Intelligent Bio Solutions (INBS, Financial) has introduced three new websites in Arabic, Italian, and Spanish as part of its international growth strategy. This initiative enhances the company's digital and commercial reach in key regions known for their rapid expansion and high demand for workplace safety and compliance solutions.

The newly launched sites are essential to INBS's localization efforts, enabling the company to better position itself in the markets of Europe, the Middle East, and Latin America. By aligning its operations and market strategies, INBS aims to capture new revenue streams and strengthen its foothold in these areas.

President and CEO Harry Simeonidis emphasized that this move is more than just a translation exercise. It serves as a strategic growth mechanism designed to establish scalable access to critical markets. By enhancing online and sales infrastructure for local customers, INBS is set to bolster distributor relationships, increase lead generation, and achieve quicker market entry on a global scale.

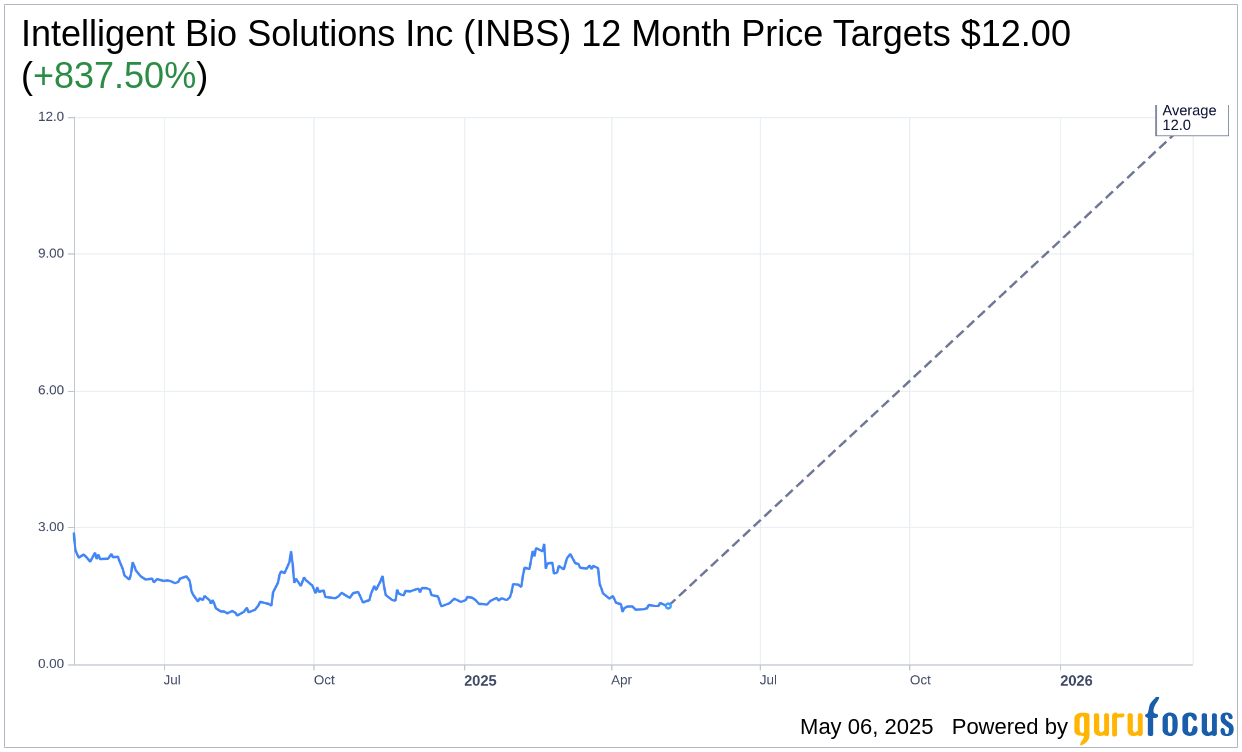

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Intelligent Bio Solutions Inc (INBS, Financial) is $12.00 with a high estimate of $12.00 and a low estimate of $12.00. The average target implies an upside of 837.50% from the current price of $1.28. More detailed estimate data can be found on the Intelligent Bio Solutions Inc (INBS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Intelligent Bio Solutions Inc's (INBS, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.