Highlights:

- Sterling Infrastructure (STRL, Financial) experienced a 29% rise in adjusted EPS for Q1 2025.

- The E-Infrastructure Solutions segment fueled a 7% revenue increase year-over-year.

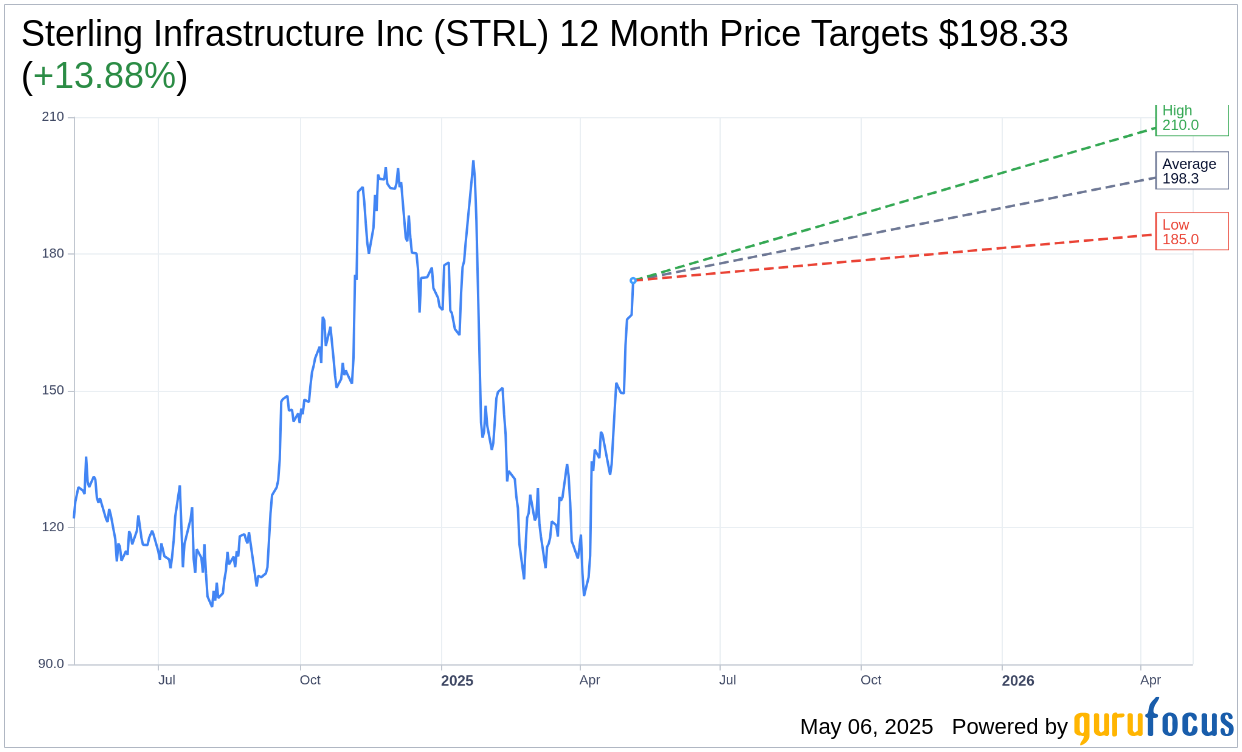

- Analysts set an average price target of $198.33, indicating potential upside.

Sterling Infrastructure's Strong Q1 Performance

Sterling Infrastructure Inc. (STRL) reported impressive financial results for the first quarter of 2025. The company's adjusted earnings per share soared by 29% to $1.63, while adjusted EBITDA surged by 31% to $80 million. This robust performance was bolstered by a 7% increase in revenue compared to the previous year, primarily driven by strong growth in the E-Infrastructure Solutions segment. Moreover, the strategic acquisition of Drake Concrete played a pivotal role in expanding Sterling Infrastructure's backlog to a substantial $2.1 billion.

Wall Street Analysts' Forecasts

Wall Street analysts have provided insightful one-year price targets for Sterling Infrastructure Inc. (STRL, Financial). Among the three analysts' estimates, the average target price is $198.33, with a high of $210.00 and a low of $185.00. This average target suggests a potential upside of 13.88% from the current stock price of $174.16. Investors seeking more detailed projections can refer to the Sterling Infrastructure Inc (STRL) Forecast page.

Recommendation Status

Sterling Infrastructure has garnered a favorable consensus recommendation from three brokerage firms, with an average brokerage recommendation score of 1.3. This score indicates a "Buy" status on a rating scale ranging from 1 (Strong Buy) to 5 (Sell), underscoring the prevailing positive sentiment among analysts.

GF Value Estimate and Implications

According to GuruFocus estimates, the GF Value for Sterling Infrastructure Inc. (STRL, Financial) is projected to be $70.44 in one year. This estimation suggests a potential downside of 59.55% from the current trading price of $174.155. The GF Value represents an estimate of the stock's fair trading value, calculated based on historical trading multiples, past business growth, and future performance projections. For further information, investors can explore the Sterling Infrastructure Inc (STRL) Summary page.