ConnectOne Bancorp (CNOB, Financial), the parent entity of ConnectOne Bank, has secured approval from the Federal Deposit Insurance Corporation to move ahead with its planned merger with The First of Long Island Corporation, which is the parent of The First National Bank of Long Island. This development is a critical step toward the merger's completion.

The transaction is anticipated to be finalized around June 1, 2025, subject to obtaining further necessary approvals or waivers from the New Jersey Department of Banking and Insurance as well as the Federal Reserve Bank of New York.

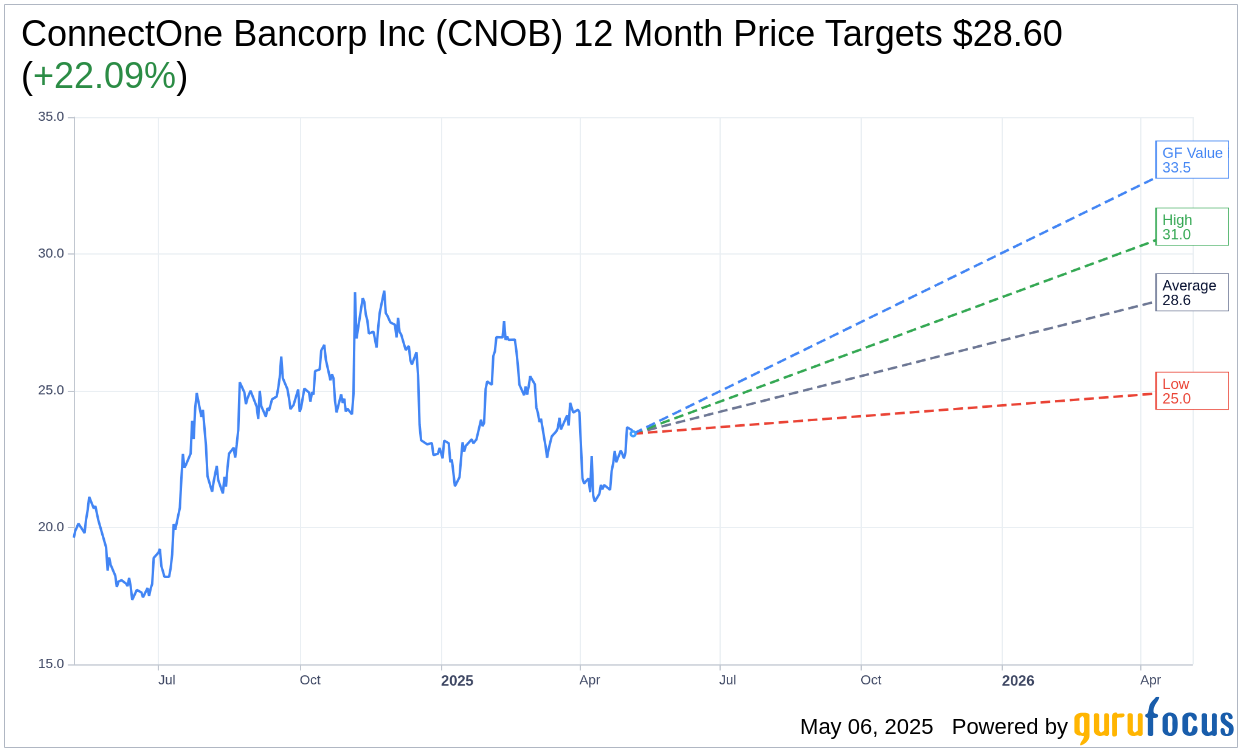

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for ConnectOne Bancorp Inc (CNOB, Financial) is $28.60 with a high estimate of $31.00 and a low estimate of $25.00. The average target implies an upside of 22.09% from the current price of $23.43. More detailed estimate data can be found on the ConnectOne Bancorp Inc (CNOB) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, ConnectOne Bancorp Inc's (CNOB, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ConnectOne Bancorp Inc (CNOB, Financial) in one year is $33.45, suggesting a upside of 42.8% from the current price of $23.425. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ConnectOne Bancorp Inc (CNOB) Summary page.