Transaction Overview

On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a significant transaction involving NextDecade Corp (NASDAQ: NEXT), reducing its holdings by 11,303,319 shares. The shares were traded at a price of $7.78 each. This move left BlackRock with a total of 9,047,314 shares in the company. The transaction did not impact the firm's portfolio, maintaining a trade impact of 0. This reduction in holdings is noteworthy, given the strategic positioning of NextDecade Corp within the energy sector.

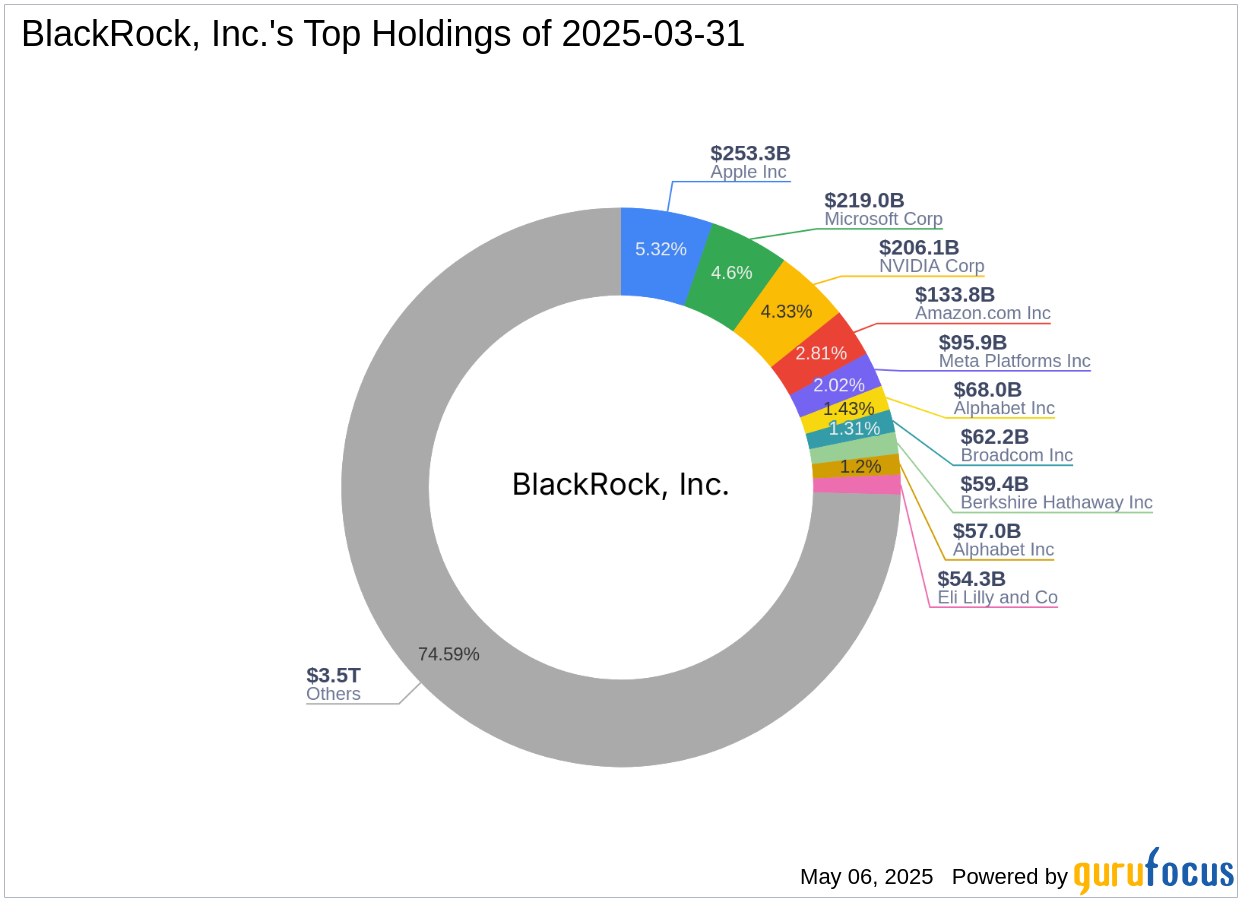

Profile of BlackRock, Inc. (Trades, Portfolio)

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a leading global investment firm with an equity portfolio valued at an impressive $4,758.45 trillion. The firm is renowned for its diversified investment strategy, with top holdings in major corporations such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). BlackRock's investment philosophy emphasizes long-term growth and value, making its portfolio decisions closely watched by market participants.

Introduction to NextDecade Corp

NextDecade Corp is a Houston-based energy company specializing in the liquefaction of natural gas and the management of CO2 emissions. The company is actively involved in the construction and development of the Rio Grande LNG Facility, located in the Rio Grande Valley near Brownsville, Texas. Additionally, NextDecade is advancing its NEXT Carbon Solutions, which focuses on proprietary processes to reduce the cost of carbon capture and storage (CCS), aiding companies in achieving their clean energy objectives.

