Analyst Tristan Gerra from Baird has revised the price target for On Semi (ON, Financial), reducing it from $42 to $34. The adjustment comes in the wake of the first-quarter earnings, where the company continues to face challenges due to persistent pricing pressures, even with lower utilization rates. Gerra has maintained a Neutral rating on the stock following these developments.

Wall Street Analysts Forecast

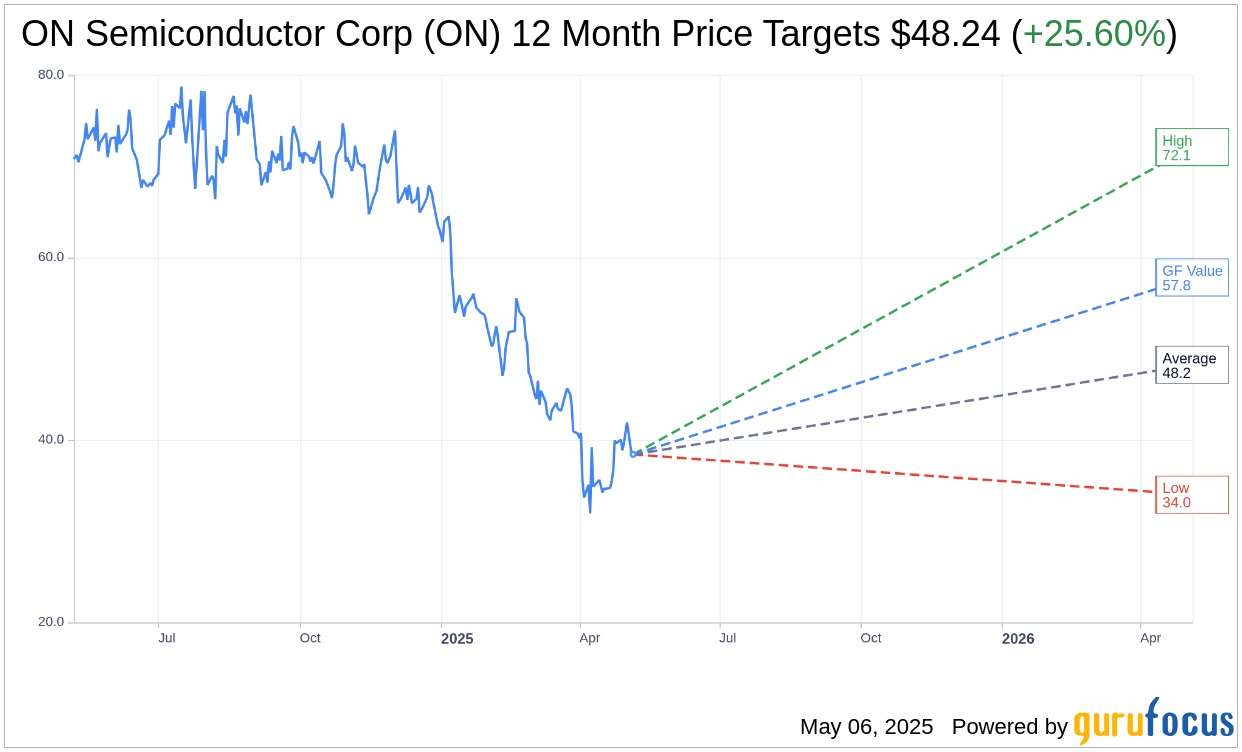

Based on the one-year price targets offered by 25 analysts, the average target price for ON Semiconductor Corp (ON, Financial) is $48.24 with a high estimate of $72.12 and a low estimate of $34.00. The average target implies an upside of 25.60% from the current price of $38.41. More detailed estimate data can be found on the ON Semiconductor Corp (ON) Forecast page.

Based on the consensus recommendation from 32 brokerage firms, ON Semiconductor Corp's (ON, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ON Semiconductor Corp (ON, Financial) in one year is $57.82, suggesting a upside of 50.53% from the current price of $38.41. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ON Semiconductor Corp (ON) Summary page.

ON Key Business Developments

Release Date: May 05, 2025

- Revenue: $1.45 billion, exceeded the midpoint of guidance.

- Non-GAAP Earnings Per Share: $0.55, exceeded the midpoint of guidance.

- Non-GAAP Gross Margin: 40%.

- Free Cash Flow: Increased 72% year over year.

- Share Buyback: $300 million of shares repurchased, 66% of free cash flow.

- Automotive Revenue: $762 million, decreased 26% sequentially.

- Industrial Revenue: $400 million, decreased 4% sequentially.

- Power Solutions Group Revenue: $645 million, decreased 20% quarter over quarter.

- Analog and Mixed Signal Group Revenue: $566 million, decreased 7% quarter over quarter.

- Intelligent Sensing Group Revenue: $234 million, decreased 23% quarter over quarter.

- GAAP Operating Margin: Negative 39.7%.

- Non-GAAP Operating Margin: 18.3%.

- Cash and Short-term Investments: $3 billion.

- Capital Expenditures: $147 million in Q1.

- Inventory: 219 days, increased by 3 days.

- Q2 Revenue Guidance: $1.4 billion to $1.5 billion.

- Q2 Non-GAAP Gross Margin Guidance: 36.5% to 38.5%.

- Q2 Non-GAAP Earnings Per Share Guidance: $0.48 to $0.58.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ON Semiconductor Corp (ON, Financial) exceeded the midpoint of their guidance with Q1 revenue of $1.45 billion and non-GAAP earnings per share of $0.55.

- The company has a flexible and geographically diversified supply chain, enhancing supply resilience and reducing risk exposure.

- ON Semiconductor Corp (ON) is seeing early signs of stabilization in the industrial market with favorable booking trends.

- The company has secured significant design wins in the automotive sector, particularly with silicon carbide technology in electric vehicles.

- ON Semiconductor Corp (ON) increased their share buyback to 66% of free cash flow, repurchasing $300 million of shares in Q1, and plans to increase it to 100% for 2025.

Negative Points

- Automotive revenue declined 26% sequentially, driven by weakness in Europe and seasonality in Asia.

- Non-GAAP gross margin decreased to 40%, down 530 basis points sequentially due to lower revenue and under absorption.

- The company expects low single-digit pricing declines in certain parts of their business.

- ON Semiconductor Corp (ON) reduced their global workforce by 9% as part of a restructuring initiative.

- The company is facing challenges with inventory digestion and cautious customer behavior in the current macroeconomic environment.