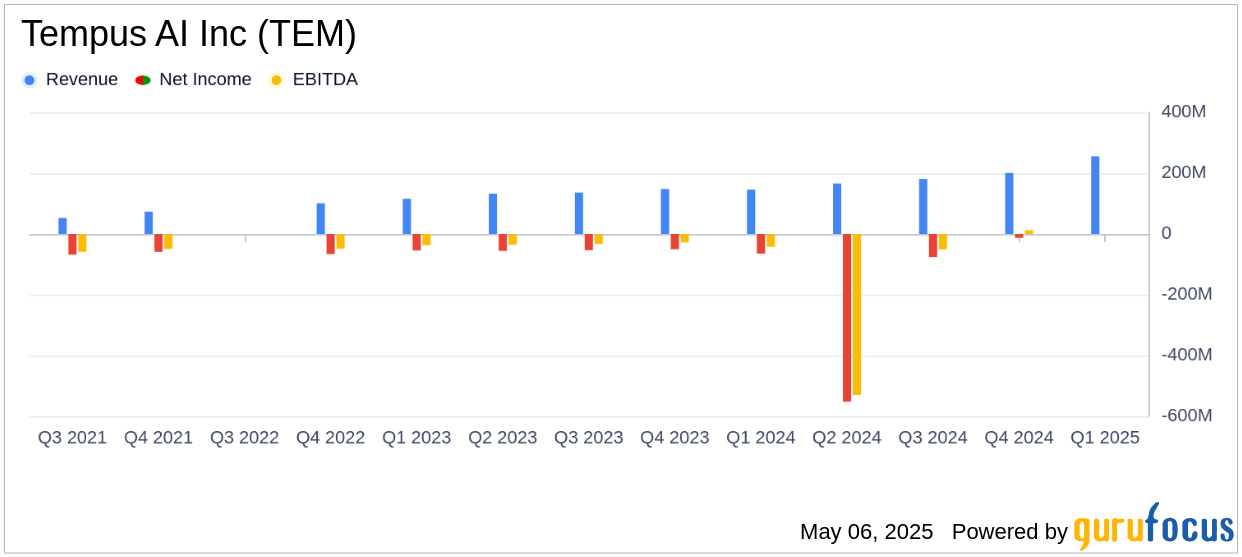

Tempus AI Inc (TEM, Financial), a technology company at the forefront of AI-driven precision medicine, released its 8-K filing on May 6, 2025, detailing its financial performance for the first quarter ended March 31, 2025. The company reported a remarkable 75.4% increase in revenue year-over-year, reaching $255.7 million. This growth is attributed to the company's strategic focus on AI and its application in healthcare, particularly in genomics and oncology testing.

Company Overview

Tempus AI Inc is a technology company that has developed the Tempus Platform, which integrates a technology platform to liberate healthcare data from silos and an operating system to make this data actionable. The company's Intelligent Diagnostics leverages AI, including generative AI, to enhance the accuracy and personalization of laboratory tests.

Performance and Challenges

Tempus AI's performance in the first quarter of 2025 underscores its robust growth trajectory, with a 99.8% increase in gross profit to $155.2 million. The company has also announced strategic collaborations with AstraZeneca and Pathos, expected to generate an additional $200 million in data licensing and model development fees over the next three years. However, the company reported a net loss of $68.0 million, which includes significant stock compensation expenses and fair value losses related to marketable equity securities. These challenges highlight the ongoing financial pressures despite revenue growth.

Financial Achievements

The company's financial achievements are significant within the healthcare providers and services industry. Tempus AI's revenue from genomics surged by 88.9% to $193.8 million, while oncology testing revenue increased by 31.0% to $119.0 million. These achievements are crucial as they demonstrate the company's ability to capitalize on the growing demand for precision medicine and AI-driven diagnostics.

Key Financial Metrics

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Revenue | $255.7 million | $145.8 million | 75.4% |

| Gross Profit | $155.2 million | $77.7 million | 99.8% |

| Net Loss | ($68.0 million) | ($64.7 million) | NM |

| Adjusted EBITDA | ($16.2 million) | ($43.9 million) | 63.2% |

These metrics are vital for assessing the company's operational efficiency and financial health. The improvement in adjusted EBITDA indicates better cost management and operational leverage.

Analysis and Outlook

Tempus AI's strategic investments in AI and its collaborations with industry leaders position it well for future growth. The company's increased revenue guidance for 2025 to $1.25 billion, representing an 80% year-over-year growth, reflects its confidence in sustaining this momentum. However, the ongoing net losses and high operational costs remain areas of concern that need addressing to ensure long-term profitability.

The business is performing well with revenues growing, margins improving, and our costs remaining in check, allowing us to demonstrate significant year-over-year operating leverage," said Eric Lefkofsky, Founder and CEO of Tempus.

Tempus AI's focus on AI-driven solutions in healthcare continues to drive its growth, making it a company to watch in the evolving landscape of precision medicine.

Explore the complete 8-K earnings release (here) from Tempus AI Inc for further details.