LCII anticipates its revenue for the second quarter to be roughly $1.1 billion, mirroring the figures reported in the same period last year. Analysts' predictions, though, are slightly lower, averaging around $1.07 billion. The company expects its RV Original Equipment Manufacturer (OEM) sales to increase by approximately 5%. Despite this optimistic outlook for RV sales, LCII highlights ongoing challenges in the marine sector and several other related markets. These insights were shared during their first-quarter earnings conference call.

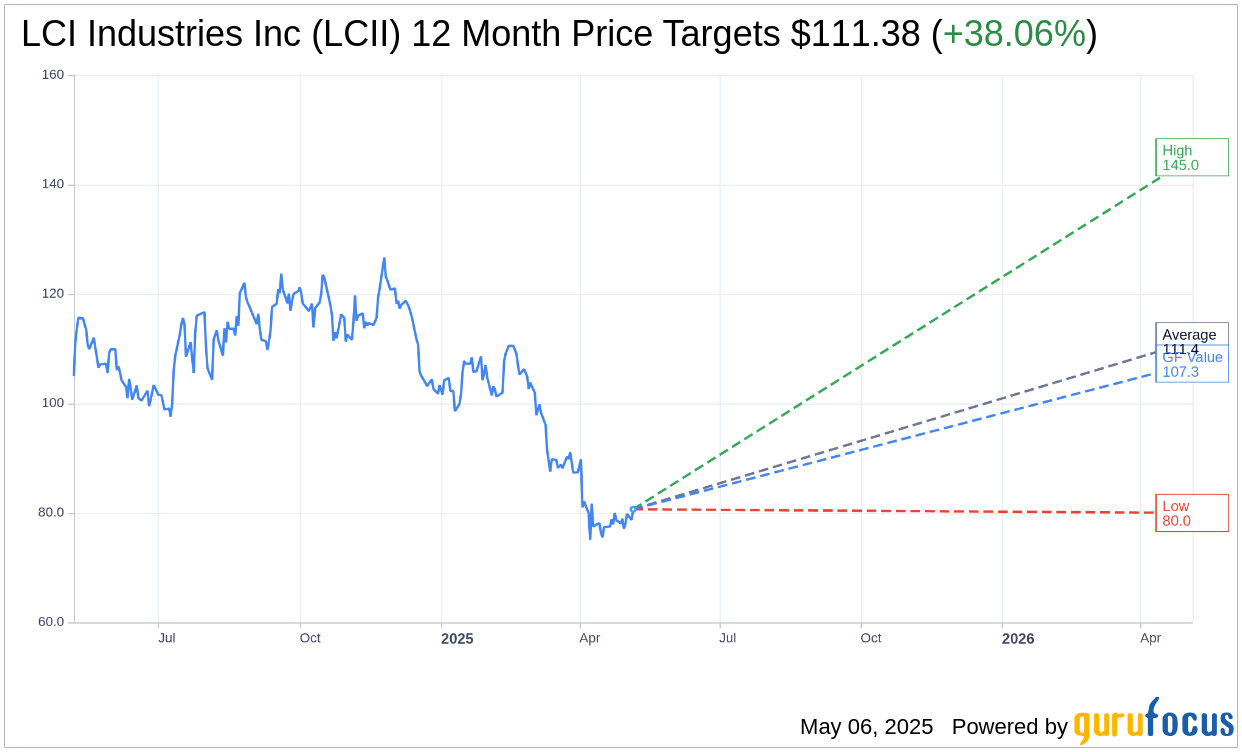

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for LCI Industries Inc (LCII, Financial) is $111.38 with a high estimate of $145.00 and a low estimate of $80.00. The average target implies an upside of 38.06% from the current price of $80.67. More detailed estimate data can be found on the LCI Industries Inc (LCII) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, LCI Industries Inc's (LCII, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for LCI Industries Inc (LCII, Financial) in one year is $107.30, suggesting a upside of 33.01% from the current price of $80.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the LCI Industries Inc (LCII) Summary page.

LCII Key Business Developments

Release Date: February 11, 2025

- Full Year Revenue: $3.7 billion, down 1% year-over-year.

- Fourth Quarter Revenue: $803 million, a decrease of 4% from Q4 2023.

- OEM Net Sales (Q4 2024): $621.6 million, down 6% from Q4 2023.

- RV OEM Net Sales (Q4 2024): $376 million, down 3% year-over-year.

- Aftermarket Net Sales (Q4 2024): $181.6 million, up 1% year-over-year.

- Adjacent Industries OEM Net Sales (Q4 2024): $245.5 million, down 9% year-over-year.

- Gross Margin (Q4 2024): 21.1%, up from 19.2% in Q4 2023.

- Operating Profit Margin (Q4 2024): 2%, a 170 basis point improvement from Q4 2023.

- GAAP Net Income (Q4 2024): $10 million or $0.37 per diluted share.

- EBITDA (Q4 2024): $46 million, a 29% increase year-over-year.

- Cash Flow from Operations (2024): $370 million.

- Net Debt (End of 2024): $591 million, 1.7 times pro forma EBITDA.

- January 2025 Sales: Up 6% year-over-year, with RV sales up 17%.

- Dividend Increase: 10% to $1.15 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- LCI Industries Inc (LCII, Financial) achieved a full-year revenue of $3.7 billion in 2024, demonstrating resilience despite a challenging RV and marine market.

- The company expanded its market leadership across top product categories, with a 7% organic growth in the automotive aftermarket.

- LCI Industries Inc (LCII) increased EBITDA by $89 million through cost savings and operational improvements.

- The company successfully reduced net debt below 2 times EBITDA, generating $370 million in cash flow from operations.

- LCI Industries Inc (LCII) reported a 17% increase in January RV sales, indicating a positive start to 2025.

Negative Points

- Consolidated net sales for the fourth quarter decreased by 4% compared to the same period in 2023.

- OEM net sales for the fourth quarter of 2024 were down 6% year-over-year.

- The marine market experienced a 15% decline in sales due to inflation and high interest rates impacting retail demand.

- The company faces a potential 50 basis point headwind from tariffs, which they are working to mitigate.

- There was a shift in unit mix towards lower content single axle travel trailers, impacting revenue negatively.