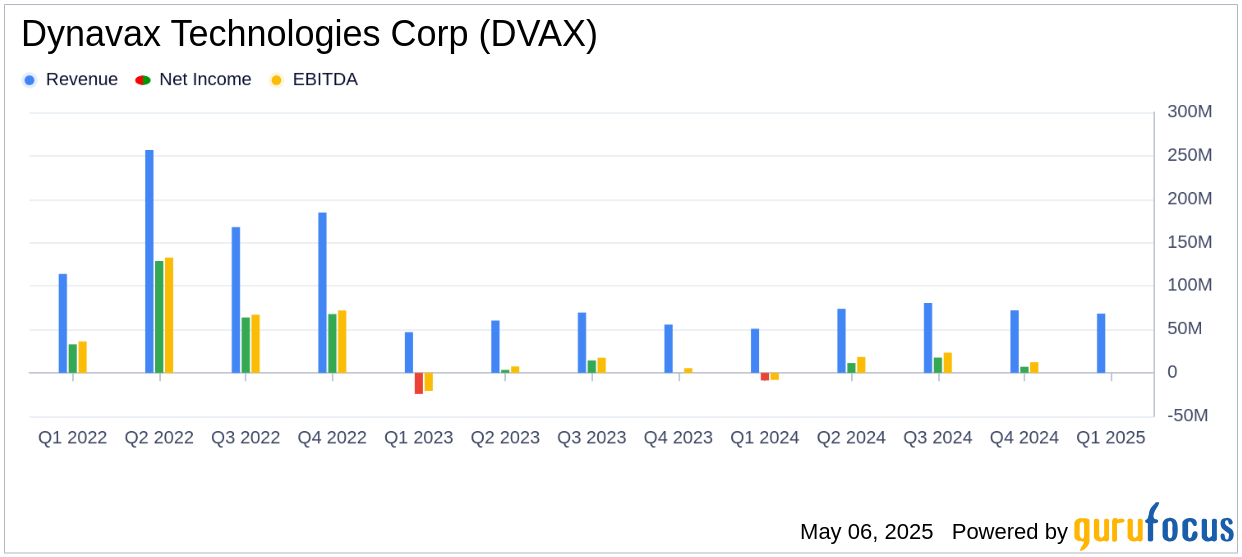

On May 6, 2025, Dynavax Technologies Corp (DVAX, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The biopharmaceutical company, known for its innovative vaccines, reported a total revenue of $68.2 million, falling short of the analyst estimate of $70.58 million. However, the company posted a GAAP net loss of $0.77 per share, which fell short of the estimated earnings per share of $0.04.

Company Overview

Dynavax Technologies Corp is a commercial-stage biopharmaceutical company that focuses on leveraging the body's immune responses through toll-like receptor stimulation. The company is primarily known for its HEPLISAV-B vaccine, a hepatitis B vaccine that generates significant revenue alongside its CpG 1018 product. Dynavax is also advancing its pipeline with new programs targeting pandemic influenza and Lyme disease.

Performance and Challenges

Dynavax reported a record net product revenue of $65 million for HEPLISAV-B in the first quarter, marking a 36% year-over-year growth. This achievement underscores the company's strong market position and its potential to capture a significant share of the hepatitis B vaccine market. However, the company faced challenges, including a substantial GAAP net loss of $96.1 million, primarily due to a loss on debt extinguishment related to convertible debt refinancing.

Financial Achievements and Industry Impact

The 34% increase in total revenues to $68.2 million highlights Dynavax's robust sales performance, particularly in the competitive drug manufacturing industry. The company's strategic focus on expanding its vaccine portfolio and leveraging its CpG 1018 adjuvant technology is crucial for long-term growth and market competitiveness.

Income Statement and Key Metrics

Dynavax's income statement reveals a significant increase in operating expenses, totaling $91.8 million, up from $68.6 million in the previous year. This rise is attributed to higher research and development expenses and a notable bad debt expense of $11 million related to an agreement with Clover Biopharmaceuticals. Despite these challenges, the company's adjusted EBITDA improved to negative $4.4 million from negative $6.8 million, indicating better operational efficiency.

Balance Sheet and Cash Flow

As of March 31, 2025, Dynavax reported cash, cash equivalents, and marketable securities totaling $661.3 million, a decrease from $713.8 million at the end of 2024. The company's balance sheet reflects a strategic refinancing of convertible debt, which extended debt maturity and reduced overall capital costs. Additionally, Dynavax has repurchased $172 million worth of common stock under its $200 million share repurchase program, demonstrating a commitment to returning value to shareholders.

Strategic Developments and Future Outlook

Dynavax is advancing its clinical pipeline with promising programs in shingles, plague, pandemic influenza, and Lyme disease vaccines. The company anticipates significant milestones in these areas, including top-line results from its shingles vaccine trial in Q3 2025. These developments are expected to enhance Dynavax's market position and drive future revenue growth.

“We started 2025 off strong, executing across our strategic growth initiatives, including delivering our highest first quarter net product revenue for HEPLISAV-B to date, putting us on track to achieve the top half of our full year guidance range,” said Ryan Spencer, Chief Executive Officer of Dynavax.

Dynavax's reaffirmation of its full-year 2025 financial guidance, with expected HEPLISAV-B net product revenue between $305 million and $325 million, reflects confidence in its strategic direction and market opportunities. The company's focus on innovative vaccine development and disciplined capital allocation positions it well for sustained growth in the biopharmaceutical sector.

Explore the complete 8-K earnings release (here) from Dynavax Technologies Corp for further details.