- BWX Technologies (BWXT, Financial) exceeded earnings expectations with a notable 13% revenue increase.

- Analysts predict a significant potential upside for BWXT stock, with targets set as high as $166.

- GuruFocus' GF Value suggests a cautious outlook with an estimated downside from current prices.

Shares of BWX Technologies (BWXT) witnessed a 2.8% climb in premarket trading following the release of its first-quarter earnings report, which outperformed market expectations. The company announced a robust 13% rise in revenue, reaching $682.3 million and surpassing analyst forecasts. Additionally, BWXT's net income increased to $75.5 million, primarily driven by substantial growth in its government operations division.

Wall Street Analyst Projections

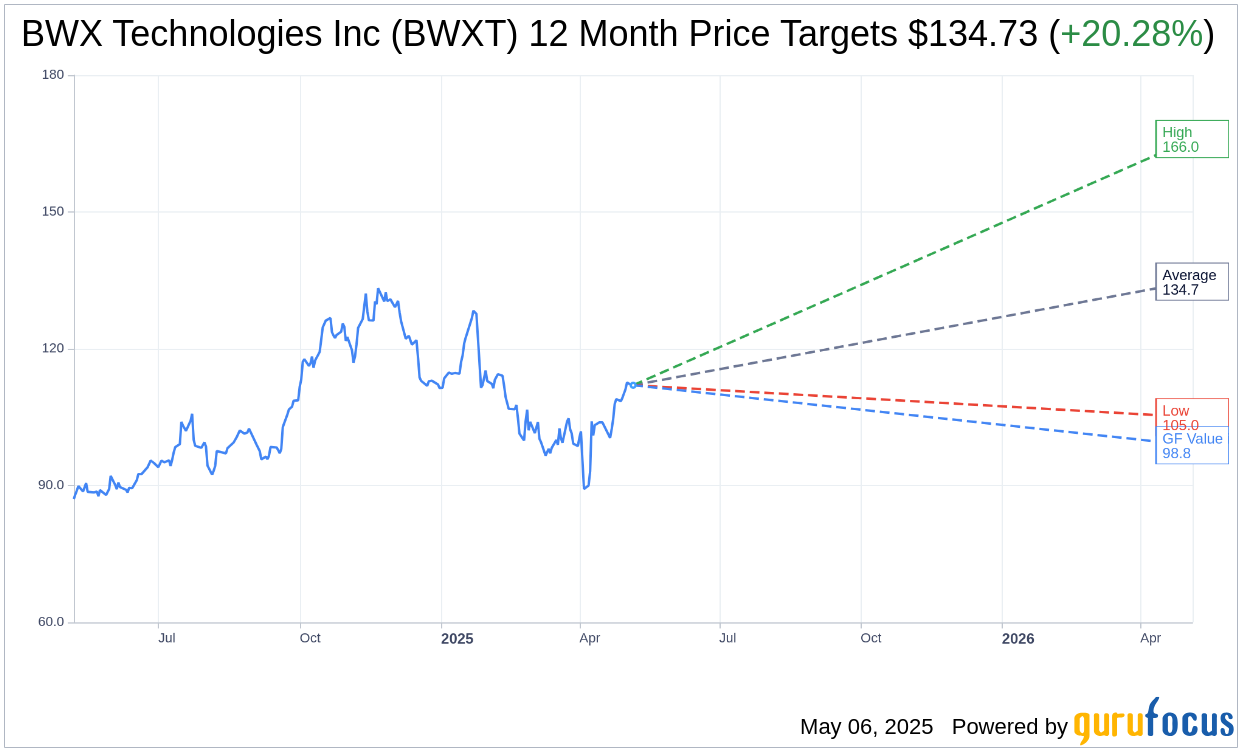

Analyzing the one-year price targets provided by 11 analysts, BWX Technologies Inc (BWXT, Financial) shows an average target price of $134.73. The projections vary, with a high estimate at $166.00 and a low at $105.00. This average target suggests a potential upside of 20.28% compared to the current market price of $112.01. For further details on these forecasts, visit the BWX Technologies Inc (BWXT) Forecast page.

According to the consensus from 11 brokerage firms, BWX Technologies Inc (BWXT, Financial) holds an average brokerage recommendation of 1.9, which translates to an "Outperform" rating. The rating system ranges from 1 to 5, with 1 indicating a Strong Buy and 5 reflecting a Sell.

However, when considering GuruFocus metrics, the estimated GF Value for BWX Technologies Inc (BWXT, Financial) over the next year stands at $98.83, hinting at a downside of 11.77% from the current price of $112.01. The GF Value is calculated using historical trading multiples, past business growth, and projected future performance. For more in-depth analysis, please visit the BWX Technologies Inc (BWXT) Summary page.