- SolarEdge Technologies posts a significant quarterly rebound with a 19% stock surge.

- Impressive revenue growth and optimistic future guidance defy market challenges.

- Analyst consensus suggests a "Hold" with substantial potential upside according to GuruFocus metrics.

SolarEdge Technologies (SEDG, Financial) recently showcased a remarkable recovery by reporting a narrower-than-anticipated loss in the first quarter. This positive news catapulted the stock nearly 19%, reflecting growing investor confidence. The company achieved a 12% quarter-over-quarter revenue increase, reaching $219.5 million, defying challenges such as tariff impacts.

Future Projections: Revenue and Margins

Looking ahead, SolarEdge forecasts second-quarter sales between $265 million and $285 million, comfortably surpassing analyst expectations. Furthermore, the company anticipates adjusted gross margins in the range of 8% to 12%, underscoring its strategic resilience amidst market volatility.

Wall Street Analysts Forecast

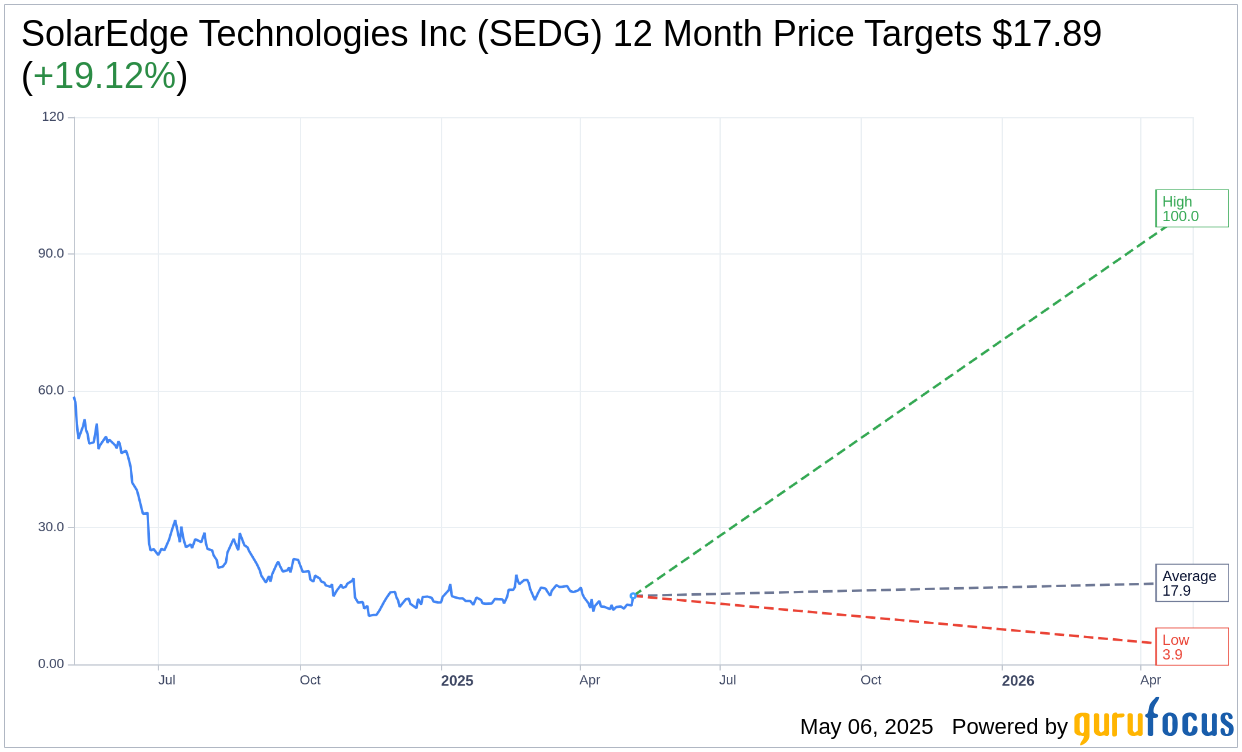

The financial community exhibits diverse opinions on SolarEdge's future price trajectory. Based on projections from 28 analysts, the average one-year target price for SolarEdge Technologies Inc (SEDG, Financial) is $17.89. This reflects a potential upside of 19.12% from its current level of $15.02, with estimates ranging from a high of $100.00 to a low of $3.90. Detailed data is available on the SolarEdge Technologies Inc (SEDG) Forecast page.

Investment Recommendations

The consensus among 33 brokerage firms is a recommendation of "Hold" for SolarEdge Technologies, with an average rating of 3.4 on a scale where 1 indicates a Strong Buy and 5 denotes a Sell. This suggests a cautious yet optimistic approach to the stock.

GuruFocus’s GF Value Estimation

According to GuruFocus estimations, SolarEdge Technologies Inc (SEDG, Financial) presents a compelling investment case with an estimated GF Value of $54.76 within one year. This projection indicates a substantial potential upside of 264.7% from its current price of $15.015. The GF Value reflects a calculated estimate of the fair trading value, integrating historical trading multiples, business growth patterns, and future performance estimates. For further insights, visit the SolarEdge Technologies Inc (SEDG) Summary page.