Key Takeaways:

- Arcutis Biotherapeutics (ARQT, Financial) exceeded Q1 EPS and revenue expectations.

- Significant year-over-year revenue growth highlights strong business performance.

- Analysts predict a notable upside potential from current stock prices.

Arcutis Biotherapeutics Inc (ARQT) demonstrated strong financial performance in the first quarter, reporting a GAAP EPS of -$0.20, which surpassed analyst expectations by $0.02. The company's revenue also showcased robust growth, expanding by 32.8% year-over-year to achieve $65.8 million, exceeding forecasts by $3.32 million. On the liquidity front, Arcutis maintained cash and marketable securities of $198.7 million as of March 31, 2025.

Wall Street Analysts Forecast

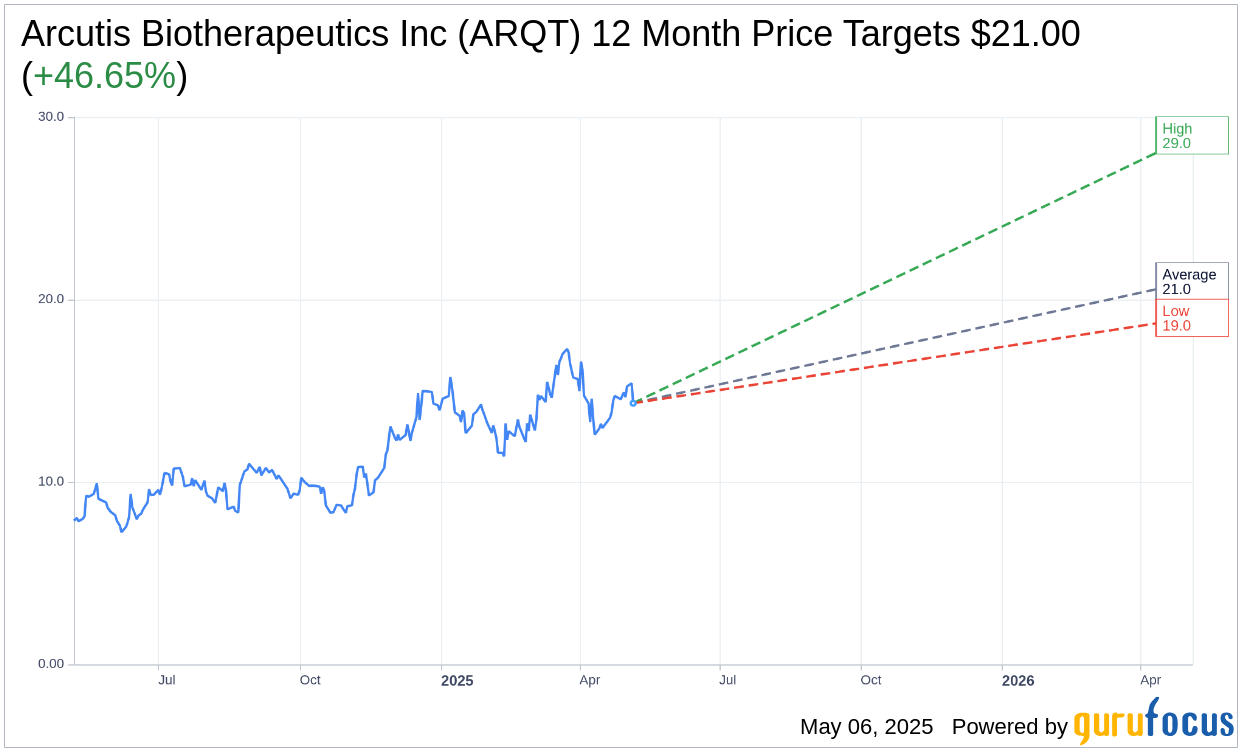

According to insights from seven Wall Street analysts, Arcutis Biotherapeutics Inc (ARQT, Financial) holds an average one-year price target of $21.00. Price projections range from a high of $29.00 to a low of $19.00, suggesting a promising upside potential of 46.65% from the current stock price of $14.32. For a more comprehensive breakdown, investors can visit the Arcutis Biotherapeutics Inc (ARQT) Forecast page.

Brokerage Recommendations

The stock's average brokerage recommendation stands at 1.7, placing it within the "Outperform" category. This rating, derived from seven brokerage firms, reflects their confidence in Arcutis's future potential. The rating scale employed ranges from 1 to 5, with 1 representing a Strong Buy and 5 indicating a Sell.

Investors who track biotechnology stocks may find Arcutis Biotherapeutics an appealing option given its recent financial achievements and positive analyst reviews, revealing a strong investment potential moving forward.