May 6 - Dell Technologies (DELL, Financial) is capturing investor attention in 2025, driven by its push into AI‑powered data center hardware and enterprise solutions.

Once best known for PCs, Dell has ramped up its cloud computing and high‑performance server offerings. As companies boost tech spending and adopt AI, Dell's hybrid‑cloud and AI infrastructure positioning stands out.

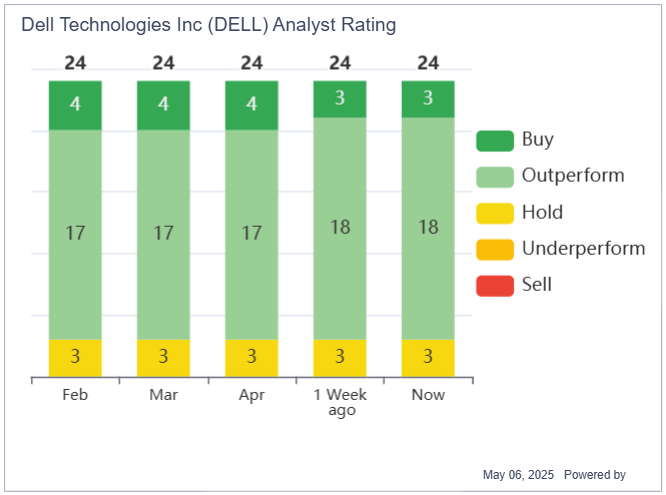

Analysts maintain a "Strong Buy" consensus on DELL stock, though tariff worries and softer demand have led several to trim price targets. Year‑to‑date, DELL shares have slid about 19%, reflecting broader market pressures.

Bank of America's five‑star analyst Wamsi Mohan reiterated a Buy rating and a $150 target, citing Dell's AI partnerships showcased at Nvidia's (NVDA, Financial) GTC 2025 event. Dell's end‑to‑end AI stack, from AI‑enabled PCs to GPU‑powered racks—earned special mention.

At Citi, five‑star analyst Asiya Merchant kept her Buy call but cut her target to $105, flagging weaker data center and PC spending despite potential tariff relief. Other firms, including Morgan Stanley and J.P. Morgan, have similarly lowered targets amid macro uncertainties.

Based on the consensus recommendation from 24 brokerage firms, Dell Technologies Inc's (DELL, Financial) average brokerage recommendation is currently 2.0, indicating a "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.