- Coterra Energy achieves a robust first-quarter net income in 2025, alongside strategic financial moves.

- Analysts predict significant stock price appreciation, highlighting an "Outperform" status.

- GuruFocus suggests a nearly 49% upside from current valuations.

Coterra Energy (CTRA, Financial) has kicked off 2025 with noteworthy financial achievements. The company reported a net income of $516 million, complemented by an adjusted net income of $608 million. Demonstrating strategic financial management, Coterra retired $250 million in term loans while successfully integrating new acquisitions. Additionally, through effective capital reallocation, the company has lowered its 2025 capital expenditure guidance by $100 million.

Wall Street Analysts Forecast

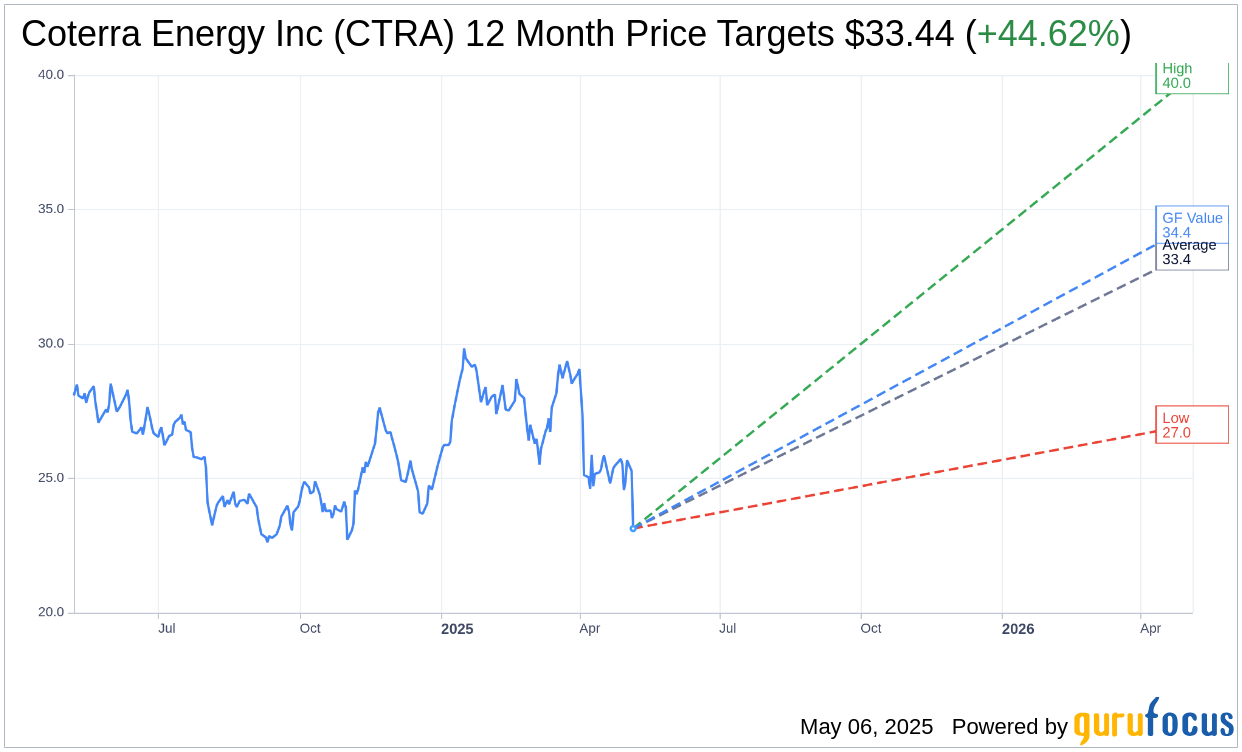

According to projections from 26 analysts, the average one-year price target for Coterra Energy Inc (CTRA, Financial) stands at $33.44, with estimates ranging from a low of $27.00 to a high of $40.00. This average target price suggests a promising potential upside of 44.62% from the current market price of $23.13. For more comprehensive estimate data, visit the Coterra Energy Inc (CTRA) Forecast page.

The consensus from 26 brokerage firms rates Coterra Energy Inc's (CTRA, Financial) as a 1.9 on the brokerage recommendation scale, indicating an "Outperform" status. This scale ranges from 1, meaning Strong Buy, to 5, indicating Sell.

Moreover, GuruFocus’ estimates reveal that the estimated GF Value for Coterra Energy Inc (CTRA, Financial) is projected to be $34.44 in one year, presenting an attractive upside of 48.93% from the current price of $23.125. The GF Value is a proprietary valuation that reflects the fair price at which the stock should trade, determined from historical trading multiples, past growth, and prospective business performance. Additional insights can be accessed on the Coterra Energy Inc (CTRA) Summary page.