Key Takeaways:

- Intercontinental Exchange (ICE, Financial) introduces "Price Improvement Volume Clearing" to enhance liquidity.

- Q1 2025 corporate bond volume reaches $62 billion, a notable 27% increase year-over-year.

- Analysts predict an 11.86% upside potential based on average price targets, with an average recommendation of "Outperform."

Intercontinental Exchange (ICE) has recently launched an innovative feature within its ICE Bonds' Risk Matching Auction, dubbed Price Improvement Volume Clearing. This strategic enhancement aims to boost liquidity and optimize pricing for corporate bond traders, reflecting ICE's commitment to evolving market needs. In the first quarter of 2025, ICE reported an impressive $62 billion in corporate bond volume, marking a substantial 27% increase compared to the previous year.

Wall Street Analysts Forecast

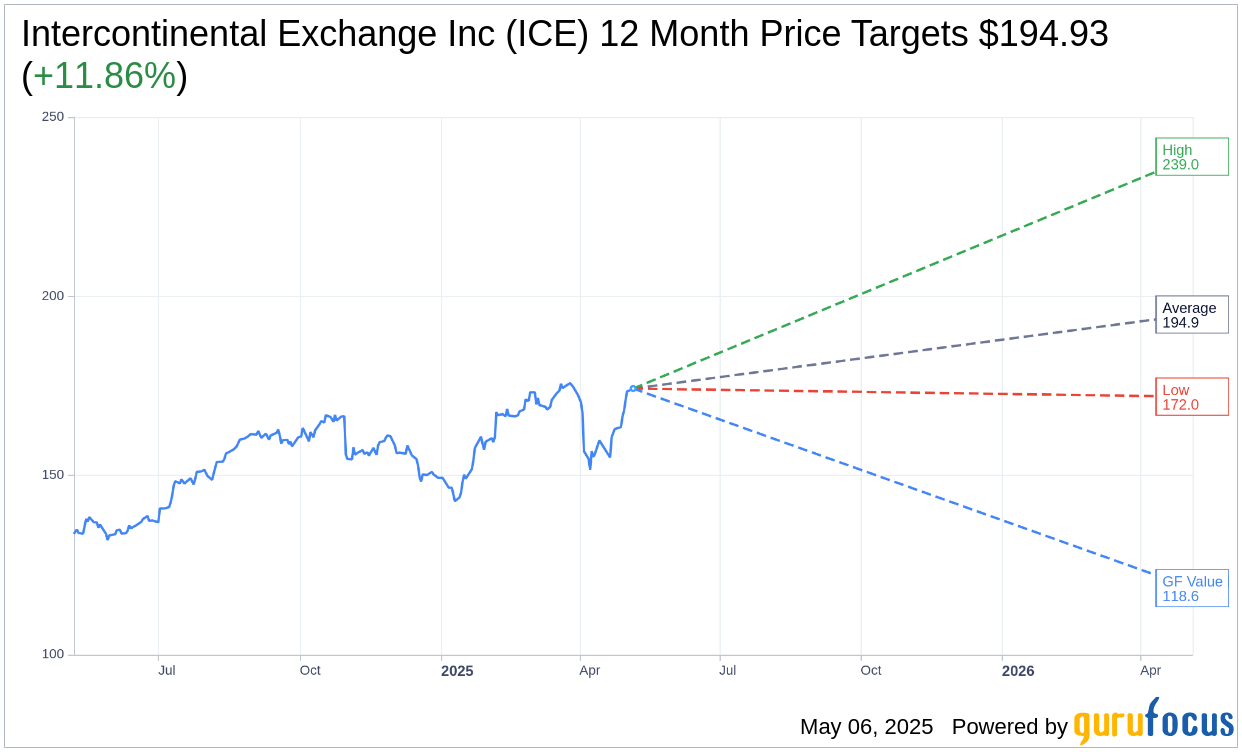

In the realm of analyst projections, 14 experts have set their one-year price targets for Intercontinental Exchange Inc (ICE, Financial). The average target stands at $194.93, with the highest estimate reaching $239.00 and the lowest at $172.00. This average suggests a potential upside of 11.86% from the current stock price of $174.26. For a deeper dive into these estimates, investors can visit the Intercontinental Exchange Inc (ICE) Forecast page.

The consensus from 18 brokerage firms reflects an average recommendation for ICE at 1.9, translating to an "Outperform" status. On this scale, where 1 signifies a Strong Buy and 5 indicates a Sell, ICE's position suggests positive market sentiment.

Turning to GuruFocus evaluations, the estimated GF Value for Intercontinental Exchange Inc (ICE, Financial) one year from now stands at $118.56. This figure warns of a potential downside of 31.96% from the current price level of $174.26. The GF Value represents GuruFocus' estimation of fair trading value, derived from historical trading multiples, past business growth, and future business performance projections. For comprehensive data, the Intercontinental Exchange Inc (ICE) Summary page offers further insights.