Uniti Group (UNIT, Financial) reported a first-quarter revenue of $293.9 million, slightly missing the consensus estimate of $295.39 million. The company has shown promising growth with its core recurring strategic fiber revenue increasing by approximately 4% compared to the same period last year. Additionally, consolidated bookings saw a significant 40% rise compared to the first quarter of 2024. The capital needs for their fiber business are also continuing to decrease.

Despite recent global economic challenges, UNIT remains in a strong position to capitalize on emerging trends in the communications infrastructure sector. This includes opportunities related to advancing technologies and industry convergence, which enhance the demand for their premium fiber infrastructure. The company is poised for further advancement with its anticipated merger with Windstream, overwhelmingly approved by investors, expected to complete in the third quarter.

Uniti recently welcomed John Harrobin as the president of Kinetic and nominated Harold Zeitz to the board, both bringing substantial experience in the fiber-to-the-home sector. These developments are set to strengthen UNIT's strategic position, aiming to establish itself as a leading force in the fiber industry with a broad platform for sustainable growth.

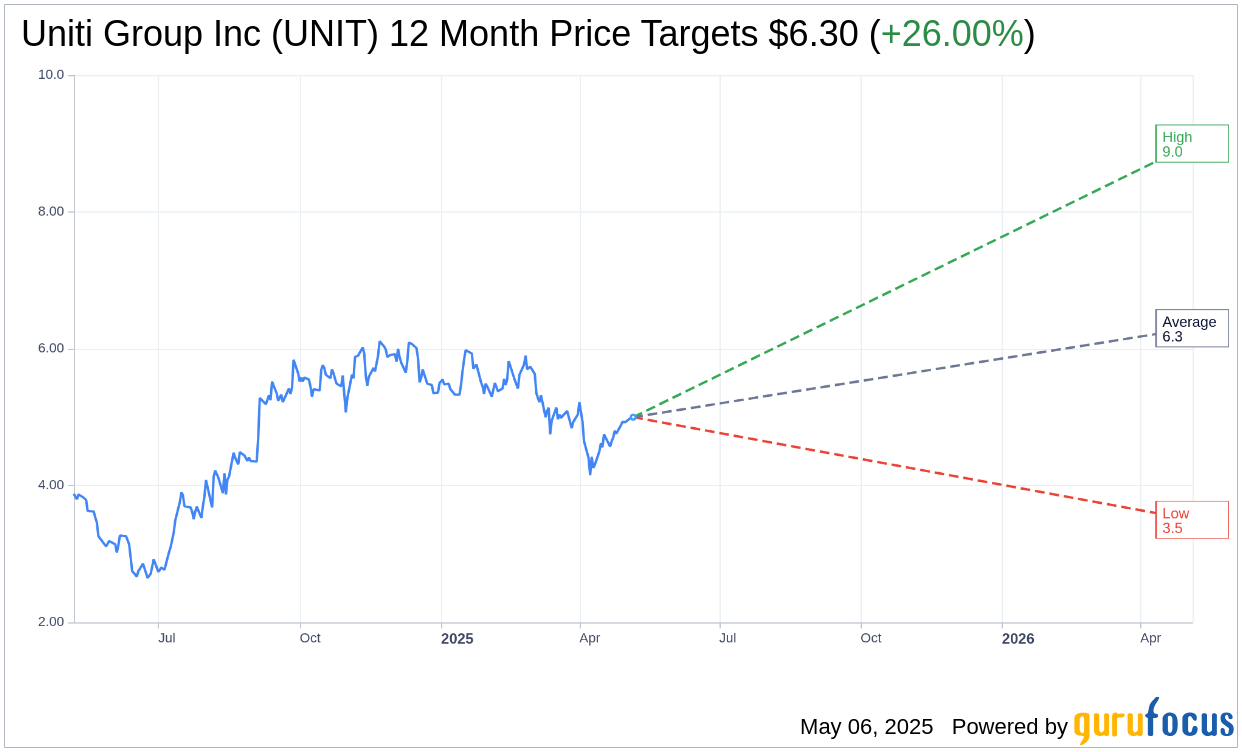

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Uniti Group Inc (UNIT, Financial) is $6.30 with a high estimate of $9.00 and a low estimate of $3.50. The average target implies an upside of 26.00% from the current price of $5.00. More detailed estimate data can be found on the Uniti Group Inc (UNIT) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Uniti Group Inc's (UNIT, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Uniti Group Inc (UNIT, Financial) in one year is $15.05, suggesting a upside of 201% from the current price of $5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Uniti Group Inc (UNIT) Summary page.

UNIT Key Business Developments

Release Date: February 21, 2025

- Consolidated Revenue: $293 million for Q4 2024.

- Consolidated Adjusted EBITDA: $239 million for Q4 2024.

- AFFO Attributed to Common Shareholders: $92 million for Q4 2024.

- AFFO Per Diluted Common Share: $0.35 for Q4 2024.

- Uniti Leasing Revenue: $222 million for Q4 2024.

- Uniti Leasing Adjusted EBITDA Margin: 97% for Q4 2024.

- Uniti Fiber Revenue: $72 million for Q4 2024.

- Uniti Fiber Adjusted EBITDA Margin: 43% for Q4 2024.

- Net Success-Based CapEx: $0.7 million for Q4 2024.

- 2025 Revenue Guidance for Uniti Leasing: $902 million at midpoint.

- 2025 Adjusted EBITDA Guidance for Uniti Leasing: $872 million at midpoint.

- 2025 Revenue Guidance for Uniti Fiber: $304 million at midpoint.

- 2025 Adjusted EBITDA Guidance for Uniti Fiber: $125 million at midpoint.

- 2025 AFFO Per Diluted Share Guidance: $1.40 to $1.47, midpoint $1.43.

- Leverage Ratio: 5.8 times based on net debt to Q4 2024 annualized adjusted EBITDA.

- Cash and Cash Equivalents: $656 million combined unrestricted cash and undrawn revolver capacity at year-end.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Uniti Group Inc (UNIT, Financial) reported strong growth in strategic recurring revenue, adjusted EBITDA, and consolidated bookings, with increases of approximately 5%, 8%, and 27%, respectively.

- The company successfully accessed the ABS market, which is expected to be a valuable financing tool moving forward.

- Uniti Group Inc (UNIT) is on track to generate positive free cash flow in 2025.

- The merger with Windstream is expected to simplify the MLA relationship and enhance strategic positioning, with the potential to close as early as July.

- The company has a well-diversified customer base, with significant growth in bookings from fiber-to-the-home carriers and hyperscalers.

Negative Points

- The company faces challenges with capital intensity, although it has been declining, it remains a focus area for improvement.

- There is uncertainty regarding the competitive environment, particularly in terms of pricing and yields in the fiber business.

- The merger with Windstream requires regulatory approvals and shareholder votes, which could pose risks to the timeline and completion.

- Wireless bookings were flat in 2024 compared to 2023, indicating a muted demand in that segment.

- The company is reliant on ABS and other financing tools, which may be subject to market conditions and availability.