Summary:

- Arista Networks (ANET, Financial) impresses with strong Q1 results, exceeding both earnings and revenue expectations.

- Analysts forecast a significant upside potential with an average price target of $107.21.

- Despite current highs, GuruFocus suggests a fair value estimate that indicates a potential downside risk.

Arista Networks (ANET) has captured investor attention with its standout performance in the first quarter. The company reported non-GAAP earnings per share of $0.65, surpassing analyst estimates by $0.06. Moreover, revenue surged 27.4% year-over-year, reaching $2 billion and exceeding expectations by $30 million. Looking ahead, Arista Networks projects Q2 revenue to climb to $2.1 billion, edging past the anticipated $2.03 billion.

Wall Street Analysts Forecast

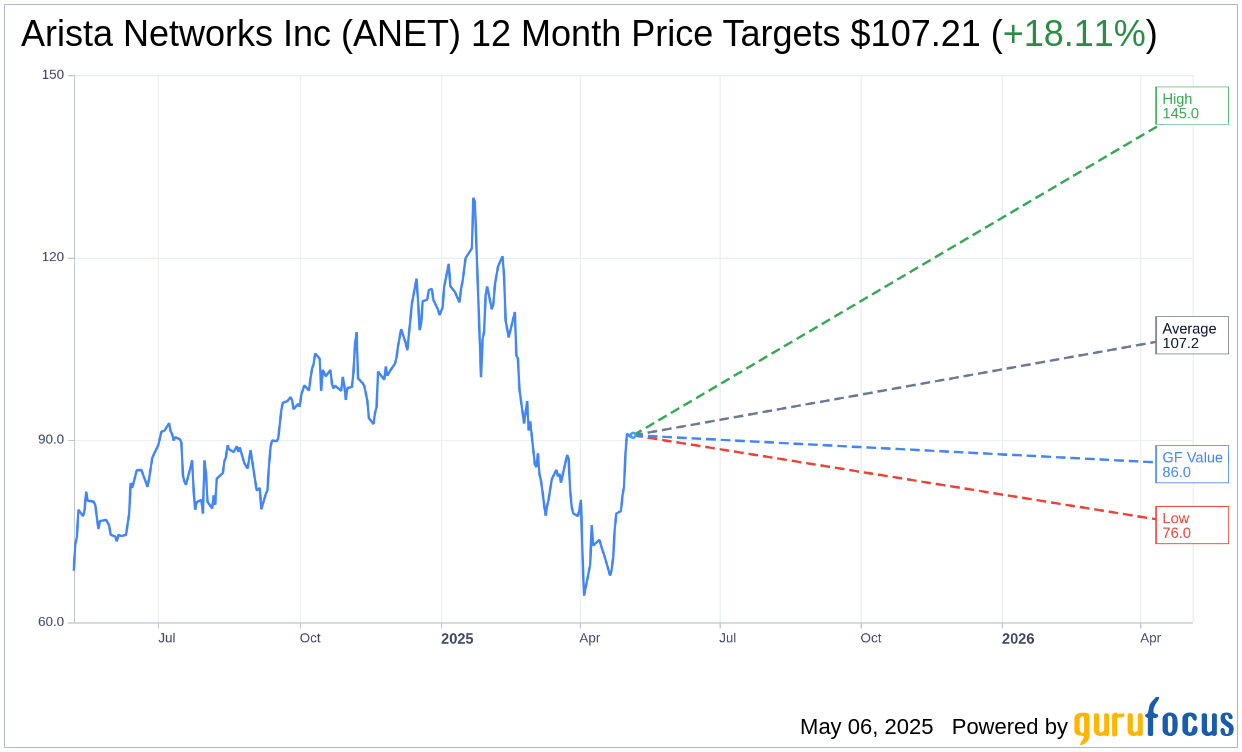

A comprehensive review of one-year price targets from 19 analysts reveals an average target price for Arista Networks Inc (ANET, Financial) at $107.21. This forecast presents a high estimate of $145.00 and a low estimate of $76.00, suggesting a potential upside of 18.11% from the current trading price of $90.77. For more detailed estimates, please visit the Arista Networks Inc (ANET) Forecast page.

Arista Networks is currently rated at an "Outperform" by 25 brokerage firms, reflected in an average brokerage recommendation of 1.9. This rating falls on a scale where 1 signifies a Strong Buy, and 5 denotes a Sell recommendation.

Despite its impressive performance, GuruFocus estimates a GF Value for Arista Networks Inc (ANET, Financial) at $86.01 for the next year. This implies a potential downside of 5.24% from the current price of $90.77, based on historical trading multiples, past business growth, and future performance projections. For more comprehensive data, refer to the Arista Networks Inc (ANET) Summary page.