eXp World Holdings Inc (EXPI, Financial) released its 8-K filing on May 6, 2025, detailing its financial performance for the first quarter ended March 31, 2025. The company, known for its cloud-based residential real estate services, reported a modest revenue increase but faced challenges with a net loss, missing analyst estimates.

Company Overview

eXp World Holdings Inc is a cloud-based residential real estate company that operates a virtual real estate brokerage and technology platform. The company offers services in Real Estate Brokerage, Technology Products and Services, Title, Escrow, Settlement Services, and Mortgage Brokerage Services. With operations primarily in the United States and Canada, eXp World Holdings also has a presence in the United Kingdom, Australia, South Africa, France, India, Portugal, and Mexico, among others.

Financial Performance and Challenges

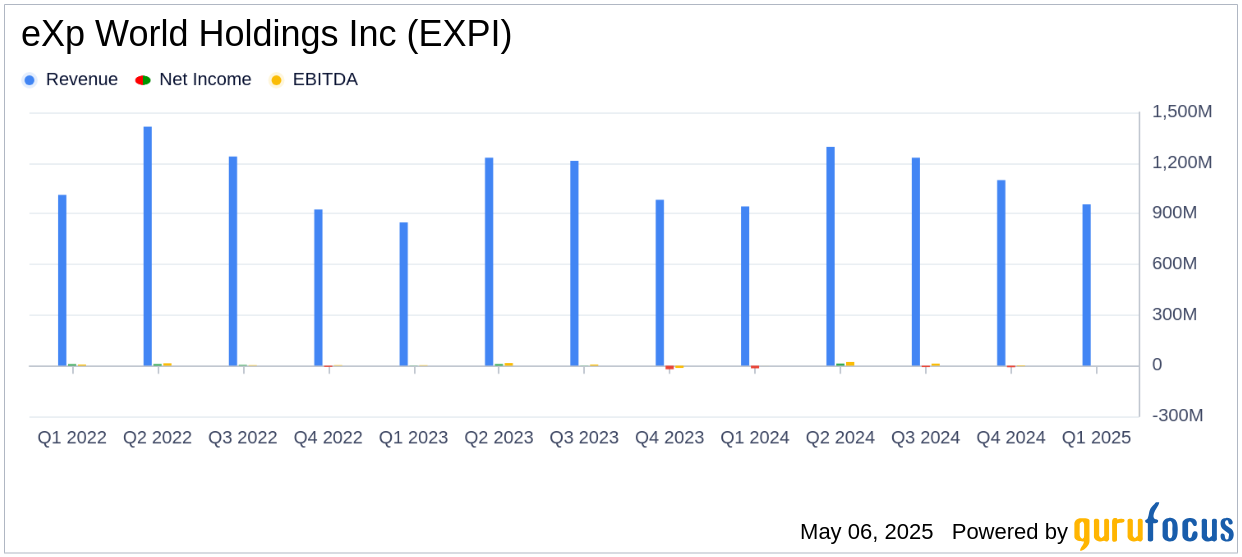

For the first quarter of 2025, eXp World Holdings reported a revenue of $954.9 million, marking a 1% increase compared to the same period last year. However, this figure fell short of the analyst estimate of $994.83 million. The company also reported a net loss of $11.0 million, translating to a loss per diluted share of $0.07, which is below the estimated earnings per share of -$0.01.

The company's performance highlights the challenges it faces in maintaining profitability while expanding its international footprint. The slight revenue growth indicates a need for strategic adjustments to meet market expectations and improve financial outcomes.

Financial Achievements and Industry Importance

Despite the challenges, eXp World Holdings achieved significant milestones in its international operations. The company more than doubled its international revenue year-over-year and expanded into new markets such as Perú and Türkiye. This international growth is crucial for a real estate company operating in a competitive and dynamic industry, as it demonstrates the scalability and adaptability of its business model.

Key Financial Metrics

eXp World Holdings reported an adjusted EBITDA of $2.2 million, a non-GAAP financial measure that provides insight into the company's operational efficiency. Additionally, the company had cash and cash equivalents totaling $115.7 million as of March 31, 2025, compared to $109.2 million a year ago. Net cash provided by operating activities was $39.8 million, with an adjusted operating cash flow of $28.2 million.

We’re entering 2025 from a position of strength. eXp has built one of the most comprehensive, tech-enabled agent value stack in the industry – one that’s driving record International agent productivity and empowering entrepreneurs at scale," said Glenn Sanford, Founder, Chairman and CEO of eXp World Holdings.

Analysis and Outlook

The financial results for Q1 2025 reflect both the opportunities and challenges faced by eXp World Holdings. While the company has successfully expanded its international operations, the revenue shortfall and net loss highlight the need for strategic focus on cost management and revenue enhancement. The company's commitment to enhancing technology and agent support is a positive step towards achieving long-term growth and profitability.

As the real estate industry continues to evolve, eXp World Holdings' innovative approach and global expansion efforts position it well for future success, provided it can address the current financial challenges effectively.

Explore the complete 8-K earnings release (here) from eXp World Holdings Inc for further details.