Telesat (TSAT, Financial) reported first-quarter revenue of C$117 million, marking a decline from C$152 million in the same period last year. The company emphasized steady progress within its GEO operations and its Telesat Lightspeed initiatives. Recent agreements with Viasat, Orange, and ADN underscore the market's positive reception of Telesat Lightspeed. Currently, the backlog for their Low Earth Orbit (LEO) segment stands at nearly $1.1 billion, and expectations are set for this backlog to surpass the GEO segment's by the end of 2025.

In the GEO sector, disciplined approach yielded a notable Adjusted EBITDA margin of 74%, alongside a significant contractual backlog totalling $1.0 billion. Telesat maintains confidence in achieving its 2025 financial targets as previously outlined in earlier discussions.

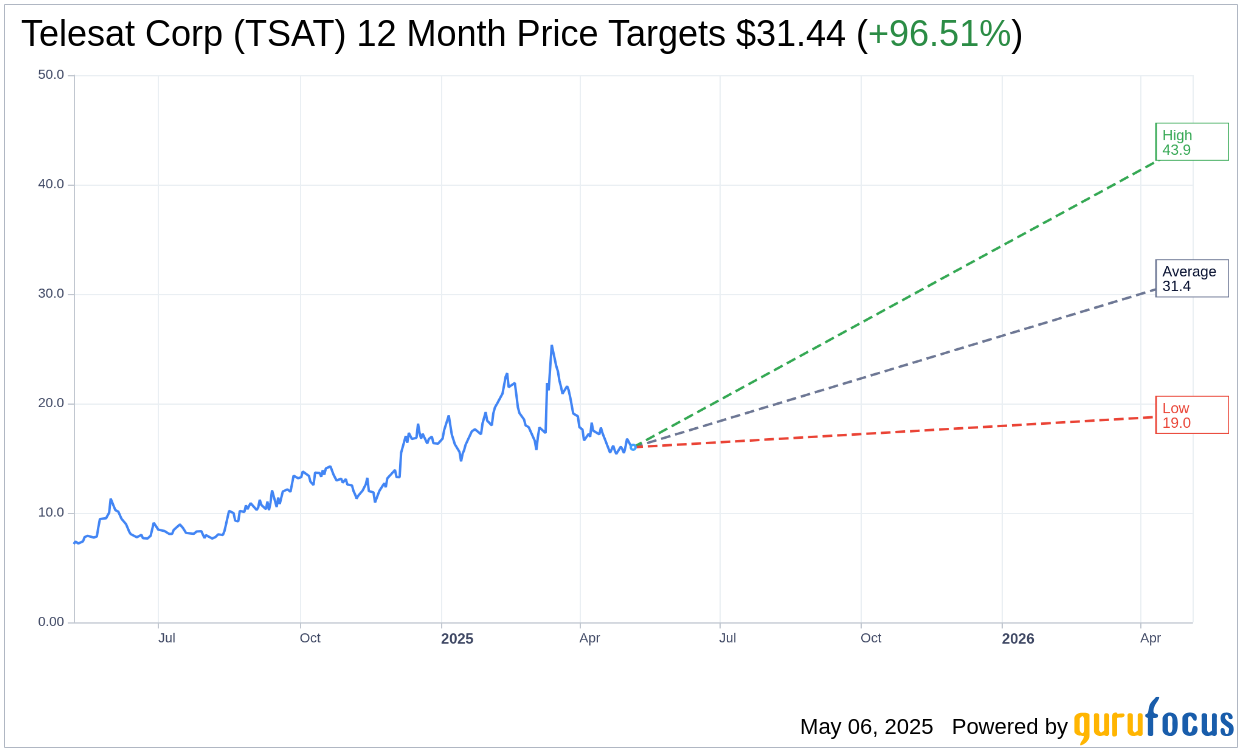

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Telesat Corp (TSAT, Financial) is $31.44 with a high estimate of $43.92 and a low estimate of $18.96. The average target implies an upside of 96.51% from the current price of $16.00. More detailed estimate data can be found on the Telesat Corp (TSAT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Telesat Corp's (TSAT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Telesat Corp (TSAT, Financial) in one year is $4.79, suggesting a downside of 70.06% from the current price of $16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Telesat Corp (TSAT) Summary page.

TSAT Key Business Developments

Release Date: March 27, 2025

- Revenue: $571 million for the year 2024; $128 million for Q4 2024.

- Adjusted EBITDA: $384 million for the year 2024; $73 million for Q4 2024.

- Cash from Operations: $62 million for the year 2024.

- Cash on Balance Sheet: $552 million at year-end 2024.

- Adjusted EBITDA Margin: 67.4% for Q4 2024, down from 74.3% in Q4 2023.

- GEO Segment Adjusted EBITDA Margin: 78% for Q4 2024, down from 82.2% in Q4 2023.

- Net Loss: $447 million for Q4 2024; $302 million for the full year 2024.

- Capital Expenditures: $1.11 billion cash basis; $1.21 billion accrual basis for 2024, primarily for Telesat Lightspeed.

- Debt Repurchases: USD262 million repurchased in 2024 at a cost of USD119 million.

- Interest Expense Savings: USD54 million annually from debt repurchases.

- 2025 Revenue Guidance: $405 million to $425 million.

- 2025 Adjusted EBITDA Guidance: $170 million to $190 million.

- 2025 LEO Operating Expenses: $110 million to $120 million.

- 2025 Capital Expenditures Guidance: $900 million to $1.1 billion, primarily for Telesat Lightspeed.

- Cash and Liquidity: $211 million cash on hand in the restricted group; $317 million in the LEO Group at year-end 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Telesat Corp (TSAT, Financial) exceeded its revenue and adjusted EBITDA guidance for 2024, demonstrating strong financial performance.

- The company successfully closed financing arrangements with the governments of Canada and Quebec for the Telesat Lightspeed project, securing necessary funding for global service.

- Significant progress was made in the development and deployment of the Lightspeed constellation, with over $1 billion invested in 2024.

- Telesat Corp (TSAT) has announced several new customer contracts for Lightspeed, indicating strong market interest and potential for future revenue growth.

- The company has been proactive in debt management, repurchasing a significant portion of its debt, which has resulted in annual interest savings of approximately USD54 million.

Negative Points

- Telesat Corp (TSAT) anticipates a challenging operating environment for its GEO business in 2025, with expected revenue declines of approximately CAD155 million.

- The company faces competitive pressures from Starlink, particularly impacting its enterprise and consulting revenues.

- There is a forecasted increase in Lightspeed operating expenses by approximately CAD40 million, driven by investments in engineering and commercial resources.

- Telesat Corp (TSAT) reported a significant net loss of $447 million in Q4 2024, primarily due to foreign exchange losses and reduced revenues.

- The GEO segment is experiencing revenue declines due to contract renewals at lower rates and the end of service for certain satellites, impacting overall financial performance.