MFA Financial Inc (MFA, Financial) released its 8-K filing on May 6, 2025, reporting its financial results for the first quarter ended March 31, 2025. The company, a specialty finance entity focused on residential mortgage assets, aims to deliver shareholder value through distributable income and asset performance linked to residential mortgage credit fundamentals.

Performance Overview and Challenges

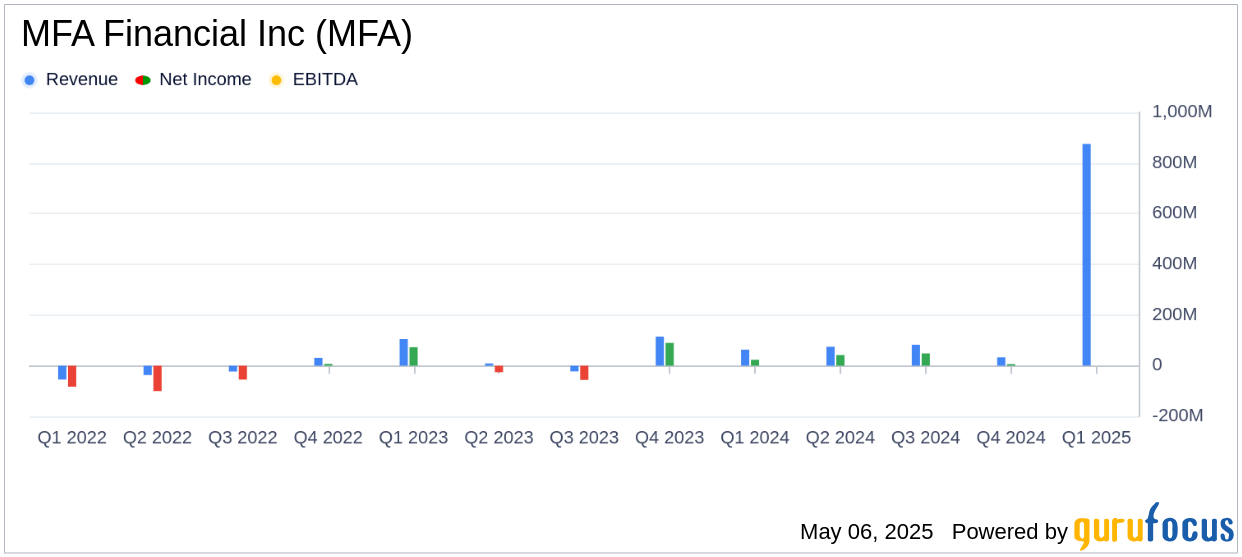

MFA Financial Inc (MFA, Financial) reported a GAAP net income of $33.0 million, translating to $0.32 per basic and $0.31 per diluted common share. This performance exceeded the analyst estimate of $0.13 per share. MFA Financial Inc's revenue for the quarter was $54.2 million, which is above the estimated revenue of $53.05 million, showcasing the company's ability to outperform market expectations. However, the company faces challenges such as market volatility, which could impact future performance.

Financial Achievements and Industry Significance

The company achieved distributable earnings of $30.6 million, or $0.29 per basic common share, and declared an increased regular cash dividend of $0.36 per common share. These achievements are significant for a real estate investment trust (REIT) like MFA Financial Inc, as they reflect the company's capacity to generate income and return value to shareholders.

Key Financial Metrics

MFA Financial Inc's GAAP book value stood at $13.28 per common share, while the economic book value, a non-GAAP measure, was $13.84 per common share. The total economic return for the quarter was 1.9%, and the company closed the quarter with unrestricted cash of $253.7 million. These metrics are crucial as they indicate the company's financial health and its ability to sustain operations and growth.

Portfolio Activity and Strategic Moves

During the quarter, MFA Financial Inc sourced $875 million of residential loans and securities, including $383 million of Non-QM loans with an average coupon of 7.8% and average LTV of 65%. The company's subsidiary, Lima One, originated $213 million of new business purpose loans, indicating strategic growth initiatives. Additionally, MFA expanded its Agency MBS position to $1.6 billion and issued its 17th Non-QM securitization.

“We are pleased to report a 1.9% total economic return for the opening quarter of 2025,” said Craig Knutson, MFA’s Chief Executive Officer. “Our recent dividend increase reflects our confidence in the earnings power of our $10.7 billion investment portfolio.”

Analysis and Conclusion

MFA Financial Inc's performance in the first quarter of 2025 demonstrates its resilience and strategic acumen in navigating market challenges. The company's ability to exceed earnings estimates and increase dividends underscores its robust financial management and commitment to shareholder value. As a REIT, maintaining a strong portfolio and generating distributable income are critical, and MFA Financial Inc appears well-positioned to capitalize on future opportunities.

Explore the complete 8-K earnings release (here) from MFA Financial Inc for further details.