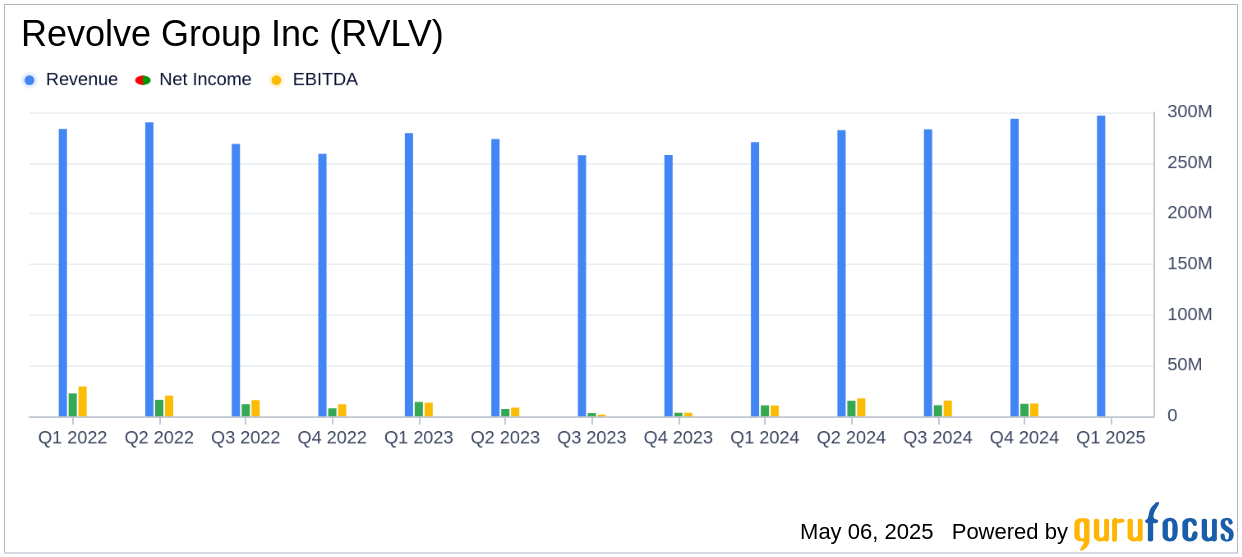

On May 6, 2025, Revolve Group Inc (RVLV, Financial) released its 8-K filing detailing its financial results for the first quarter ended March 31, 2025. The company, a prominent e-commerce retailer targeting Millennial and Generation Z consumers, reported a diluted earnings per share (EPS) of $0.16, surpassing the analyst estimate of $0.15. This performance was driven by a 10% year-over-year increase in net sales, reaching $296.7 million, slightly below the estimated revenue of $298.03 million.

Company Overview

Revolve Group Inc (RVLV, Financial) operates as a next-generation fashion retailer, offering a wide range of women's apparel, accessories, and beauty products through its platforms, Revolve and FWRD. The company focuses on mobile commerce and influencer marketing, catering to the aspirational yet attainable luxury niche. With $1.1 billion in 2024 net sales, Revolve is a significant player in the digital retail space, generating approximately 18% of sales from private-label offerings.

Performance Highlights and Challenges

Revolve Group Inc (RVLV, Financial) demonstrated robust performance in Q1 2025, with a 10% increase in net sales to $296.7 million compared to $270.6 million in Q1 2024. The company's gross profit rose by 9% to $154.3 million, although the gross margin slightly decreased to 52.0% from 52.3% due to a lower mix of full-price sales and deeper markdowns. Despite these challenges, the company maintained strong operational efficiency, with fulfillment costs and selling and distribution expenses decreasing as a percentage of net sales.

Financial Achievements and Industry Significance

Revolve Group Inc (RVLV, Financial) achieved a 57% year-over-year growth in operating income and generated $45 million in operating cash flow, strengthening its balance sheet. The company's adjusted EBITDA increased by 45% to $19.3 million, reflecting improved efficiency in selling, distribution, and marketing investments. These achievements underscore Revolve's resilience and strategic positioning in the retail-cyclical industry, where digital channels continue to gain prominence.

Key Financial Metrics

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Net Sales | $296.7 million | $270.6 million | 10% |

| Gross Profit | $154.3 million | $141.5 million | 9% |

| Net Income | $11.4 million | $10.9 million | 5% |

| Adjusted EBITDA | $19.3 million | $13.3 million | 45% |

| Free Cash Flow | $42.8 million | $36.7 million | 17% |

Analysis of Performance

Revolve Group Inc (RVLV, Financial) has effectively navigated a challenging macroeconomic environment, achieving double-digit top-line growth and significant improvements in operating income and cash flow. The company's strategic investments in key initiatives and its focus on operational efficiency have positioned it well to capitalize on growth opportunities. The increase in active customers and total orders placed further highlights the brand's strong market presence and consumer appeal.

“Our strong execution within a dynamic macro environment resulted in outstanding first quarter results, highlighted by double-digit top-line growth, 57% growth in operating income year-over-year, and $45 million in operating cash flow that further strengthened our balance sheet,” said co-founder and co-CEO Mike Karanikolas.

Revolve Group Inc (RVLV, Financial) continues to demonstrate resilience and adaptability, leveraging its solid financial foundation and strategic initiatives to drive long-term success in the evolving retail landscape. The company's focus on digital channels and influencer marketing remains a key differentiator in capturing the next-generation customer base.

Explore the complete 8-K earnings release (here) from Revolve Group Inc for further details.