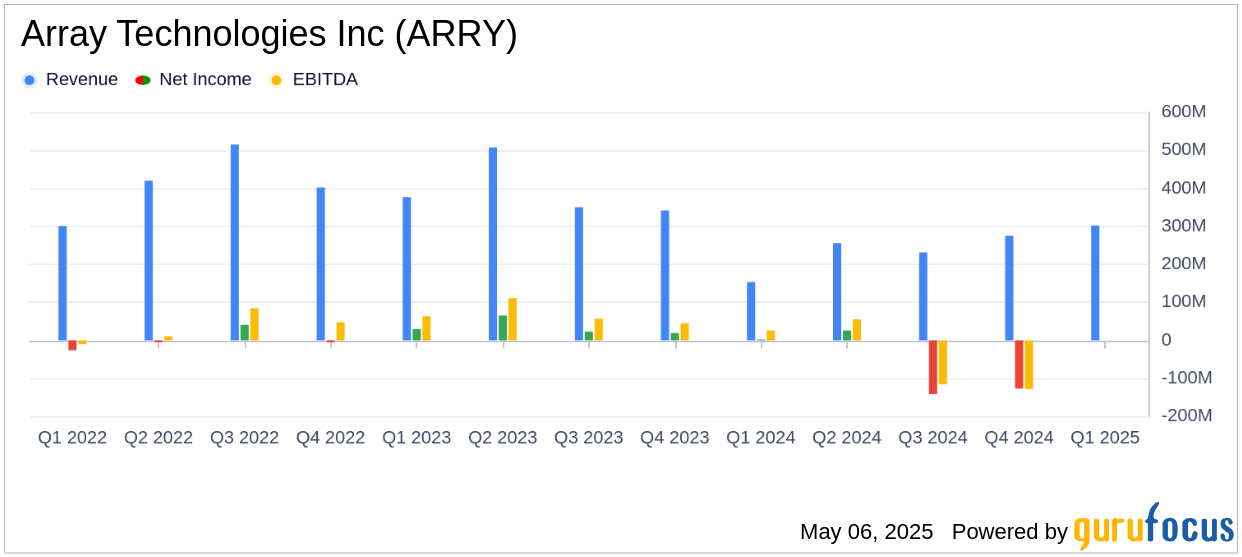

Array Technologies Inc (ARRY, Financial) released its 8-K filing on May 6, 2025, reporting impressive financial results for the first quarter of 2025. The company, a leading manufacturer of ground-mounting systems used in solar energy projects, reported a revenue of $302.4 million, significantly surpassing the analyst estimate of $264.43 million. Additionally, the company achieved a net income per basic and diluted share of $0.02, outperforming the estimated earnings per share of -$0.04.

Company Overview

Array Technologies Inc (ARRY, Financial) specializes in solar tracking technology, providing integrated systems of steel supports, electric motors, gearboxes, and electronic controllers known as single-axis trackers. These systems optimize solar panel orientation to enhance energy production. The company operates through two segments: the Array Legacy Operations and the STI Operations, with the majority of revenue derived from the Array Legacy Operations. Array Technologies Inc's operations span the United States, Australia, Spain, Brazil, and other regions, with the U.S. being the primary revenue source.

Performance and Challenges

The first quarter of 2025 marked a significant achievement for Array Technologies Inc, with revenue growth in high double digits compared to the same period in 2024. This growth reflects a robust market share recovery and strong execution capabilities. The company also reported the second-largest quarter of volume shipped since 2023. However, challenges such as global economic uncertainty, tariffs, and potential changes to the Inflation Reduction Act (IRA) remain. Despite these challenges, the company is confident in navigating the utility-scale solar landscape.

Financial Achievements

Array Technologies Inc's financial achievements in Q1 2025 are noteworthy. The company reported a gross margin of 25.3% and an adjusted gross margin of 26.5%. The adjusted EBITDA stood at $40.6 million, highlighting the company's operational efficiency. These achievements are crucial for a company in the solar technology industry, as they indicate strong financial health and the ability to invest in future growth.

Key Financial Metrics

Key details from the financial statements reveal a net income to common shareholders of $2.3 million and an adjusted net income per diluted share of $0.13. The company's total executed contracts and awarded orders reached $2.0 billion by March 31, 2025. Additionally, Array Technologies Inc successfully amended and extended its Revolving Credit Facility, enhancing its financial flexibility.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $302.4 million | $153.4 million |

| Gross Margin | 25.3% | 35.9% |

| Net Income to Common Shareholders | $2.3 million | $(11.3) million |

| Adjusted EBITDA | $40.6 million | $26.2 million |

Analysis and Outlook

Array Technologies Inc's performance in Q1 2025 demonstrates its resilience and adaptability in a challenging market environment. The company's ability to exceed revenue and earnings expectations underscores its strong market position and operational capabilities. With a solid order book and increasing interest in Volume Commitment Agreements, Array Technologies Inc is well-positioned for continued growth. The company's focus on supply chain resilience and domestic content trackers further enhances its competitive edge.

“ARRAY is off to a great start for 2025 with first quarter high double digits revenue growth compared with the first quarter of 2024, and achieving the second largest quarter of volume shipped since 2023, indicating solid market share recovery and the strength of our execution capabilities,” said Chief Executive Officer, Kevin G. Hostetler.

Array Technologies Inc maintains its full-year 2025 guidance, with revenue expected to range between $1.05 billion and $1.15 billion, and adjusted net income per share projected to be between $0.60 and $0.70. This guidance reflects the company's confidence in its strategic direction and ability to deliver long-term value to shareholders.

Explore the complete 8-K earnings release (here) from Array Technologies Inc for further details.