On March 31, 2025, JPMorgan Chase & Co. executed a notable transaction by acquiring an additional 3,176,248 shares of McDonald's Corp. This acquisition increased the firm's position in McDonald's by 9.70%, bringing its total holdings to 35,931,728 shares. The transaction was executed at a price of $312.37 per share, resulting in a 0.07% impact on the firm's portfolio. This strategic move reflects JPMorgan Chase & Co.'s confidence in McDonald's growth trajectory and its potential for profitability.

JPMorgan Chase & Co.: A Financial Powerhouse

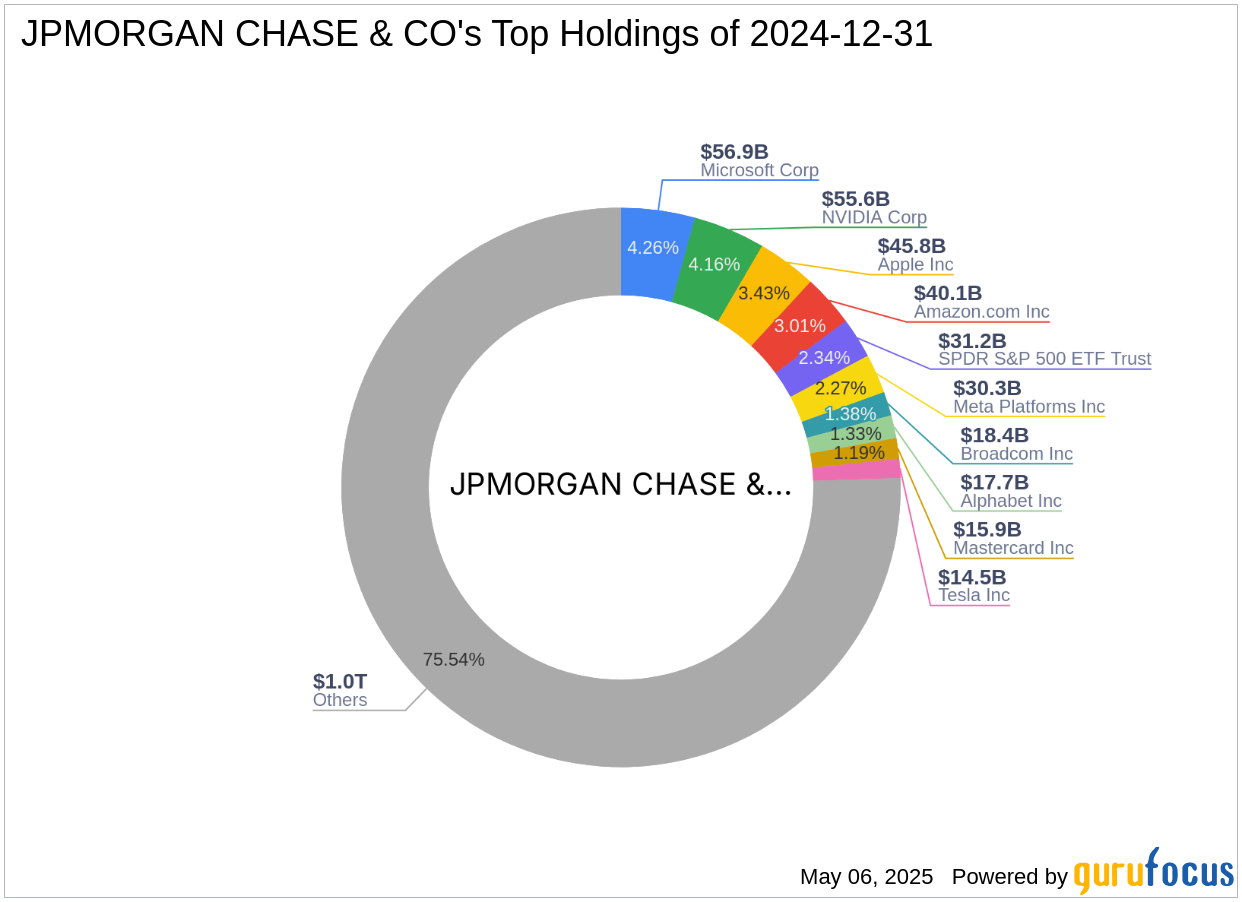

JPMorgan Chase & Co. is one of the world's oldest and largest financial institutions, with a rich history dating back to 1799. The firm operates in over 60 countries and focuses on six major business areas, including investment banking and asset management. With a corporate headquarters in New York City, JPMorgan Chase & Co. serves millions of clients globally, employing nearly a quarter million employees who manage $2.6 trillion in total assets. The firm's top holdings include SPDR S&P 500 ETF Trust (SPY, Financial), Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial).

