Cipher Mining (CIFR, Financial) reported a first-quarter revenue of $49 million, falling short of the expected $51.52 million. Despite this, the company made significant strides in its 2025 expansion goals. CEO Tyler Page highlighted the partnership with Fortress to develop an advanced data center at Barber Lake, leveraging Fortress's expertise and connections with major industry players.

Progress is underway at the Black Pearl Data Center, where Phase I construction is nearly complete, with all necessary transformers already onsite. The company plans to start using existing inventory rigs immediately, facilitating 2.5 exahashes per second of processing power to go live a quarter earlier than planned. This move is strategically managed with no extra capital costs, maximizing asset utilization while awaiting new machinery expected later this summer.

Cipher Mining's prudent financial management and adaptability are pivotal in maneuvering through the current market dynamics to ensure sustained growth and success, according to Page. The company's strategic initiatives reflect its commitment to long-term operational efficiency and market positioning.

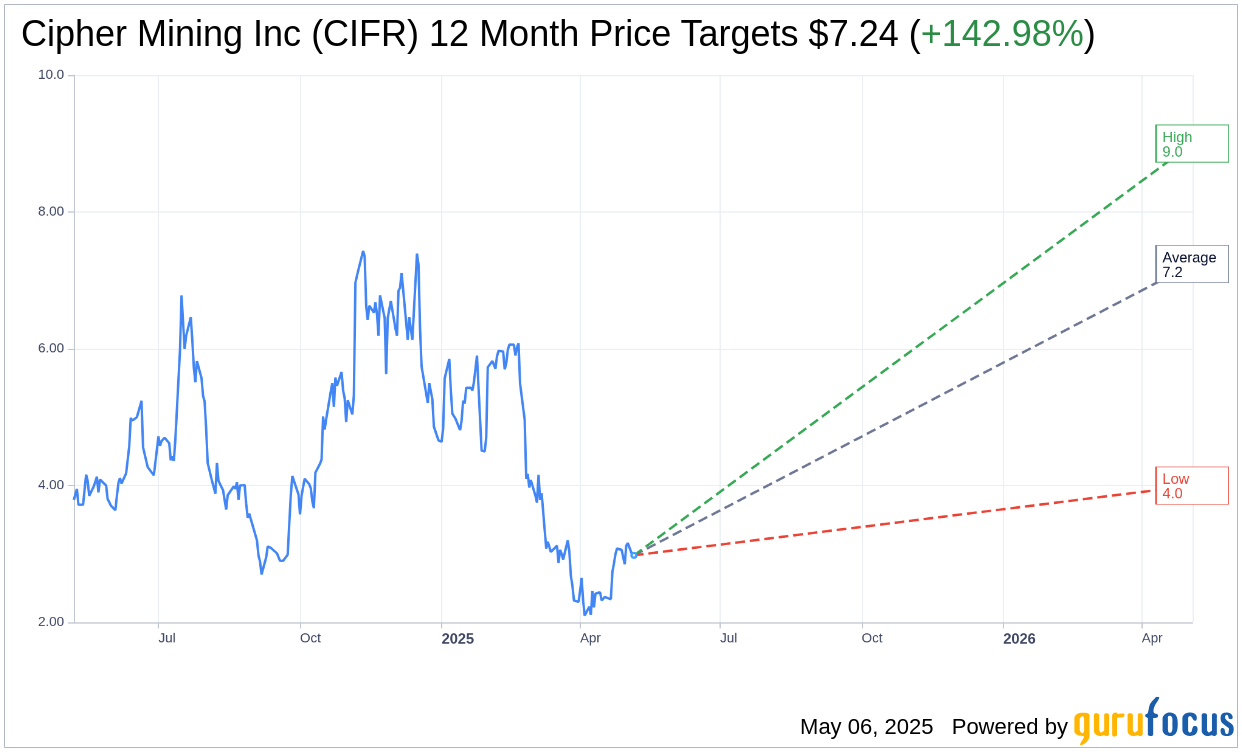

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Cipher Mining Inc (CIFR, Financial) is $7.24 with a high estimate of $9.00 and a low estimate of $4.00. The average target implies an upside of 142.98% from the current price of $2.98. More detailed estimate data can be found on the Cipher Mining Inc (CIFR) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Cipher Mining Inc's (CIFR, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

CIFR Key Business Developments

Release Date: February 25, 2025

- Revenue: $42 million in Q4 2024, a 75% increase from $24 million in Q3 2024.

- GAAP Net Earnings: $18 million in Q4 2024, or $0.05 per share.

- Adjusted Earnings: $51 million in Q4 2024, or $0.14 per share.

- Annual Revenue Increase: $24 million increase compared to 2023.

- GAAP Net Loss for 2024: $45 million, or a loss of $0.14 per share.

- Adjusted Earnings for 2024: $107 million, up from $46 million in 2023.

- Hash Rate: Increased from 7.2 exahash at the end of 2023 to 13.5 exahash at the end of 2024.

- Bitcoin Mined: 492 Bitcoin in Q4 2024 at an average price of $84,000 per Bitcoin.

- Cash Position: $6 million at year-end 2024.

- Bitcoin Holdings: 994 Bitcoin valued at $93 million at year-end 2024.

- Operating Expenses: Increased by $48 million in 2024, primarily due to depreciation and amortization.

- Depreciation Expense: $36 million in Q4 2024, a 27% increase from the prior quarter.

- SoftBank Investment: $50 million through the purchase of approximately 10.4 million shares.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cipher Mining Inc (CIFR, Financial) reported strong fourth-quarter revenues of $42 million and GAAP net earnings of $18 million, with adjusted earnings reaching $51 million.

- The company successfully upgraded its Odessa fleet, increasing its self-mining hash rate to 13.5 exahashes per second, with projections to reach 23 exahashes per second by Q3 2025.

- Cipher Mining Inc (CIFR) maintains a competitive all-in weighted average power price of $2.07 per kilowatt-hour, which is a key driver of its strong unit economics.

- The company has expanded its development pipeline to 2.8 gigawatts, positioning itself as a market leader in HPC data centers and Bitcoin mining.

- Cipher Mining Inc (CIFR) secured a $50 million investment from SoftBank, strengthening its ability to expand its data center development business.

Negative Points

- Cipher Mining Inc (CIFR) reported a GAAP net loss of $45 million for the full year 2024, despite strong quarterly performance.

- Operating expenses increased by $48 million in 2024, primarily driven by depreciation and amortization expenses.

- The company's cost of revenues increased by 21% sequentially due to strategic power purchases during curtailment periods.

- Cipher Mining Inc (CIFR) faces potential challenges in securing long-term power contracts post-2027, as current fixed-price contracts expire.

- The company has significant capital expenditures planned for 2025, including $200 million for Phase 1 of Black Pearl, which may require additional financing.