In the first quarter of 2025, WLFC demonstrated notable financial growth, with revenue increasing to $157.7 million compared to $119.1 million in the same period last year. This substantial rise underscores the robustness of WLFC's business strategy, which focuses on delivering cutting-edge and efficient solutions to the aviation sector.

Despite the uncertainties introduced by tariff-related market fluctuations, WLFC maintains confidence in the core strengths driving its business. A key factor influencing their success is the continued high cost of new engines, which pushes airlines towards leasing options. Moreover, WLFC's comprehensive maintenance programs provide airlines with valuable cost efficiency and predictability.

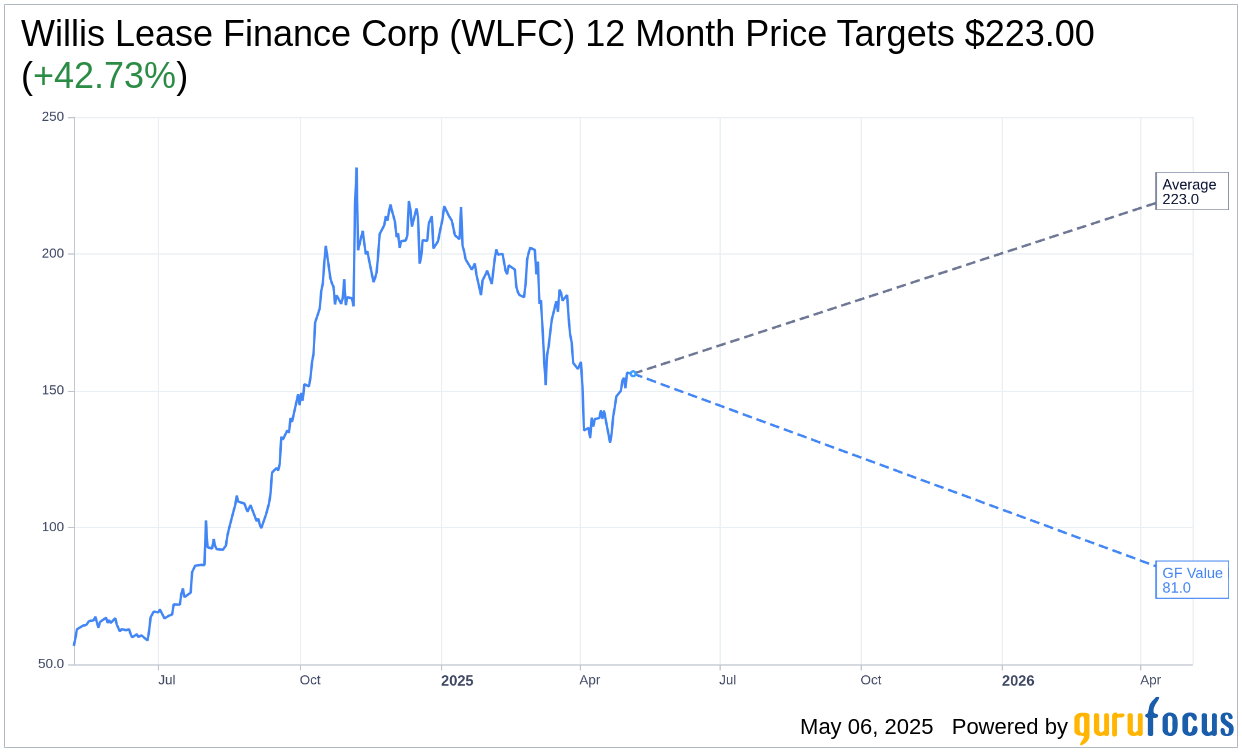

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Willis Lease Finance Corp (WLFC, Financial) is $223.00 with a high estimate of $223.00 and a low estimate of $223.00. The average target implies an upside of 42.73% from the current price of $156.24. More detailed estimate data can be found on the Willis Lease Finance Corp (WLFC) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Willis Lease Finance Corp's (WLFC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Willis Lease Finance Corp (WLFC, Financial) in one year is $80.96, suggesting a downside of 48.18% from the current price of $156.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Willis Lease Finance Corp (WLFC) Summary page.

WLFC Key Business Developments

Release Date: March 10, 2025

- Total Revenue (Q4 2024): $152.8 million

- Total Revenue (Full Year 2024): $569.2 million

- Pre-Tax Income (Q4 2024): $30.4 million

- Pre-Tax Income (Full Year 2024): $152.6 million

- Return on Equity (2024): 21%

- Core Lease Rent Revenues (2024): $238.2 million

- Interest Revenues (2024): $11.7 million

- Maintenance Reserve Revenues (2024): $213.9 million

- Spare Parts and Equipment Sales (2024): $27.1 million

- Gain on Sale of Lease Equipment (2024): $45.1 million

- Net Income Attributable to Common Shareholders (2024): $104.4 million

- Diluted Weighted Average Income Per Share (2024): $15.34

- Cash Flow from Operations (2024): $284.4 million

- Total Debt Obligations (Year-End 2024): $2.3 billion

- Leverage Ratio (Q4 2024): 3.48 times

- Quarterly Dividend (February 2025): $0.25 per share

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Willis Lease Finance Corp (WLFC, Financial) achieved a record year in 2024 with a pre-tax income of $152.6 million, up 127% from the previous year.

- The company reported a strong return on equity of 21%, marking its strongest year as a publicly traded company.

- WLFC successfully returned capital to shareholders through dividends, including a special dividend and regular quarterly dividends.

- The company acquired nearly $1 billion in engines and aircraft, focusing on future technology assets like LEAP and GTF engines.

- WLFC's ConstantThrust program continues to gain traction, providing significant savings for customers and creating value through efficient asset management.

Negative Points

- The company faced increased general and administrative expenses, rising to $146.8 million in 2024, driven by personnel costs and share-based compensation.

- Net finance costs increased to $104.8 million due to higher indebtedness and rising interest rates.

- The company experienced a $11.2 million write-down of equipment, with $10.4 million occurring in the fourth quarter.

- Gross margins for maintenance services were slightly negative at minus 1% due to the build-out of fixed base operator services.

- The absence of a test cell in WLFC's repair facilities may pose challenges in engine testing and availability of slots.