American Electric Power (AEP, Financial) announced first-quarter revenue of $5.46 billion, surpassing market expectations of $5.18 billion. The substantial earnings are attributed to effective strategies and innovations by the company's team, aiming to fulfill commitments to various stakeholders, including customers, communities, regulators, and investors.

In light of this impressive performance, AEP remains optimistic about its future, affirming its operating earnings guidance for 2025 to be between $5.75 and $5.95 per share. Additionally, the company has reiterated its outlook for a sustained long-term growth rate of 6% to 8%.

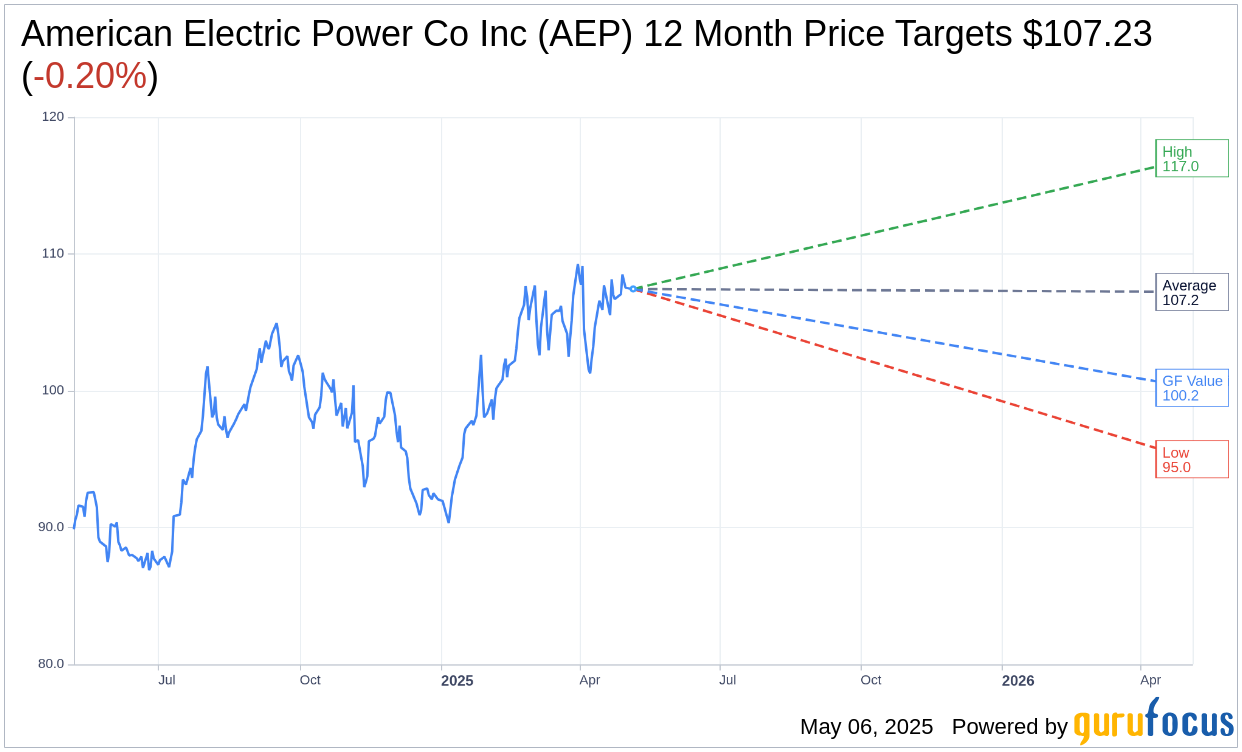

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for American Electric Power Co Inc (AEP, Financial) is $107.23 with a high estimate of $117.00 and a low estimate of $95.00. The average target implies an downside of 0.20% from the current price of $107.44. More detailed estimate data can be found on the American Electric Power Co Inc (AEP) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, American Electric Power Co Inc's (AEP, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for American Electric Power Co Inc (AEP, Financial) in one year is $100.22, suggesting a downside of 6.72% from the current price of $107.44. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the American Electric Power Co Inc (AEP) Summary page.

AEP Key Business Developments

Release Date: February 13, 2025

- Fourth Quarter Operating Earnings: $1.24 per share or $660 million.

- Full Year 2024 Operating Earnings: $5.62 per share.

- GAAP Earnings for Q4 2024: $1.25 per share.

- GAAP Earnings for Full Year 2024: $5.60 per share.

- 2025 Operating Earnings Guidance: $5.75 to $5.95 per share.

- Long-term Operating Earnings Growth Rate: 6% to 8%.

- Capital Plan: $54 billion from 2025 through 2029.

- Commercial Loan Growth Q4 2024: 12.3% over the fourth quarter.

- Full Year Commercial Loan Growth 2024: 10.6% compared to 2023.

- Debt to Capitalization: Consistent with historical range.

- FFO to Debt: 14% for the 12 months ended December 31.

- Available Liquidity: $4.6 billion.

- Credit Facilities: $6 billion.

- Minority Interest Transaction: $2.82 billion with KKR and PSP investments.

- Incremental Growth Capital: Evaluating $10 billion over the next five years.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- American Electric Power Co Inc (AEP, Financial) reported strong fourth quarter 2024 operating earnings of $1.24 per share, contributing to a full-year operating earnings of $5.62 per share, reflecting a 7% year-over-year increase.

- The company reaffirmed its 2025 operating earnings guidance range of $5.75 to $5.95 per share and a long-term operating earnings growth rate of 6% to 8%, supported by a robust $54 billion capital plan from 2025 through 2029.

- AEP announced a highly accretive transaction involving the Ohio and I&M minority interest in the transmission business, valued at $2.82 billion, which is expected to close in the second half of 2025.

- The company is experiencing significant load growth, particularly from data centers, with commercial loan growth of 12.3% in the fourth quarter and 10.6% for the full year compared to 2023.

- AEP is actively pursuing innovative solutions, such as partnerships with Bloom Energy for fuel cells and exploring small modular reactors (SMRs) to meet growing energy demands.

Negative Points

- Higher operating and maintenance (O&M) costs and lower margins at the Generation & Marketing segment partially offset the favorable drivers in the fourth quarter.

- The company faces challenges in managing increased property taxes, depreciation, and interest expenses, which impacted the Transmission & Distribution Utilities segment.

- AEP's financial metrics, such as FFO to debt, are expected to be affected by changes in Moody's calculation of deferred fuel, potentially dropping by 40 to 60 basis points.

- The company is navigating complex regulatory environments, with ongoing discussions and settlements required for data center tariffs in states like Ohio and Indiana.

- AEP's ambitious capital plan and growth opportunities necessitate careful management of financing needs, including potential equity issuance and securitization, to maintain a strong balance sheet.