Key Takeaways:

- Archer-Daniels-Midland (ADM, Financial) reports mixed fiscal results, yet maintains a promising outlook for 2025.

- Analysts offer price targets that suggest a modest potential upside for ADM stocks.

- ADM's estimated GF Value indicates significant growth potential, presenting a notable investment opportunity.

Archer-Daniels-Midland (ADM) has released its first-quarter financial results, revealing a blend of varied performances. Nonetheless, the company has reaffirmed its positive outlook for fiscal year 2025. With a stable dividend yield and limited downside risk, ADM emerges as an appealing option for investors eyeing the agriculture sector.

Wall Street Analysts' Forecast

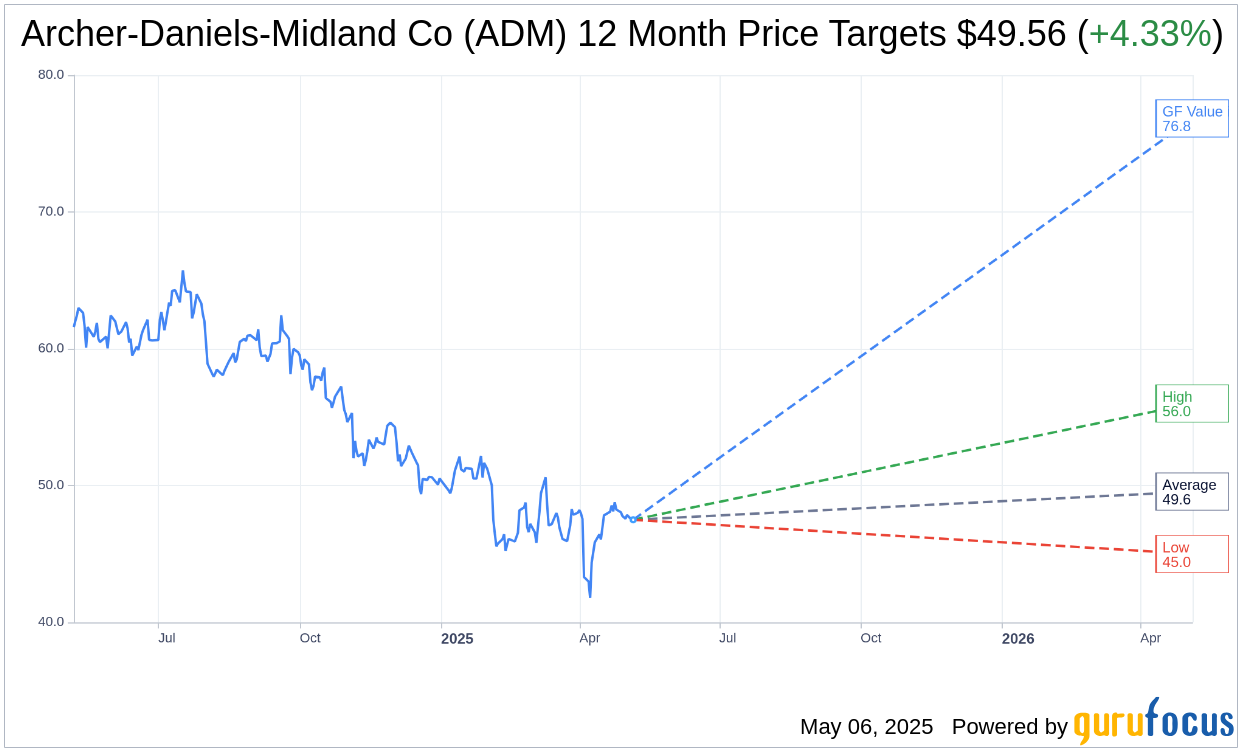

Current insights from 9 analysts suggest that Archer-Daniels-Midland Co (ADM, Financial) has a one-year average target price of $49.56. This prediction comes with a high estimate of $56.00 and a low of $45.00. These figures reflect a potential upside of 4.33% from the prevailing price of $47.50. For more comprehensive estimates, visit the Archer-Daniels-Midland Co (ADM) Forecast page.

Moreover, the consensus from 12 brokerage firms rates Archer-Daniels-Midland Co (ADM, Financial) as a "Hold," with an average brokerage recommendation score of 3.2 on a scale from 1 (Strong Buy) to 5 (Sell).

According to GuruFocus estimates, the projected GF Value for Archer-Daniels-Midland Co (ADM, Financial) over the next year is $76.84, signaling a potential upside of 61.77% from the current market price of $47.50. GF Value, a proprietary metric of GuruFocus, represents the fair trade value a stock should command. This value is derived from historical trading multiples, past growth, and future business projections. For further analysis, view the Archer-Daniels-Midland Co (ADM) Summary page.