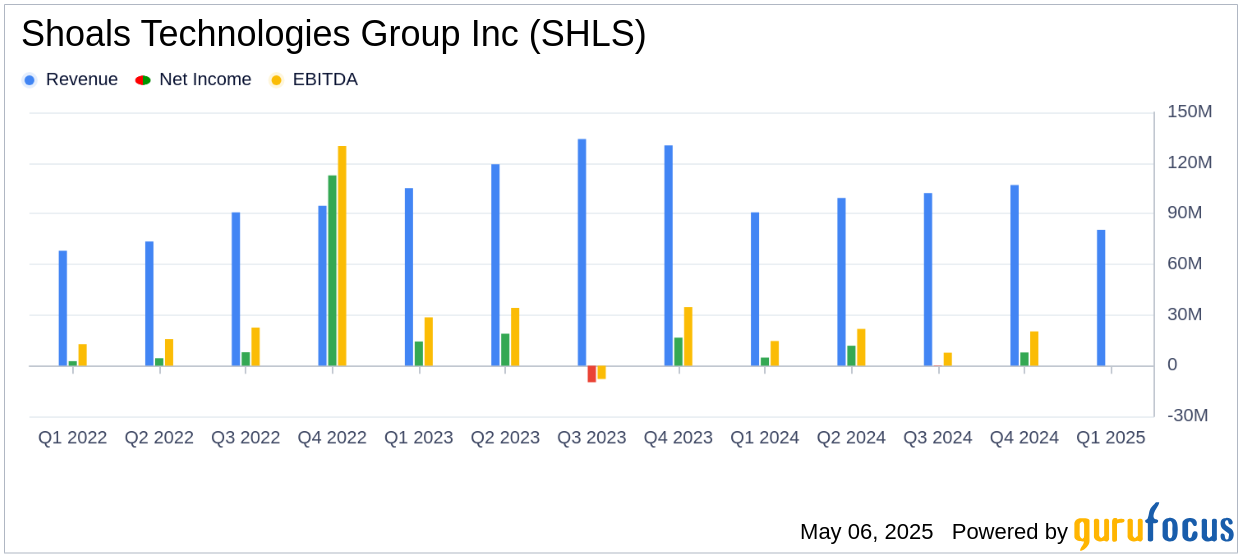

Shoals Technologies Group Inc (SHLS, Financial) released its 8-K filing on May 6, 2025, reporting financial results for the first quarter of 2025. The company, a leading provider of electrical balance of system (EBOS) solutions for solar energy projects, announced quarterly revenue of $80.4 million, surpassing the analyst estimate of $74.48 million. However, the company reported a net loss of $0.3 million, translating to an earnings per share (EPS) of $(0.00), which fell short of the estimated EPS of 0.01.

Company Overview

Shoals Technologies Group Inc (SHLS, Financial) specializes in providing EBOS solutions and components, including battery energy storage solutions (BESS) and Original Equipment Manufacturer (OEM) components, primarily for the U.S. solar energy market. The company's products are essential for carrying electric current from solar panels to inverters, and they are primarily sold to engineering, procurement, and construction firms.

Performance and Challenges

Despite exceeding revenue expectations, Shoals Technologies Group Inc (SHLS, Financial) faced a decline in profitability. Revenue decreased by 11.5% compared to the prior-year period, primarily due to strategic pricing actions, volume discounts, and changes in customer and product mix. The gross margin also declined to 35.0% from 40.2% in the previous year, reflecting reduced fixed cost absorption due to lower revenues.

Financial Achievements and Industry Importance

The company's backlog and awarded orders increased by 5% year-over-year to $645.1 million, indicating strong demand for its innovative products. This growth is significant for the semiconductor industry, as it highlights the company's ability to maintain a robust pipeline despite market volatility. The backlog includes approximately $500 million scheduled for the coming four quarters, showcasing the company's strategic initiatives in market penetration and diversification.

Key Financial Metrics

The income statement reveals a gross profit of $28.1 million, down from $36.5 million in the prior-year period. Operating expenses decreased slightly to $23.8 million, with a notable reduction in general legal expenses. However, income from operations fell to $4.3 million from $11.6 million in the previous year. Adjusted EBITDA decreased to $12.8 million from $20.5 million, reflecting the challenges faced by the company.

We began the year with a strong start, delivering revenue above our guided range. The investment that we have made in our commercial function is paying dividends as evidenced in both the growth and quality of our order book," said Brandon Moss, CEO of Shoals.

Analysis and Outlook

Shoals Technologies Group Inc (SHLS, Financial) demonstrated resilience by exceeding revenue expectations, but the decline in profitability highlights the challenges posed by strategic pricing and market conditions. The company's strong backlog and awarded orders indicate a positive outlook, with significant growth potential in international markets. For the second quarter of 2025, the company expects revenue between $100 million and $110 million, with adjusted EBITDA ranging from $20 million to $25 million. The full-year outlook projects revenue between $410 million and $450 million, emphasizing the company's strategic focus on market expansion and innovation.

Explore the complete 8-K earnings release (here) from Shoals Technologies Group Inc for further details.