Supernus Pharmaceuticals (SUPN, Financial) announced first quarter revenue reaching $149.8 million, surpassing the anticipated $147.94 million. This achievement underscores significant double-digit growth from the company's principal products and a robust increase in adjusted operating earnings. Furthermore, the company is launching ONAPGO, a new product designed to aid adults with Parkinson's disease facing motor fluctuations, which is expected to further fuel business expansion.

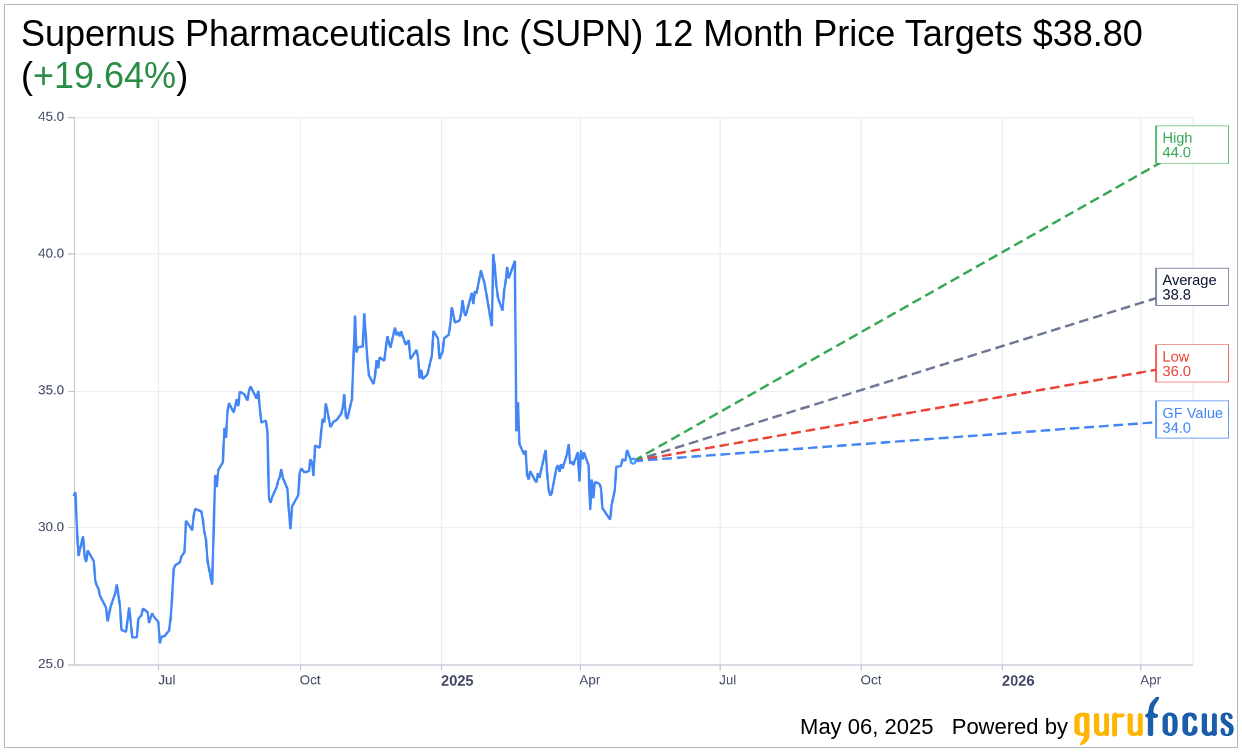

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Supernus Pharmaceuticals Inc (SUPN, Financial) is $38.80 with a high estimate of $44.00 and a low estimate of $36.00. The average target implies an upside of 19.64% from the current price of $32.43. More detailed estimate data can be found on the Supernus Pharmaceuticals Inc (SUPN) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Supernus Pharmaceuticals Inc's (SUPN, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Supernus Pharmaceuticals Inc (SUPN, Financial) in one year is $33.95, suggesting a upside of 4.69% from the current price of $32.43. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Supernus Pharmaceuticals Inc (SUPN) Summary page.

SUPN Key Business Developments

Release Date: February 25, 2025

- Total Revenue (Q4 2024): $174.2 million, up from $164.3 million in Q4 2023.

- Net Product Sales (Q4 2024): $166.4 million.

- Operating Earnings (Q4 2024, GAAP): $21.4 million, compared to an operating loss of $1 million in Q4 2023.

- Net Earnings (Q4 2024, GAAP): $15.3 million or $0.27 per diluted share, compared to $1.2 million or $0.02 per diluted share in Q4 2023.

- Total Revenue (Full Year 2024): $661.8 million, up from $607.5 million in 2023.

- Net Product Sales (Full Year 2024): $637.7 million.

- Operating Earnings (Full Year 2024, GAAP): $81.7 million, compared to an operating loss of $5.3 million in 2023.

- Net Earnings (Full Year 2024, GAAP): $73.9 million or $1.32 per diluted share, compared to $1.3 million or $0.02 per diluted share in 2023.

- Cash and Equivalents (End of 2024): $454 million, up from $271 million at the end of 2023.

- Revenue Guidance (Full Year 2025): $600 million to $630 million.

- Operating Earnings Guidance (Full Year 2025, GAAP): $10 million to an operating loss of $15 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Supernus Pharmaceuticals Inc (SUPN, Financial) reported a 25% increase in total revenues for 2024, excluding certain legacy products.

- Calvary, a core product, achieved a 72% growth in annual net sales and a 25% growth in annual prescriptions.

- The FDA approved an updated label for Calvary, highlighting its unique mechanism of action and providing important lactation data for breastfeeding women with ADHD.

- The company received a two-plus year patent term extension for Calvary, extending its patent protection to 2035.

- Supernus Pharmaceuticals Inc (SUPN) has a strong balance sheet with $454 million in cash and no debt, providing financial flexibility for potential M&A and growth opportunities.

Negative Points

- The first generic for Oxtellar XR entered the market, resulting in a decline in net sales for this legacy product.

- Combined net sales of Trokendi XR and Oxtellar XR were down 22% for the full year 2024.

- The phase 2B study of SPN-820 in adults with treatment-resistant depression did not demonstrate statistically significant improvement versus placebo.

- The company expects further erosion in sales of legacy products in 2025, with combined net sales projected to be between $65 million and $75 million.

- Operating earnings guidance for 2025 suggests a potential operating loss, with expectations ranging from $10 million in earnings to a $15 million loss.