Summary:

- Brookfield Asset Management (BAM, Financial) reported a slight miss on Q1 distributable earnings per share, coming in at $0.40.

- Revenue increased by 22.2% year-over-year but fell short of market expectations.

- Fee-related earnings saw a significant boost, rising 26% due to substantial asset inflows.

Brookfield Asset Management (BAM) recently announced its first-quarter results, highlighting a distributable earnings per share of $0.40, which narrowly missed analyst estimates by $0.01. Despite the earnings miss, the company's revenue surged to $1.08 billion, reflecting a 22.2% growth from the previous year. However, this figure was still $230 million below market expectations. The impressive 26% climb in fee-related earnings, reaching $698 million, was driven by substantial inflows exceeding $140 billion.

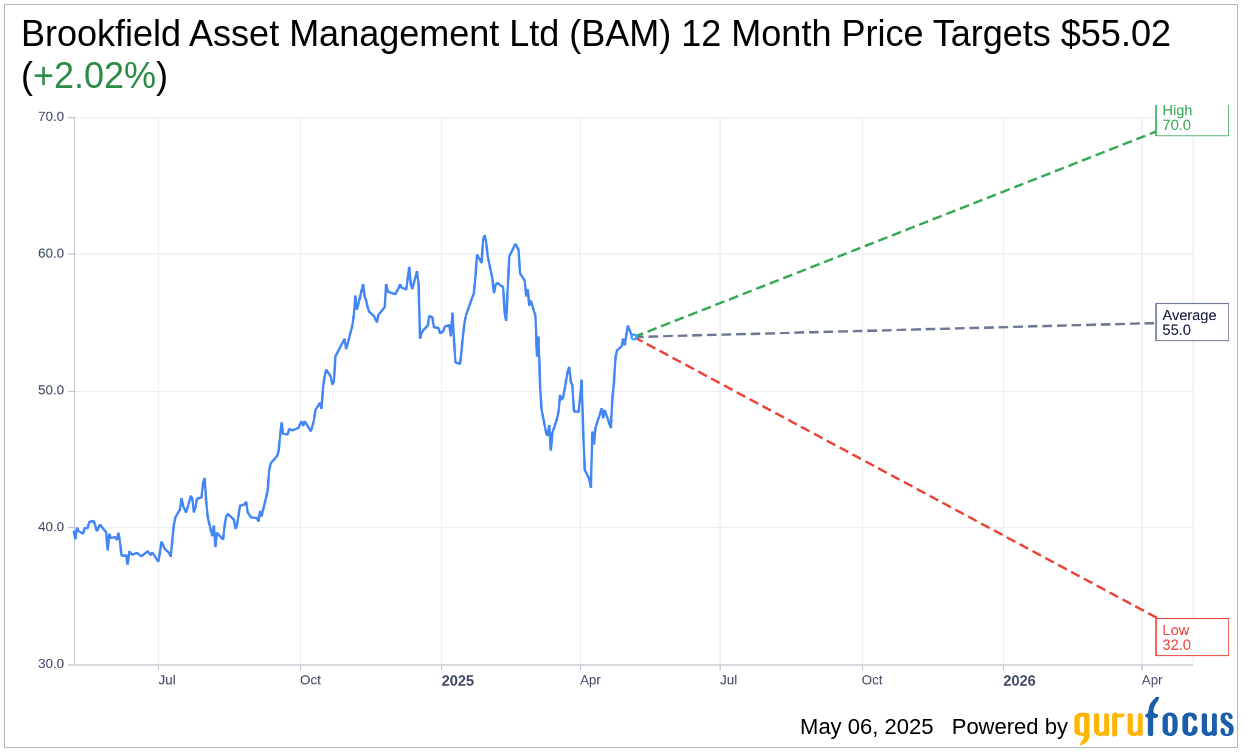

Wall Street Analysts Forecast

The current sentiment among Wall Street analysts offers a mixed perspective on Brookfield Asset Management Ltd (BAM, Financial). With insights from 15 leading analysts, the average target price stands at $55.02, suggesting a modest 2.02% upside from the current share price of $53.93. Price expectations range significantly, with estimates spanning from a low of $32.00 to a high of $70.00. For a deeper dive into these projections, be sure to visit the Brookfield Asset Management Ltd (BAM) Forecast page.

Evaluating the sentiments of 17 brokerage firms, Brookfield Asset Management Ltd (BAM, Financial) holds an average brokerage recommendation of 2.7, categorizing it as a "Hold." The recommendation spectrum ranges from 1, indicating a "Strong Buy," to 5, suggesting a "Sell" position.