On May 6, 2025, CRISPR Therapeutics AG (CRSP, Financial) released its 8-K filing detailing the financial results for the first quarter ending March 31, 2025. CRISPR Therapeutics, a leader in gene editing, focuses on developing CRISPR/Cas9-based therapeutics to treat genetically defined diseases. The company's first approved drug, Casgevy, targets sickle-cell disease and transfusion-dependent beta-thalassemia. The company is also advancing gene editing programs in immuno-oncology, cardiovascular, and stem cell-derived therapies for Type 1 diabetes.

Financial Performance and Challenges

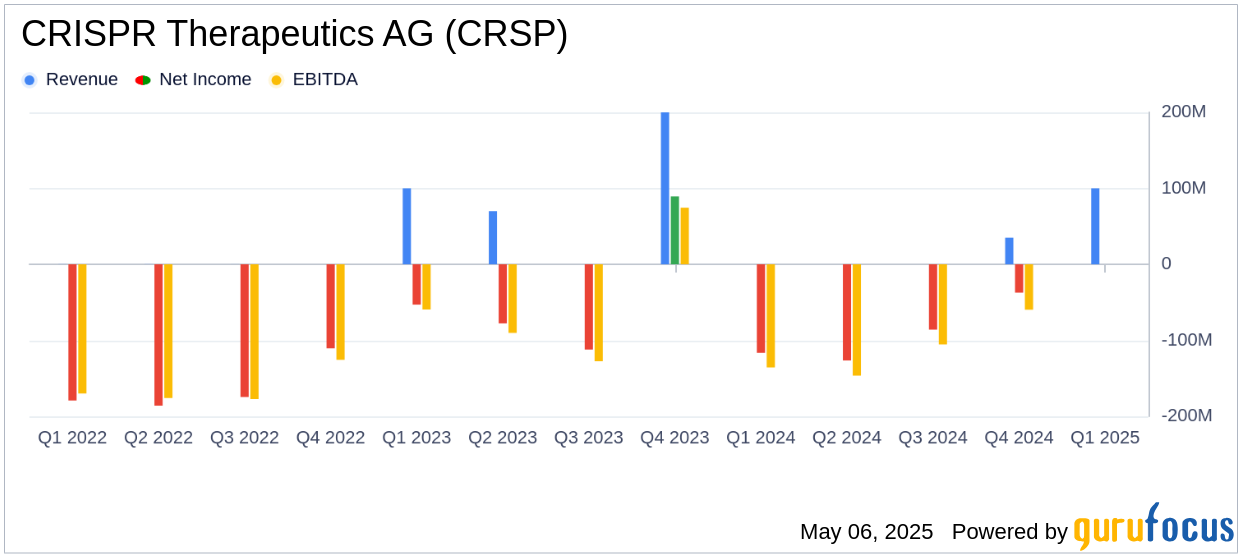

CRISPR Therapeutics AG reported a net loss of $136.0 million for Q1 2025, compared to a net loss of $116.6 million in Q1 2024. The company's earnings per share (EPS) was -$1.58, which is below the analyst estimate of -$1.21. Revenue for the quarter was $865,000, falling short of the estimated $6.50 million. These results highlight the ongoing financial challenges faced by the company as it invests heavily in research and development to advance its pipeline.

Clinical and Financial Achievements

Despite financial challenges, CRISPR Therapeutics AG achieved significant clinical milestones. The company announced positive top-line data from its Phase 1 clinical trial of CTX310™, targeting ANGPTL3, which showed dose-dependent decreases in triglycerides and low-density lipoprotein with a well-tolerated safety profile. This advancement underscores the potential of CRISPR's in vivo gene editing platform to deliver transformative medicines.

Key Financial Metrics

CRISPR Therapeutics AG's cash, cash equivalents, and marketable securities totaled approximately $1.86 billion as of March 31, 2025, down from $1.90 billion at the end of 2024. The decrease was primarily due to operating expenses. Research and development expenses were $72.5 million, a slight decrease from $76.2 million in the same period last year, while general and administrative expenses increased to $19.3 million from $18.0 million.

Analysis and Outlook

The company's financial performance reflects the high costs associated with advancing a robust pipeline of gene-editing therapies. The ongoing clinical trials and strategic collaborations, such as the partnership with Vertex Pharmaceuticals, are crucial for CRISPR Therapeutics AG to maintain its leadership in the biotechnology sector. The positive clinical data from CTX310™ and the expansion of Casgevy's global reach are promising indicators of future growth potential.

CRISPR Therapeutics AG's focus on innovative therapies and strategic partnerships positions it well for long-term success, despite current financial challenges. Investors and stakeholders will be keenly watching the company's progress in clinical trials and its ability to achieve regulatory milestones and commercial success.

Explore the complete 8-K earnings release (here) from CRISPR Therapeutics AG for further details.