Key Highlights:

- AMD's stock surged 4.5% after surpassing Q1 earnings expectations.

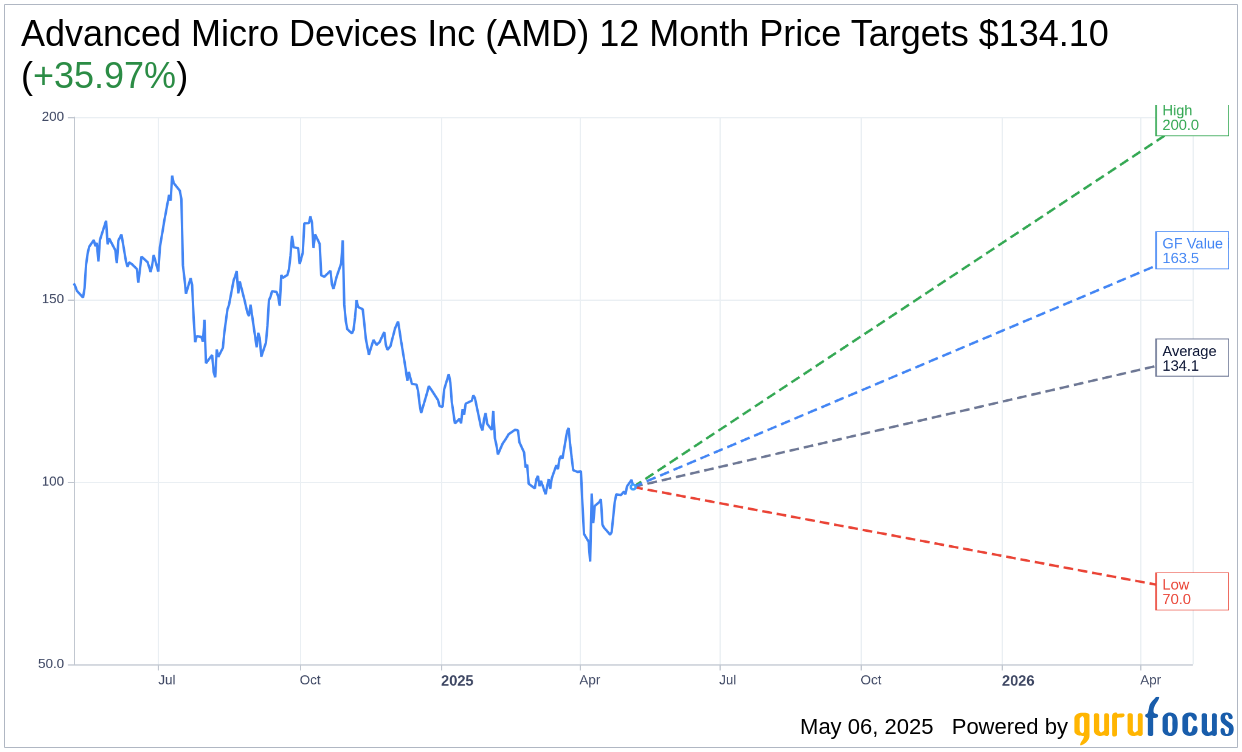

- Wall Street analysts project a promising 35.97% upside with a $134.10 average price target.

- GuruFocus estimates a significant 65.82% potential upside based on GF Value.

Impressive Earnings Propel AMD's Stock

AMD (NASDAQ: AMD) experienced a notable 4.5% increase in share price during after-hours trading, thanks to its impressive first-quarter earnings report. The semiconductor powerhouse reported a 36% boost in revenue, reaching $7.44 billion. This substantial growth was largely fueled by robust data center performance. Although gaming revenues saw a decline, the company maintains a positive outlook, undeterred by potential headwinds from new U.S. export restrictions.

Wall Street Analysts' Bullish Forecasts

According to predictions from 40 analysts, the average 12-month price target for Advanced Micro Devices Inc. (AMD, Financial) stands at $134.10, with estimates ranging from a high of $200.00 to a low of $70.00. This suggests a promising upside of 35.97% from the current share price of $98.62. For those interested in a more in-depth analysis, visit the Advanced Micro Devices Inc (AMD) Forecast page.

Analysts' Recommendations and GuruFocus Metrics

Advanced Micro Devices Inc. (AMD, Financial) currently holds an "Outperform" status, with an average brokerage recommendation of 2.3 based on evaluations from 51 brokerage firms. This rating scale, where 1 indicates a Strong Buy and 5 represents a Sell, reflects a positive sentiment among analysts.

Furthermore, GuruFocus estimates the GF Value for AMD to be $163.53 in one year, indicating a potential upside of 65.82% compared to the current price of $98.62. The GF Value represents GuruFocus' estimation of the stock's fair trading value, derived from historical trading multiples, past growth trends, and future business performance projections. For more comprehensive data, please visit the Advanced Micro Devices Inc (AMD, Financial) Summary page.