UBS analyst Ashwani Verma has updated the target price for Neurocrine Biosciences (NBIX, Financial), raising it from $137.00 to $152.00. This change reflects a 10.95% increase in the price target, signaling strong confidence in the company's potential performance. The updated recommendation maintains a "Buy" rating, consistent with the prior assessment.

The revision comes as part of UBS's ongoing analysis of Neurocrine Biosciences (NBIX, Financial), a prominent player in the biotechnology sector. The decision to raise the price target underscores a continued positive outlook from analysts regarding NBIX's growth trajectory and market positioning.

Investors in Neurocrine Biosciences (NBIX, Financial) may find this update noteworthy as it suggests further upward momentum in the stock's valuation, driven by the latest strategic moves and developments within the company. The maintained "Buy" rating indicates sustained confidence in NBIX's long-term prospects.

For stakeholders and market watchers, the revised price target and rating analysis by UBS demonstrate a favorable opinion on the stock's potential, aligning with the industry's expectations of growth within the biotech arena. Neurocrine Biosciences (NBIX, Financial) continues to be a focal point for investors seeking promising opportunities in the sector.

Wall Street Analysts Forecast

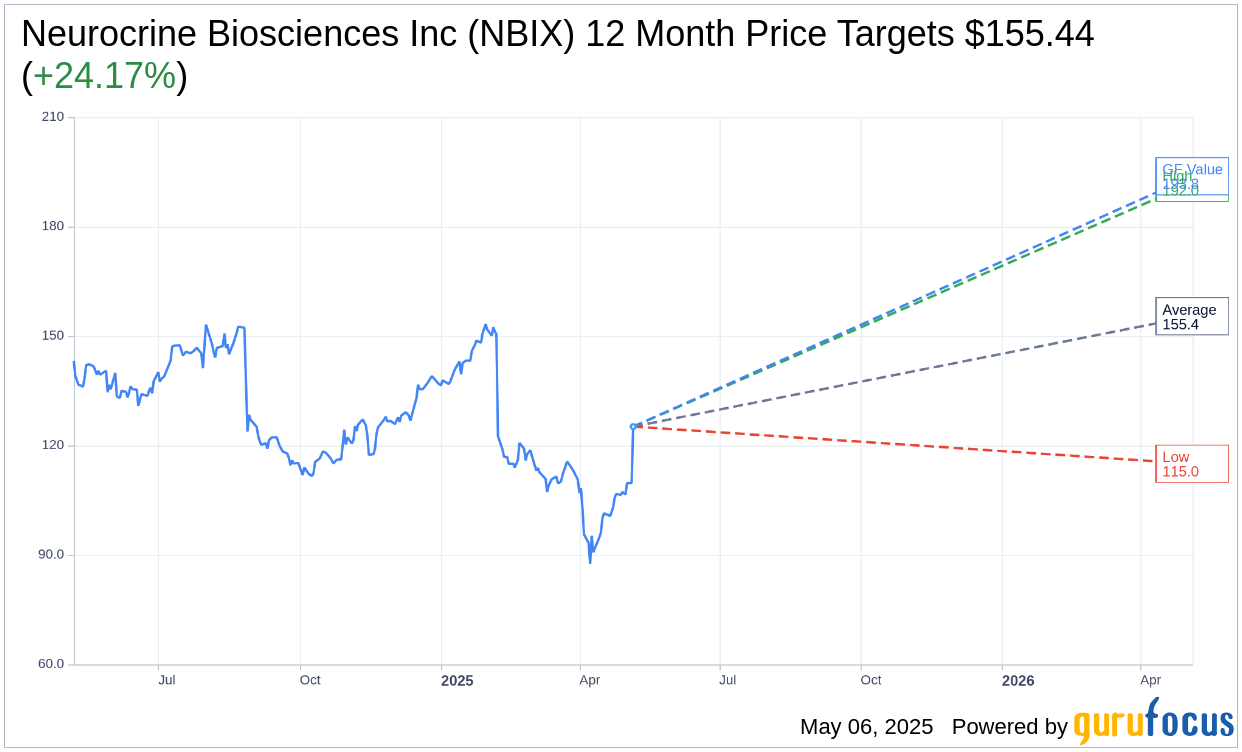

Based on the one-year price targets offered by 23 analysts, the average target price for Neurocrine Biosciences Inc (NBIX, Financial) is $155.44 with a high estimate of $192.00 and a low estimate of $115.00. The average target implies an upside of 24.45% from the current price of $124.91. More detailed estimate data can be found on the Neurocrine Biosciences Inc (NBIX) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Neurocrine Biosciences Inc's (NBIX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Neurocrine Biosciences Inc (NBIX, Financial) in one year is $193.81, suggesting a upside of 55.17% from the current price of $124.905. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Neurocrine Biosciences Inc (NBIX) Summary page.