In the first quarter, Teradata (TDC, Financial) reported revenues totaling $418 million, slightly missing analysts' consensus expectation of $423.18 million. Despite this shortfall, the company successfully achieved its internal targets across key performance indicators. This success was attributed to strategic market actions and a focus on innovation, according to CEO Steve McMillan.

Teradata remains committed to aiding global industry leaders in extracting value from its trusted AI solutions and hybrid platforms, which are especially critical during uncertain times. The company is attentive to market fluctuations while upholding its strategic 2025 outlook for growth in cloud and total annual recurring revenue (ARR).

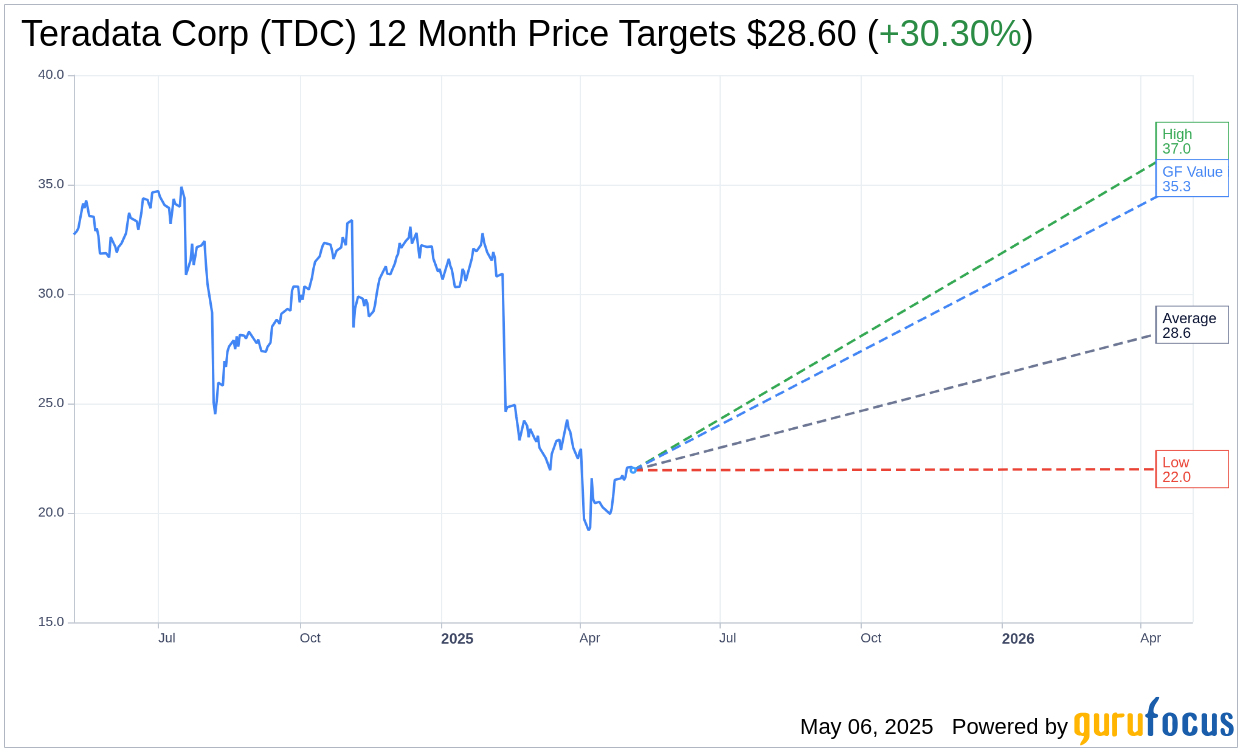

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Teradata Corp (TDC, Financial) is $28.60 with a high estimate of $37.00 and a low estimate of $22.00. The average target implies an upside of 30.30% from the current price of $21.95. More detailed estimate data can be found on the Teradata Corp (TDC) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Teradata Corp's (TDC, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teradata Corp (TDC, Financial) in one year is $35.30, suggesting a upside of 60.82% from the current price of $21.95. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teradata Corp (TDC) Summary page.

TDC Key Business Developments

Release Date: February 11, 2025

- Cloud ARR: $609 million in 2024, with a growth of 18% year-over-year in Q4.

- Total ARR: $1.474 billion in 2024, declined 4% year-over-year in Q4.

- Cloud Net Expansion Rate: 117% in Q4 2024.

- Free Cash Flow: $277 million for fiscal year 2024, representing a 16% margin.

- Share Repurchases: 78% of free cash flow returned to investors in 2024.

- Q4 Recurring Revenue: $351 million, down 6% year-over-year.

- Q4 Total Revenue: $409 million, down 11% year-over-year.

- Full Year Recurring Revenue: $1.479 billion, a decrease of 1% as reported.

- Full Year Total Revenue: $1.750 billion, down 5% as reported.

- Q4 Gross Margin: 60.9%, down 100 basis points year-over-year.

- Q4 Operating Margin: 17.6%, down 190 basis points year-over-year.

- Non-GAAP EPS: $0.53 in Q4, exceeding guidance.

- 2025 Cloud ARR Growth Outlook: 14% to 18%.

- 2025 Total ARR Growth Outlook: Flat to 2%.

- 2025 Free Cash Flow Outlook: $250 million to $280 million.

- 2025 Non-GAAP EPS Outlook: $2.15 to $2.25.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Teradata Corp (TDC, Financial) delivered $609 million in Cloud ARR and $1.474 billion in total ARR, advancing their hybrid cloud platform strategy.

- The company has formed new partnerships with NVIDIA and strengthened relationships with major cloud service providers, enhancing their AI capabilities.

- Teradata Corp (TDC) expects a meaningful improvement in retention rates for both total and on-prem ARR in 2025.

- The company has introduced innovations such as the enterprise vector store and integration with Amazon Bedrock, expanding their AI and analytics offerings.

- Teradata Corp (TDC) returned 78% of free cash flow to investors through share repurchases, demonstrating strong capital return practices.

Negative Points

- Total ARR declined by 4% year-over-year in constant currency, indicating challenges in maintaining growth.

- The company anticipates a decline in total recurring revenue and total revenue for 2025, with consulting revenue expected to decrease in the high single-digit range.

- Cloud ARR growth is projected to be lower than some expectations, with a guidance range of 14% to 18% for 2025.

- The company faces a $20 million headwind on 2025 operating income due to currency exchange rate movements.

- Teradata Corp (TDC) expects a negative impact on free cash flow due to FX headwinds and the total ARR exit rate in 2024.