GE HealthCare Techs (GEHC, Financial) has been the subject of a recent update from prominent investment firm Morgan Stanley. In a report dated May 6, 2025, analyst Patrick Wood announced a revision in the price target for GEHC.

The price target for GE HealthCare Techs was lowered from the previous target of USD 86.00 to a new target of USD 78.00. This adjustment represents a decrease of 9.30% from the prior valuation.

Despite the change in the price target, Morgan Stanley has maintained its "Equal-Weight" rating for GEHC. This implies that the investment firm sees no significant advantage or disadvantage in holding GE HealthCare Techs, relative to other investment opportunities.

Investors tracking GE HealthCare Techs (GEHC, Financial) should take note of these updates as they assess their positions and expectations in the stock's performance on the market.

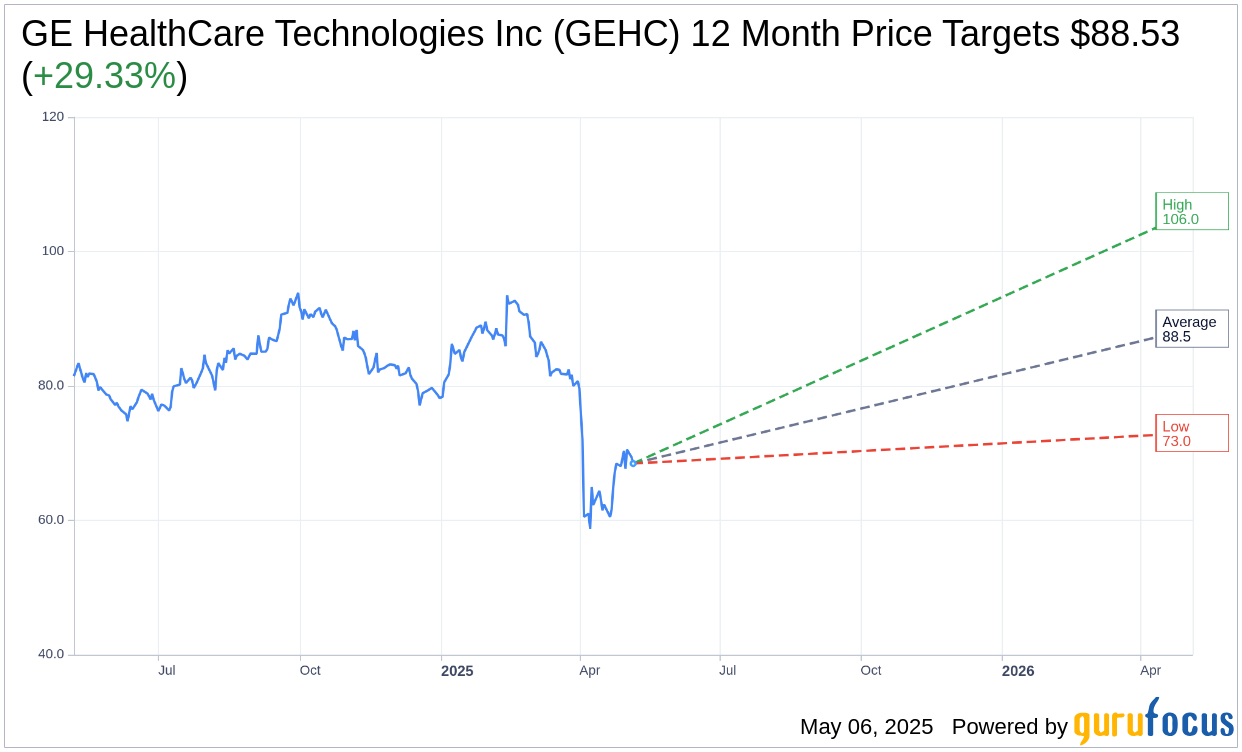

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for GE HealthCare Technologies Inc (GEHC, Financial) is $88.53 with a high estimate of $106.00 and a low estimate of $73.00. The average target implies an upside of 29.33% from the current price of $68.45. More detailed estimate data can be found on the GE HealthCare Technologies Inc (GEHC) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, GE HealthCare Technologies Inc's (GEHC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.