diverse currency mix for its forthcoming revenue and income for fiscal year 2025, with 38% in Israeli Shekel (ILS), 35% in Euro (EUR), and 27% in U.S. Dollar (USD). The company forecasts its adjusted EBITDA to range between $360 million and $380 million. Additionally, it is expected that approximately 90% of the electricity output in 2025 will be sold at predetermined rates, secured through power purchase agreements (PPAs) or hedges.

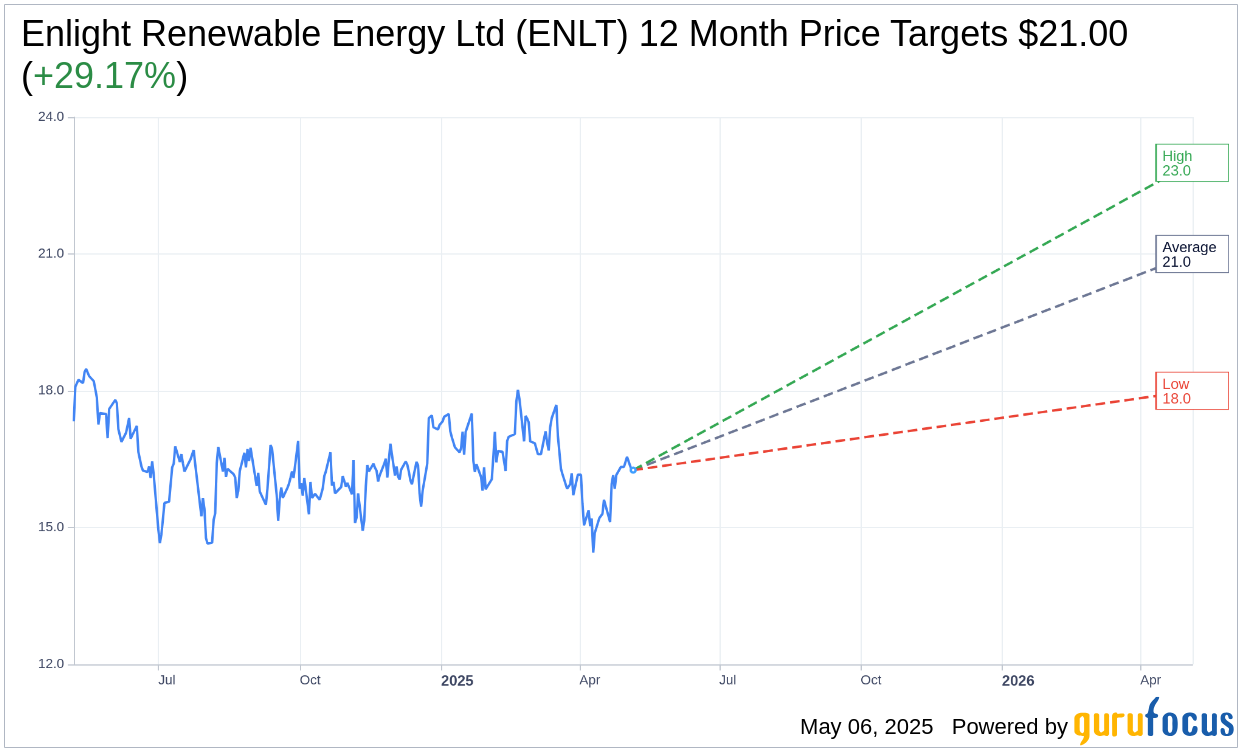

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Enlight Renewable Energy Ltd (ENLT, Financial) is $21.00 with a high estimate of $23.00 and a low estimate of $18.00. The average target implies an upside of 29.17% from the current price of $16.26. More detailed estimate data can be found on the Enlight Renewable Energy Ltd (ENLT) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Enlight Renewable Energy Ltd's (ENLT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enlight Renewable Energy Ltd (ENLT, Financial) in one year is $36.15, suggesting a upside of 122.36% from the current price of $16.2575. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enlight Renewable Energy Ltd (ENLT) Summary page.

ENLT Key Business Developments

Release Date: February 19, 2025

- Full Year 2024 Revenue: $399 million, a 53% increase year over year.

- Full Year 2024 Adjusted EBITDA: $289 million, a 49% increase year over year.

- Full Year 2024 Operating Cash Flow: $193 million, a 29% increase over 2023.

- Full Year 2024 Net Income: $67 million, a 32% decrease due to one-time items last year.

- Q4 2024 Revenue: $104 million, a 35% increase year over year.

- Q4 2024 Adjusted EBITDA: $65 million, a 31% increase year over year.

- Q4 2024 Operating Cash Flow: $36 million, a 49% increase year over year.

- Q4 2024 Net Income: $8 million, a 48% decrease due to one-time items last year.

- 2025 Revenue Guidance: $490 million to $510 million, a 25% increase over 2024.

- 2025 Adjusted EBITDA Guidance: $360 million to $380 million, a 28% increase over 2024.

- New Projects in 2024: 650 megawatts of generation capacity and 1.6 gigawatt hours of energy storage capacity connected.

- Current Operational Capacity: 2.5 gigawatts of generation and 1.9 gigawatt hours of energy storage.

- 2025 Projected COD: 440 megawatts and 1,100 megawatt hours of projects expected to reach COD.

- 2025 New Construction: 1.8 gigawatts and 3.9 gigawatt hours of new projects expected to begin construction.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Enlight Renewable Energy Ltd (ENLT, Financial) reported a 53% year-over-year revenue growth in 2024, reaching $399 million.

- Adjusted EBITDA increased by 49% to $289 million, showcasing strong financial performance.

- The company connected 650 megawatts of generation capacity and 1.6 gigawatt hours of energy storage capacity across Israel, Europe, and the US.

- Enlight Renewable Energy Ltd (ENLT) completed the financial closing of major projects, raising $1 billion in term loans and tax equity.

- The company anticipates 25% growth in operating capacity in 2025, with significant new projects expected to contribute to revenue and EBITDA growth.

Negative Points

- Net income dropped by 32% to $67 million in 2024, primarily due to one-time items from the previous year.

- Fourth-quarter net income fell 48% to $8 million, again due to one-time items from the previous year.

- The company faces potential minor impacts from a 10% tariff increase on equipment originating from China.

- Operating expenses increased by $6 million due to new projects, and company overheads rose by $5 million year over year.

- There is uncertainty regarding potential changes to the US Inflation Reduction Act (IRA) under the new administration, which could affect financing and tax equity availability.