Arcutis Biotherapeutics (ARQT, Financial) has reported first-quarter revenue of $65.85 million, surpassing analysts' expectations of $62.48 million. This strong performance is attributed to the rising demand for the ZORYVE portfolio, which offers a compelling alternative to steroids for both healthcare providers and patients.

The company highlights its extensive commercial coverage and successful expansion into Medicaid, with a substantial portion of recipients now covered. Arcutis is maintaining its gross-to-net ratio in the 50s, reflecting efficient financial management.

Looking ahead, Arcutis is optimistic about its growth prospects, driven by strategic execution, a robust financial foundation, and several upcoming market catalysts. These include potential new indications and expanded coverage for ZORYVE. With a promising development pipeline, the company is poised for continued success through 2025 and beyond.

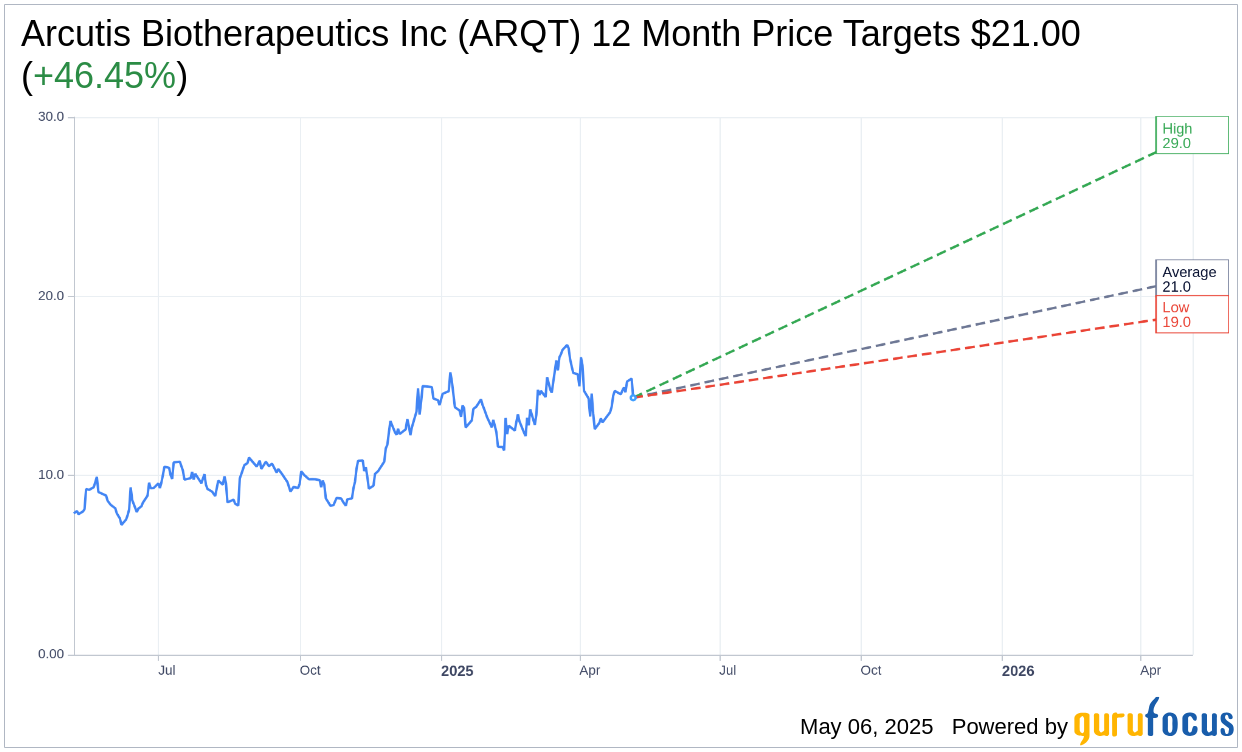

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Arcutis Biotherapeutics Inc (ARQT, Financial) is $21.00 with a high estimate of $29.00 and a low estimate of $19.00. The average target implies an upside of 46.45% from the current price of $14.34. More detailed estimate data can be found on the Arcutis Biotherapeutics Inc (ARQT) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Arcutis Biotherapeutics Inc's (ARQT, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

ARQT Key Business Developments

Release Date: February 25, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Arcutis Biotherapeutics Inc (ARQT, Financial) reported strong revenue growth with $71 million in Q4 2024, primarily driven by the Zari franchise.

- The company achieved a 471% year-over-year growth in product sales, indicating robust market demand.

- Arcutis Biotherapeutics Inc (ARQT) has secured broad access to commercially insured patients and is making progress in gaining Medicare and Medicaid coverage.

- The company is expanding its product portfolio with anticipated approvals for new indications, including scalp and body psoriasis.

- Arcutis Biotherapeutics Inc (ARQT) is well-capitalized with $228.6 million in cash and marketable securities, providing financial stability and flexibility.

Negative Points

- The company faces typical Q1 gross-to-net fluctuations due to deductible resets and insurance plan changes, which may impact revenue.

- There is a potential risk of cannibalization between the foam and cream formulations, although the company believes this is unlikely.

- Arcutis Biotherapeutics Inc (ARQT) is still in the early stages of its growth, indicating that significant market penetration is yet to be achieved.

- The company is facing ongoing intellectual property lawsuits, which could pose risks to its product exclusivity.

- Despite strong revenue growth, the company does not expect to reach cash break-even until 2026, indicating ongoing financial challenges.