Barclays has increased its price target for First Quantum Minerals (FQVLF, Financial), moving it to C$21.60 from the previous C$21.40. The investment firm maintains an Overweight rating on the company's shares. This adjustment comes as First Quantum Minerals undertakes significant financial maneuvers, such as bond refinancing and prepayments, to enhance its balance sheet liquidity. These steps are particularly crucial as the company begins talks with the Panamanian government, according to an analyst's research note.

Wall Street Analysts Forecast

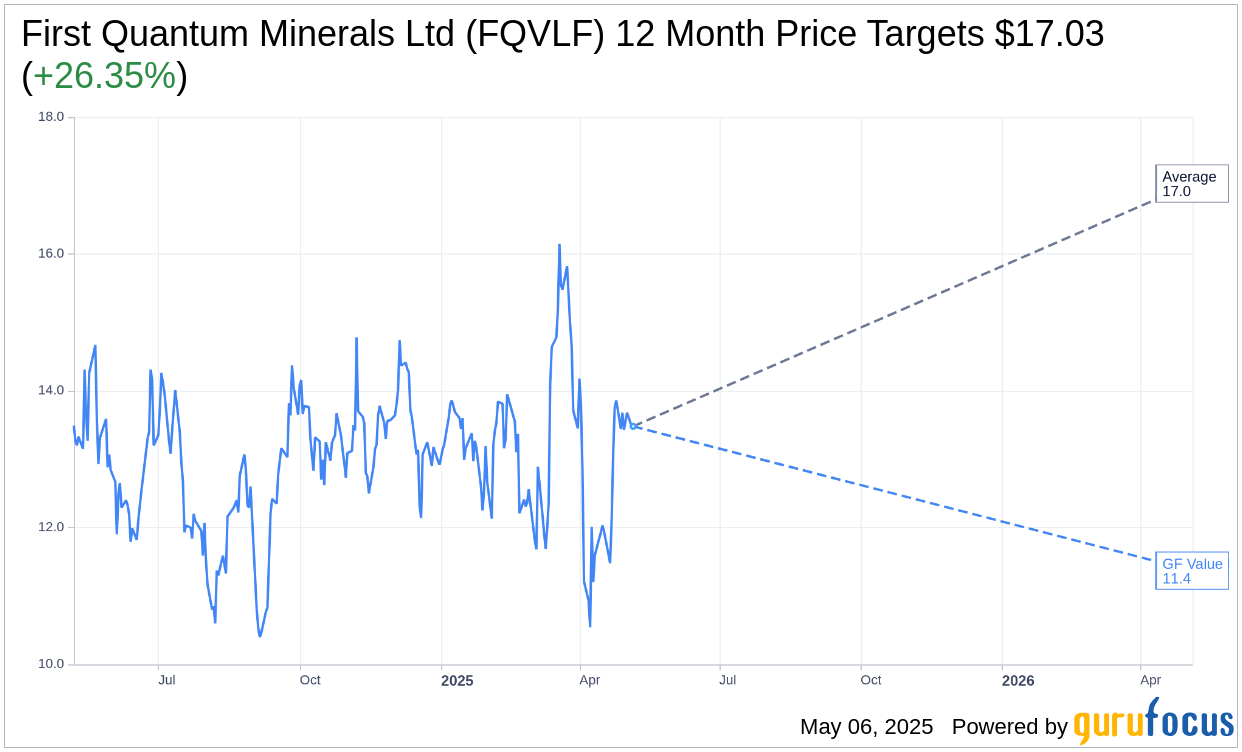

Based on the one-year price targets offered by 1 analysts, the average target price for First Quantum Minerals Ltd (FQVLF, Financial) is $17.03 with a high estimate of $17.03 and a low estimate of $17.03. The average target implies an upside of 26.35% from the current price of $13.48. More detailed estimate data can be found on the First Quantum Minerals Ltd (FQVLF) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, First Quantum Minerals Ltd's (FQVLF, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First Quantum Minerals Ltd (FQVLF, Financial) in one year is $11.37, suggesting a downside of 15.65% from the current price of $13.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First Quantum Minerals Ltd (FQVLF) Summary page.

FQVLF Key Business Developments

Release Date: February 12, 2025

- Total Copper Production (2024): 431,000 tonnes, 14% higher than the prior year, exceeding guidance of 420,000 tonnes.

- Gold Production (2024): 139,000 ounces, exceeding guidance of 135,000 ounces.

- Nickel Production (2024): 24,000 tonnes, within guidance range.

- Q4 Copper Production: 112,000 tonnes.

- Q4 Net Earnings: $99 million.

- Adjusted Earnings Per Share (Q4): $0.14.

- Copper C1 Costs (Q4): $1.68 per pound, up 7% due to lower production volumes and increased costs.

- Full-Year Copper C1 Costs: $1.74 per pound, below revised guidance.

- Revenue (Q4): Down 2% quarter over quarter.

- EBITDA (Q4): Down 13% quarter over quarter.

- Net Debt (Q4): Decreased by $61 million to $5.5 billion.

- Liquidity (Q4): $1.6 billion, including $112 million in cash and $750 million of undrawn revolver.

- 2025 CapEx Guidance: $1.3 billion to $1.45 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- First Quantum Minerals Ltd (FQVLF, Financial) exceeded its 2024 copper and gold production guidance, with copper production reaching 431,000 tonnes and gold production at 139,000 ounces.

- The Kansanshi S3 expansion project is on track, with strong progress reported, and is expected to be completed by mid-2025.

- The company successfully reduced net debt by $61 million in the fourth quarter, bringing it down to $5.5 billion.

- Operational initiatives led to strong performance at Kansanshi and Sentinel, with Kansanshi achieving its highest annual copper production since 2021.

- First Quantum Minerals Ltd (FQVLF) maintained strong liquidity at $1.6 billion, including $112 million in cash and $750 million of undrawn revolver.

Negative Points

- The company faces ongoing challenges in Panama, with unresolved issues related to the Cobre Panama mine and pending approval of the Preservation and Safe Management program.

- Copper C1 costs increased by 7% to $1.68 per pound due to lower production volumes and higher costs at Sentinel.

- The environmental audit in Panama could potentially lead to long-term restoration costs and impact operations.

- The Zambian energy situation remains challenging, with reliance on supplementary power imports expected to continue into 2025.

- Nickel production at Enterprise was impacted by weathering and alteration, leading to lower production and increased costs.