Alphabet's (GOOG, Financial) rolls out early access to Gemini 2.5 Pro Preview ahead of Google I/O, supercharging coding for interactive web apps.

In a blog post, Senior Director Tulsee Doshi said the I/O edition builds on “overwhelmingly positive feedback” for Gemini 2.5 Pro's coding and multimodal reasoning, adding UI-focused tools along with code transformation, editing and agentic workflow development.

Developers can start building with the update today via the Gemini API in Google AI Studio and Vertex AI, while users of the Gemini app will see new Canvas features that let anyone “vibe code” and spin up interactive web apps with a single prompt.

Gemini 2.5 Pro now leads the WebDev Arena Leaderboard, outpacing the prior version by 147 Elo points—a clear signal of its improved performance. Google said this positions Gemini ahead of rivals like OpenAI's ChatGPT, Meta's Llama-based offerings and Anthropic's Claude, just as Meta last week debuted its standalone Llama 4 chatbot app. Meanwhile, Google expects to ink an agreement with Apple (AAPL) by mid-2025 to preload Gemini on new iPhones, CEO Sundar Pichai reportedly told investors, extending Gemini's reach beyond Android and the web.

Why it matters: Early access to advanced coding features and leaderboard leadership could accelerate enterprise and developer adoption, reinforcing Google's competitive edge in AI platforms.

Investors and developers will look to Google I/O in a couple of weeks for demos, pricing details and the Apple partnership announcement, which could drive broader Gemini integration across devices.

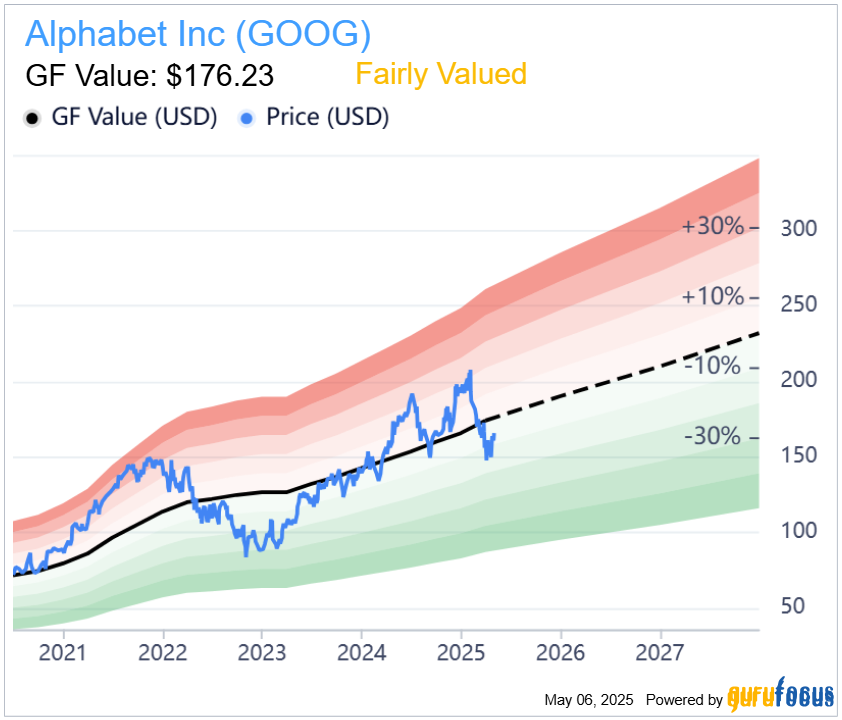

Alphabet Inc. is currently fairly valued according to GuruFocus, with a GF Value of $176.23 as of May 6, 2025. The stock's recent dip puts its price slightly below the estimated fair value line, signaling potential upside if valuation reverts to the mean. The trendline suggests long-term growth remains intact, with pricing still comfortably within the neutral zone. Investors may see this as a consolidation phase rather than overvaluation.