Financial Performance and Valuation

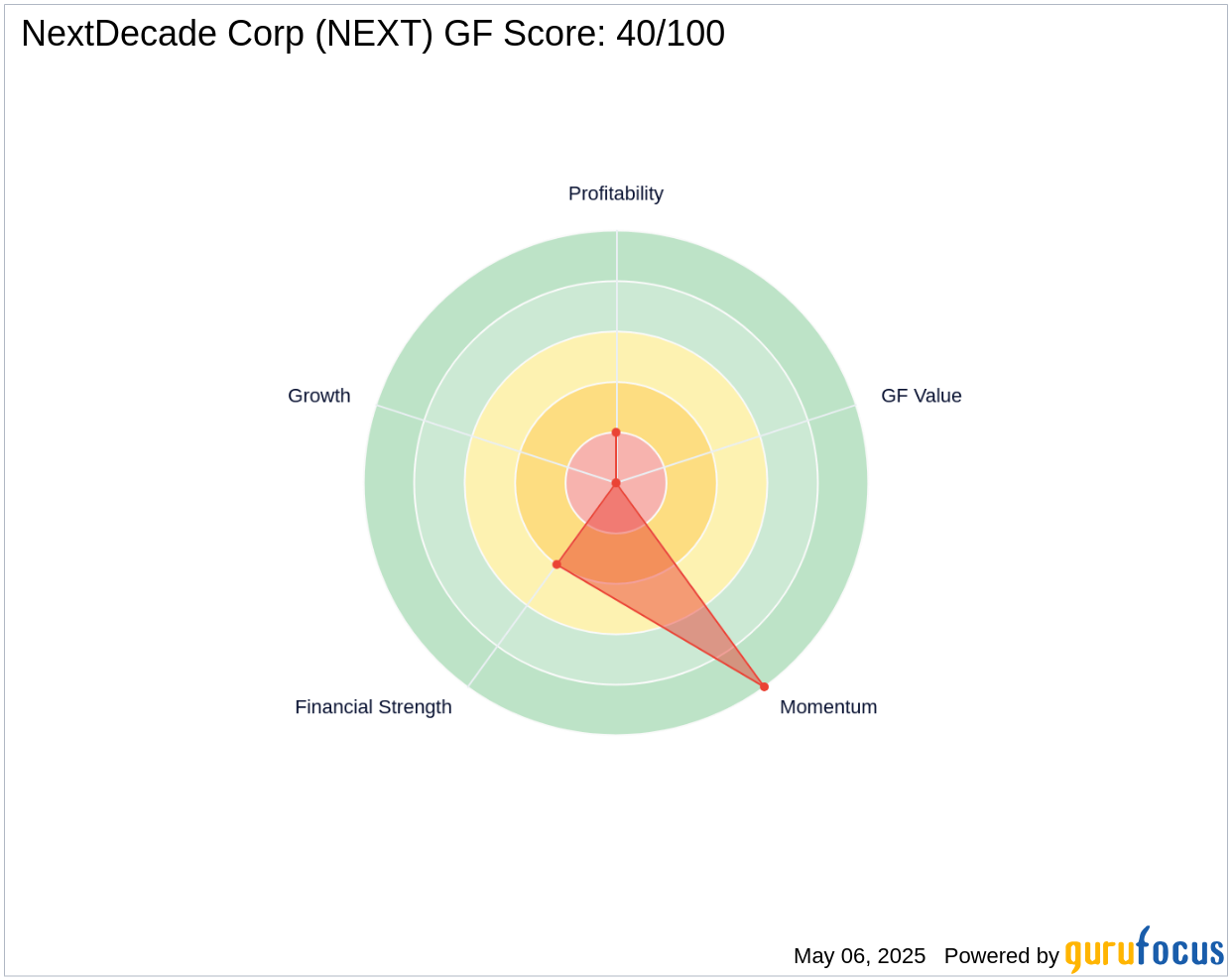

NextDecade Corp currently holds a market capitalization of $1.93 billion, with its stock priced at $7.385. The company's financial metrics reveal a challenging landscape, with a PE percentage of 0.00, indicating a loss. The [GF Score](https://www.gurufocus.com/term/gf-score/NEXT) of 40/100 suggests a poor future performance potential. These figures highlight the financial hurdles NextDecade faces, despite its strategic projects in the energy sector.

Implications of the Transaction

The reduction in BlackRock's holdings in NextDecade Corp could signal a reassessment of the company's growth prospects. Since the transaction, the stock has experienced a decline, with a gain percentage of -5.08% and a year-to-date change of -11.02%. This performance may reflect broader market sentiments and the challenges within the energy sector, impacting investor confidence.

Industry Context and Competitive Position

Operating within the oil and gas industry, NextDecade Corp faces significant challenges, including fluctuating energy prices and regulatory pressures. The company's financial health, as indicated by its [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/NEXT) and [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/NEXT), is relatively weak compared to industry peers. With a [Growth Rank](https://www.gurufocus.com/term/rank-growth/NEXT) of 0/10 and a [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/NEXT) of 10/10, NextDecade's growth prospects appear limited, although its momentum remains strong.

Conclusion

BlackRock, Inc. (Trades, Portfolio)'s decision to reduce its stake in NextDecade Corp provides valuable insights into the firm's strategic considerations. For value investors, this transaction underscores the importance of evaluating a company's financial standing and industry position. While NextDecade's projects hold potential, its current financial metrics and market performance suggest caution. Investors should weigh these factors carefully when considering their investment strategies in the energy sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.