McDonald's Corp: A Global Restaurant Leader

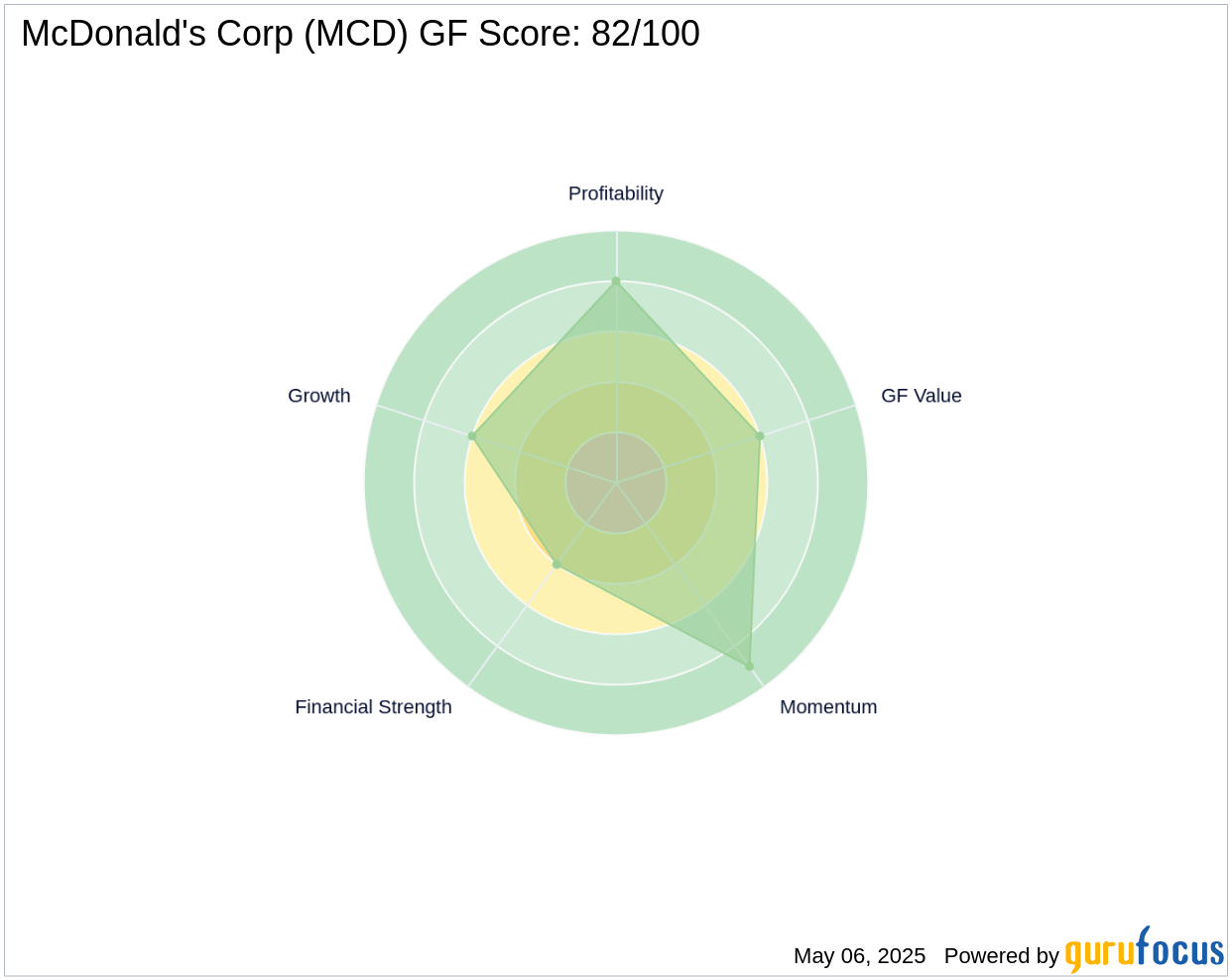

McDonald's Corp is the largest restaurant owner-operator in the world, with 2024 system sales of $131 billion across more than 43,000 stores. The company earns approximately 60% of its revenue from franchise royalty fees and lease payments, with the remainder coming from company-operated stores. McDonald's operates in three core segments: the United States, internationally operated markets, and international developmental/licensed markets. The company's market capitalization stands at $225.77 billion, with a price-to-earnings ratio of 27.87. McDonald's is currently fairly valued with a GF Score of 82/100, indicating good outperformance potential.

Transaction Details and Portfolio Impact

The recent acquisition by JPMorgan Chase & Co. was executed at a price of $312.37 per share. Post-transaction, the firm holds 35,931,728 shares of McDonald's, representing 0.84% of its portfolio. This strategic addition aligns with the firm's investment philosophy, which emphasizes growth and profitability in sectors such as technology and financial services. The transaction reflects the firm's confidence in McDonald's ability to maintain its market leadership and continue delivering strong financial performance.

Financial Metrics and Valuation of McDonald's Corp

McDonald's Corp boasts a robust financial profile with a market capitalization of $225.77 billion and a price-to-earnings ratio of 27.87. The stock is currently fairly valued with a GF Value of $299.06. The company's Profitability Rank is 8/10, indicating strong profitability, while its Financial Strength Rank is 4/10. McDonald's has demonstrated consistent growth, with a 3-year revenue growth rate of 5.10% and an Operating Margin growth of 3.20%. The company's Altman Z score of 5.19 suggests financial stability, while its Piotroski F-Score of 6 indicates moderate financial health.

Comparative Analysis with Other Gurus

The Bill & Melinda Gates Foundation Trust holds the largest share percentage of McDonald's, showcasing its confidence in the company's long-term prospects. Other notable investors in McDonald's include Ken Fisher (Trades, Portfolio), Jefferies Group (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). These investors' involvement further underscores the attractiveness of McDonald's as a stable and profitable investment opportunity.

Conclusion: A Strategic Move by JPMorgan Chase & Co.

The addition of McDonald's shares by JPMorgan Chase & Co. reflects the firm's confidence in the company's growth and profitability. This transaction aligns with the firm's investment philosophy and its focus on technology and financial services sectors. As McDonald's continues to expand its global footprint and enhance its revenue streams, JPMorgan Chase & Co.'s increased stake positions the firm to benefit from the company's ongoing success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: