On March 31, 2025, BlackRock, Inc. (Trades, Portfolio) executed a strategic transaction involving CommVault Systems Inc (CVLT, Financial), reducing its holdings by 419,204 shares. This move represents a -6.81% change in the firm's position in the company. Despite this reduction, BlackRock, Inc. (Trades, Portfolio) still holds a significant number of shares, totaling 5,737,508, which accounts for 13.00% of its total holdings in the stock. The transaction was executed at a trade price of $157.76 per share, reflecting BlackRock, Inc. (Trades, Portfolio)'s ongoing portfolio management strategy.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

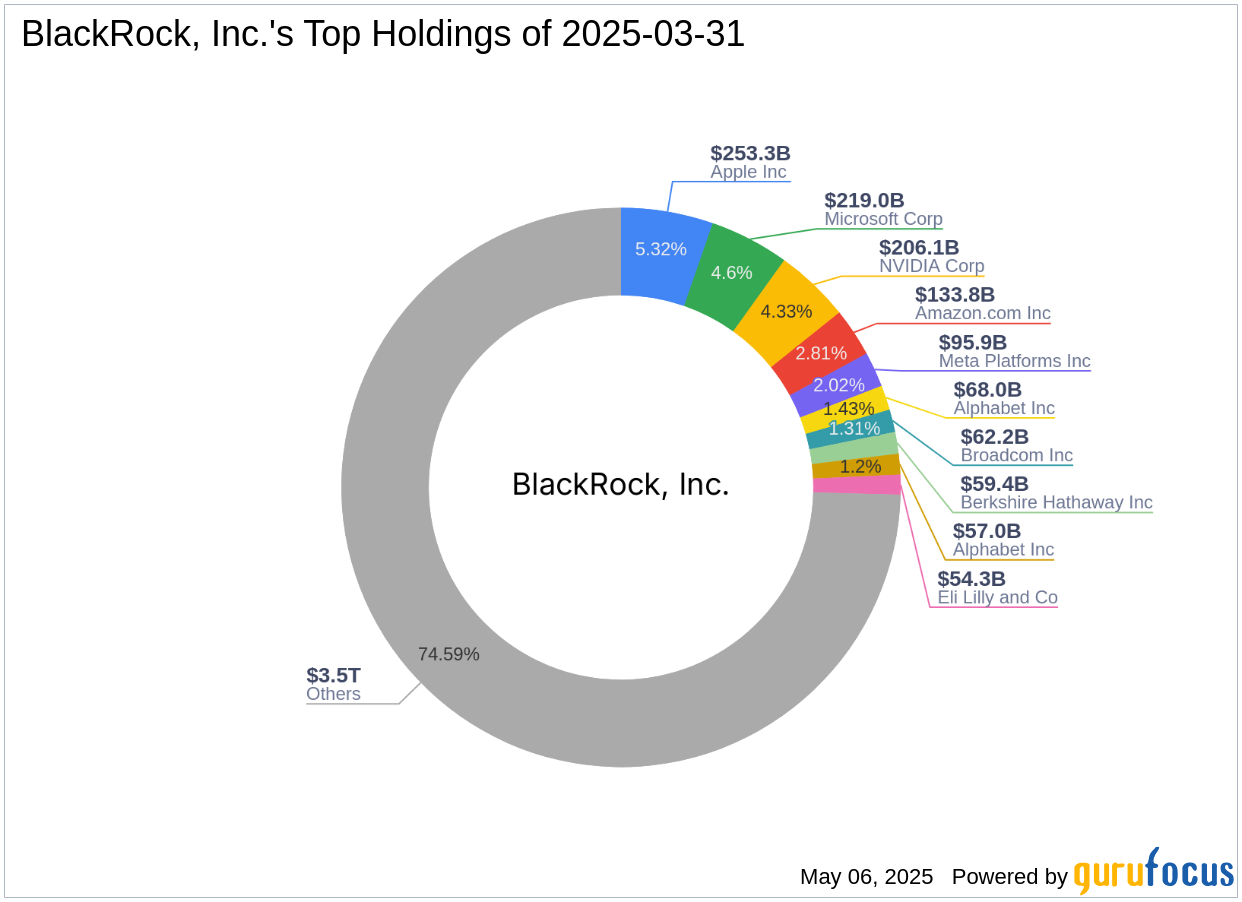

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, NY, is a leading investment firm renowned for its diversified investment philosophy. With an impressive equity value of $4,758.45 trillion, the firm is a major player in the global financial markets. BlackRock, Inc. (Trades, Portfolio)'s top holdings include prominent companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). This diverse portfolio underscores the firm's strategic approach to investment, balancing risk and opportunity across various sectors.

CommVault Systems Inc: An Overview

CommVault Systems Inc, based in the USA, specializes in providing data management software and services. The company offers a range of solutions, including Commvault Complete Backup and Recovery and HyperScale, catering to large global enterprises, small- and midsize businesses, and government agencies. CommVault Systems Inc operates globally, leveraging its salesforce and a network of reseller partners to distribute its software licenses and services. The company's market capitalization stands at $7.47 billion, with a current stock price of $169.86.

Financial Metrics and Valuation of CommVault Systems Inc

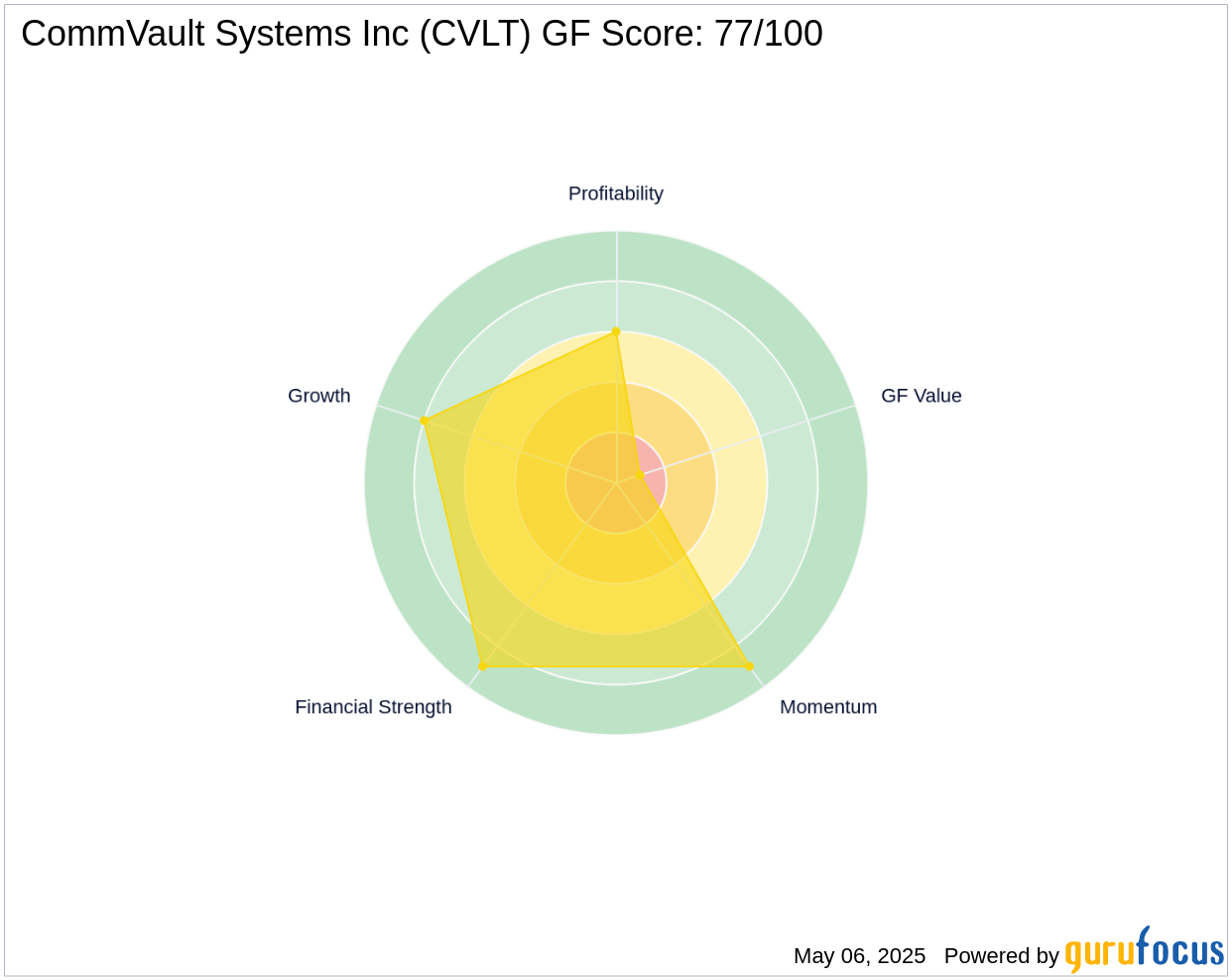

CommVault Systems Inc is currently valued at a market capitalization of $7.47 billion, with its stock price significantly overvalued at $169.86 compared to its GF Value of $93.12. This results in a Price to GF Value ratio of 1.82, indicating a potential overvaluation. The company's GF Score of 77/100 suggests likely average performance, with a 3-year revenue growth of 10.60% and an EBITDA growth of 20.20%. These metrics highlight CommVault's growth potential and financial health, despite the current overvaluation.

Impact of the Transaction on BlackRock, Inc. (Trades, Portfolio)'s Portfolio

The recent transaction had minimal impact on BlackRock, Inc. (Trades, Portfolio)'s overall portfolio, with the stock position representing just 0.02% of the firm's total holdings. However, the firm's stake in CommVault Systems Inc remains substantial, accounting for 13.00% of its total holdings in the stock. This strategic reduction aligns with BlackRock, Inc. (Trades, Portfolio)'s broader investment strategy, allowing the firm to optimize its portfolio while maintaining a significant interest in CommVault Systems Inc.

Market and Industry Context

CommVault Systems Inc operates within the software industry, boasting a strong balance sheet rank of 9/10. The company exhibits robust financial health, with a high interest coverage ratio of 213.30. These indicators reflect CommVault's ability to manage its financial obligations effectively, positioning it well within the competitive software market.

Conclusion

BlackRock, Inc. (Trades, Portfolio)'s decision to reduce its stake in CommVault Systems Inc is a reflection of strategic portfolio management, balancing risk and opportunity. The transaction, coupled with CommVault's financial metrics, provides valuable insights for value investors considering this stock. As BlackRock, Inc. (Trades, Portfolio) continues to navigate the complexities of the financial markets, its actions offer a window into the firm's investment philosophy and approach to managing its extensive portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.