On May 6, 2025, Mercury General Corp (MCY, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The insurance holding company, known for its personal automobile and property insurance products, faced significant challenges this quarter, primarily due to catastrophic events.

Performance Overview and Challenges

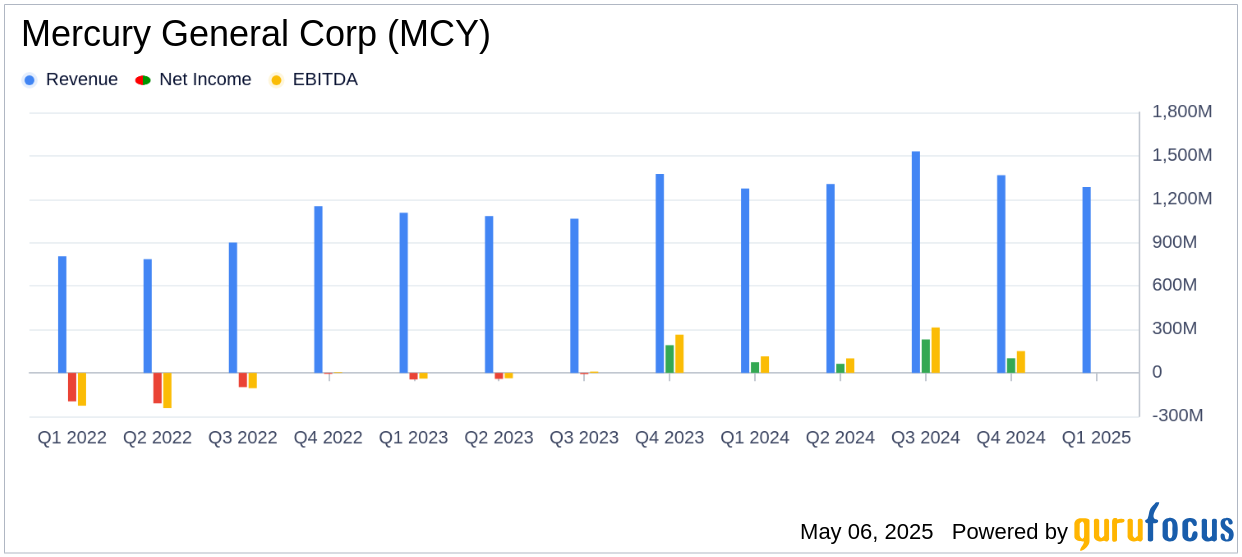

Mercury General Corp reported a net loss of $108.3 million for the first quarter of 2025, a stark contrast to the net income of $73.5 million in the same period last year. This resulted in a net loss per diluted share of $1.96, which is above the analyst estimate of -$3.53 per share. The company's operating loss was $126.8 million, compared to an operating income of $43.3 million in the previous year, highlighting a challenging quarter.

The primary challenge faced by Mercury General Corp was the catastrophic losses from the Southern California wildfires in January 2025. The company recorded net catastrophe losses and loss adjustment expenses of approximately $414 million, which significantly impacted its financial results. The combined ratio, a key measure of underwriting profitability, increased to 119.2% from 100.9% in the prior year, indicating higher claims and expenses relative to premiums earned.

Financial Achievements and Industry Context

Despite the challenges, Mercury General Corp achieved a 10% increase in net premiums earned, reaching $1.28 billion, up from $1.17 billion in the first quarter of 2024. This growth in premiums is crucial for the company as it reflects its ability to maintain and expand its customer base in a competitive insurance market.

The company declared a quarterly dividend of $0.3175 per share, demonstrating its commitment to returning value to shareholders even amid financial difficulties. This decision is significant in the insurance industry, where maintaining investor confidence is essential.

Key Financial Metrics and Analysis

Mercury General Corp's financial statements reveal several important metrics. The net realized investment gains, net of tax, were $18.4 million, down from $30.2 million in the previous year, reflecting a decrease in investment income. The company's catastrophe reinsurance program played a critical role in mitigating losses, with $1.29 billion of limits used for the January 2025 wildfires.

The company's balance sheet showed resilience, with efforts to recover subrogation from Southern California Edison for the Eaton fire, estimated at $525 million. This recovery is vital for offsetting some of the incurred losses and stabilizing the company's financial position.

Commentary and Future Considerations

Theodore Stalick, SVP/CFO, stated, "The January 2025 Southern California wildfires significantly impacted our financial results. However, our reinsurance program and subrogation efforts are crucial in managing these catastrophic losses."

Mercury General Corp's performance this quarter underscores the volatility and risks inherent in the insurance industry, particularly related to natural disasters. The company's ability to navigate these challenges through strategic reinsurance and subrogation efforts will be critical in the coming quarters.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Mercury General Corp for further details.