Benchmark has adjusted its price target for Nexstar (NXST, Financial), reducing it from $225 to $215 while maintaining a Buy rating on the stock. The firm acknowledges that although the stock has shown some recovery, its assessment still suggests a favorable risk/reward balance, with considerable downside protection should proposed regulatory changes not materialize. Despite the optimism, Benchmark is slightly lowering its forecast and price target to align just below the broader market consensus.

Wall Street Analysts Forecast

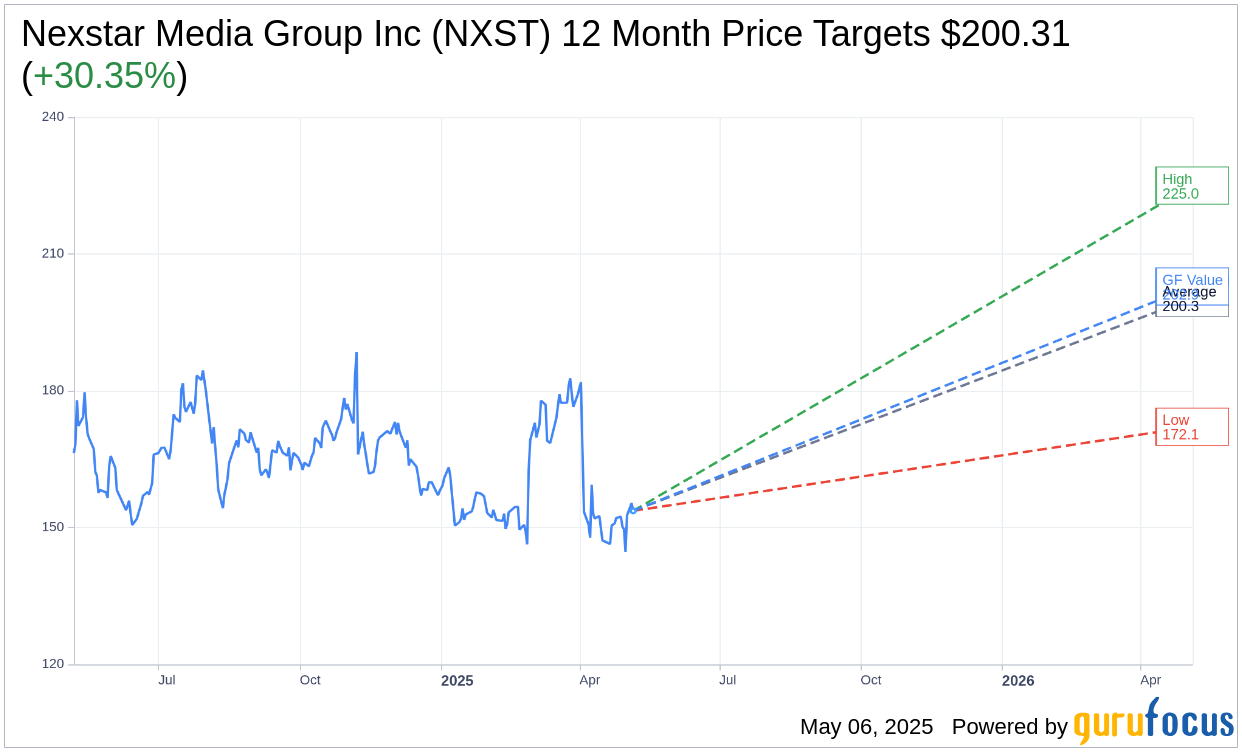

Based on the one-year price targets offered by 10 analysts, the average target price for Nexstar Media Group Inc (NXST, Financial) is $200.31 with a high estimate of $225.00 and a low estimate of $172.11. The average target implies an upside of 30.35% from the current price of $153.67. More detailed estimate data can be found on the Nexstar Media Group Inc (NXST) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Nexstar Media Group Inc's (NXST, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Nexstar Media Group Inc (NXST, Financial) in one year is $202.87, suggesting a upside of 32.02% from the current price of $153.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Nexstar Media Group Inc (NXST) Summary page.

NXST Key Business Developments

Release Date: February 27, 2025

- Total Net Revenue: $5.4 billion for the full year, a company record.

- Adjusted EBITDA: $2 billion for the full year.

- Adjusted Free Cash Flow: $1.2 billion for the full year.

- Shareholder Returns: $820 million returned through share repurchases and dividends, reducing shares outstanding by nearly 9% during the year.

- Debt Reduction: $327 million allocated toward debt reduction, achieving a net leverage of 2.91 times.

- Fourth Quarter Net Revenue: $1.5 billion, up 14% year-over-year.

- Fourth Quarter Distribution Revenue: $714 million, a 1.4% increase over the prior year.

- Fourth Quarter Advertising Revenue: $758 million, a 29.6% increase year-over-year.

- Political Revenue: $491 million for the year, maintaining a 13% market share of all television political advertising spending.

- Fourth Quarter Adjusted EBITDA: $628 million, representing a 42.2% margin.

- Fourth Quarter Adjusted Free Cash Flow: $411 million.

- 2025 Adjusted EBITDA Guidance: $1.5 to $1.595 billion.

- 2025 CapEx Guidance: $120 to $125 million for the year.

- 2025 Cash Interest Expense Guidance: $375 to $380 million.

- Dividend Increase: 12th consecutive annual increase, with a near 5% yield.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Nexstar Media Group Inc (NXST, Financial) achieved a record $5.4 billion in total net revenue for 2024, marking the highest in the company's history.

- The company returned $820 million, or 68% of adjusted free cash flow, to shareholders through share repurchases and dividends.

- Nexstar Media Group Inc (NXST) announced its 12th consecutive annual increase in the quarterly cash dividend, reflecting a near 5% yield.

- The CW network's transformation into a top-tier broadcast network continued, with significant improvements in ratings and advertising revenue.

- Nexstar Media Group Inc (NXST) achieved a record fourth quarter net revenue of $1.5 billion, up 14% compared to the prior year, driven by strong election-year political advertising.

Negative Points

- Nexstar Media Group Inc (NXST) faced a $51 million year-over-year reduction in non-political advertising revenue due to market softness and political displacement.

- The company experienced continued weakness in automotive advertising and insurance advertising due to recent natural disasters.

- Nexstar Media Group Inc (NXST) anticipates operating expenses to be reduced in the low to mid-eight figures due to operational restructuring, indicating cost-cutting measures.

- The CW network is still operating at a loss, although it is expected to reduce losses by more than 25% in 2025.

- Subscriber attrition remains a challenge, although Nexstar Media Group Inc (NXST) expects a slight improvement in the rate of attrition.