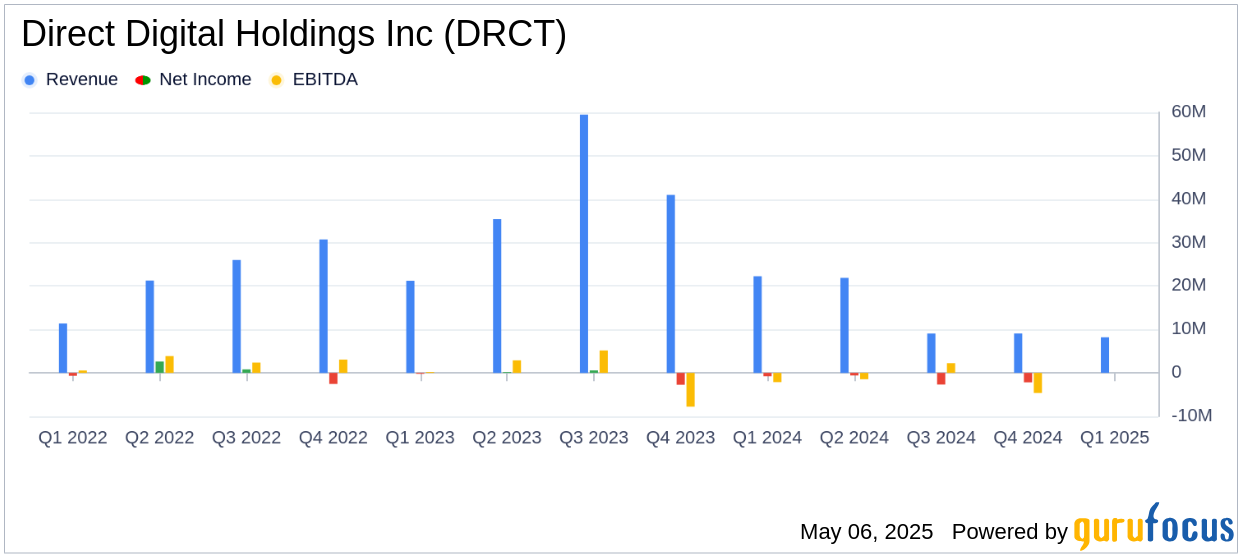

Direct Digital Holdings Inc (DRCT, Financial) released its 8-K filing on May 6, 2025, revealing a challenging first quarter with revenue falling short of analyst expectations. The company, a full-service programmatic advertising platform, reported a consolidated revenue of $8.2 million, significantly below the estimated $9.40 million. This performance underscores the ongoing challenges in its sell-side advertising segment, despite growth in buy-side revenues.

Company Overview

Direct Digital Holdings Inc operates through two main segments: sell-side advertising, managed by Colossus Media, and buy-side advertising, managed by Orange 142 and Huddled Masses. The company focuses on providing advertising technology and data-driven solutions to underserved markets within the digital advertising ecosystem, with all revenues attributed to the United States.

Performance and Challenges

The first quarter of 2025 saw Direct Digital Holdings Inc grappling with a 63% decline in total revenue compared to the same period in 2024. The sell-side segment, in particular, experienced an 88% drop in revenue, primarily due to a decrease in impression inventory. This decline highlights the ongoing impact of disruptions faced in 2024. However, the buy-side segment showed resilience, with a 6% increase in revenue, reaching $6.1 million.

Financial Achievements and Strategic Initiatives

Despite the revenue shortfall, Direct Digital Holdings Inc achieved a gross profit margin improvement, reaching 29% compared to 22% in the previous year. The company also successfully reduced operating expenses by 19%, driven by strategic cost-saving initiatives. These efforts are crucial for enhancing operational efficiency and positioning the company for future growth.

Key Financial Metrics

Direct Digital Holdings Inc reported a net loss of $5.9 million for the first quarter of 2025, compared to a net loss of $3.8 million in the same period of 2024. The adjusted EBITDA loss widened to $3.0 million from $1.7 million. As of March 31, 2025, the company held cash and cash equivalents of $1.8 million, up from $1.4 million at the end of 2024.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Revenue | $8.2 million | $22.3 million |

| Sell-side Revenue | $2.0 million | $16.5 million |

| Buy-side Revenue | $6.1 million | $5.8 million |

| Net Loss | $(5.9) million | $(3.8) million |

| Adjusted EBITDA Loss | $(3.0) million | $(1.7) million |

Analysis and Outlook

The first quarter results reflect the challenges Direct Digital Holdings Inc faces in rebuilding its sell-side business. However, the company's strategic initiatives, including cost reductions and new partnerships, are steps toward stabilizing and growing its operations. The buy-side segment's growth is a positive indicator, suggesting potential for future revenue diversification.

Mark D. Walker, Chairman and CEO, stated, “Our focus in 2025 is on driving growth and value for our shareholders. We’ve launched several initiatives to drive our progress, including revenue optimization efforts to diversify our revenue base and cost-saving initiatives to drive reductions in operating expenses and enhance operational efficiencies.”

Direct Digital Holdings Inc maintains its full-year revenue guidance of $90 million to $110 million, banking on the recovery of its sell-side segment and continued buy-side growth. The company's ability to navigate these challenges will be crucial in achieving its financial goals and returning to profitability.

Explore the complete 8-K earnings release (here) from Direct Digital Holdings Inc for further details.