On May 6, 2025, Gulfport Energy Corp (GPOR, Financial) released its 8-K filing detailing the financial and operational results for the first quarter of 2025. Gulfport Energy Corp is an independent natural gas-weighted exploration and production company, primarily operating in the Appalachia and Anadarko basins in the United States. The company focuses on the exploration, acquisition, and production of natural gas, crude oil, and natural gas liquids.

Financial Performance and Challenges

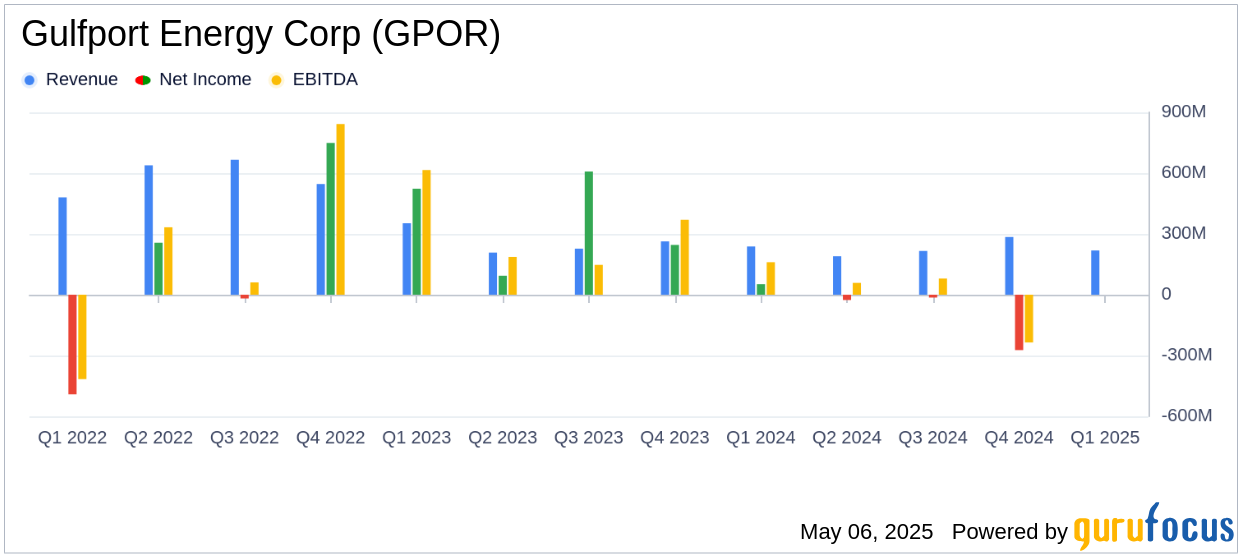

Gulfport Energy Corp reported a net loss of $0.5 million for the first quarter of 2025, falling short of the analyst estimate of $4.83 earnings per share. The company's revenue details were not explicitly mentioned, but the performance indicates a challenging quarter. The reported adjusted EBITDA was $218.3 million, showcasing the company's operational efficiency despite the net loss.

The company's total net production averaged 929.3 MMcfe per day, with a significant portion, 91%, being natural gas. This production level is crucial for Gulfport Energy Corp as it highlights the company's ability to maintain a steady output amidst fluctuating market conditions. However, the net loss indicates potential challenges in managing costs or achieving expected revenue targets.

Operational Achievements and Strategic Plans

Gulfport Energy Corp achieved a 14% increase in total net liquids production compared to the first quarter of 2024, reaching 15.2 MBbl per day. This increase is significant for the company as it demonstrates growth in its production capabilities, which is essential in the competitive oil and gas industry.

The company incurred capital expenditures of $159.8 million, with $148.6 million allocated to operated drilling and completion activities. This investment is part of Gulfport's strategy to enhance its production capabilities and maintain its asset base. The company also repurchased approximately 340.7 thousand shares of common stock, totaling $60.0 million, reflecting its commitment to returning value to shareholders.

Financial Position and Liquidity

As of March 31, 2025, Gulfport Energy Corp had $5.3 million in cash and cash equivalents, with $35.0 million in outstanding borrowings under its revolving credit facility. The company's liquidity totaled approximately $906.5 million, including available borrowing capacity. This financial position provides Gulfport with the flexibility to navigate market uncertainties and invest in growth opportunities.

John Reinhart, President and CEO, commented, “Gulfport is off to an active start in 2025, delivering first quarter results ahead of Company expectations while remaining on track to execute on our previously provided full year guidance. Our ability to generate adjusted free cash flow during a front-loaded capital program highlights the strength of our asset base and the operations team’s high-level of efficiency and execution.”

Analysis and Future Outlook

Gulfport Energy Corp's first quarter results highlight both achievements and challenges. The increase in production and strategic capital investments are positive indicators of the company's operational strength. However, the net loss and failure to meet analyst EPS estimates suggest areas for improvement, particularly in cost management and revenue generation.

The company's strategic shift towards dry gas Utica development and its commitment to maximizing shareholder value through stock repurchases are promising steps. These initiatives, coupled with a robust liquidity position, position Gulfport Energy Corp to capitalize on future market opportunities and improve its financial performance in the coming quarters.

Explore the complete 8-K earnings release (here) from Gulfport Energy Corp for further details.