Key Highlights:

- Aris Water Solutions (ARIS, Financial) posts a solid revenue increase of 16.5% year-over-year.

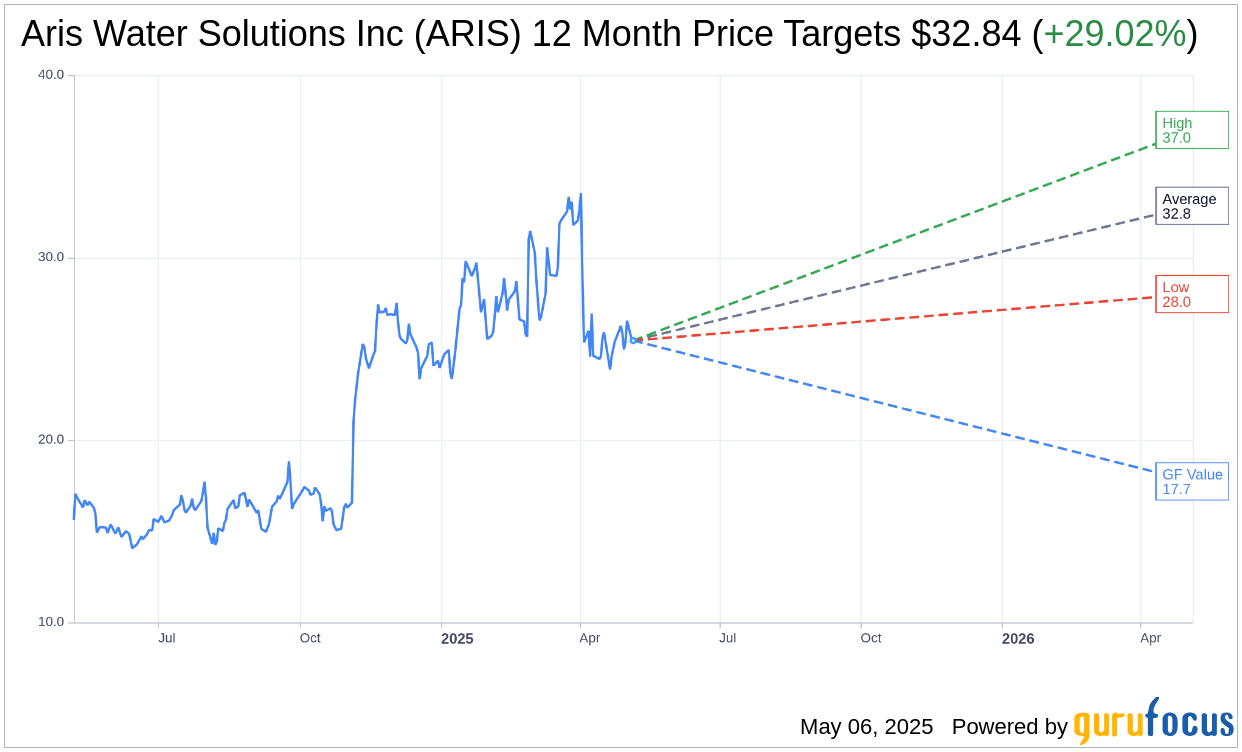

- Wall Street anticipates an average price target of $32.84, indicating a potential 29.02% upside.

- GF Value suggests a potential 30.33% downside, offering a mixed perspective on future valuation.

Aris Water Solutions (ARIS) recently announced its first-quarter financial results, showcasing an earnings per share (EPS) of $0.25, which missed projections by $0.02. However, the company reported a commendable revenue growth of 16.5% compared to the previous year, reaching $120.49 million—a figure that surpassed market estimates by $5.25 million.

Wall Street Analysts Forecast

Insights from 12 analysts reveal that the average one-year price target for Aris Water Solutions Inc (ARIS, Financial) stands at $32.84, with a high estimate of $37.00 and a low estimate of $28.00. This projection suggests a potential upside of 29.02% from the current stock price of $25.45. For more detailed estimate data, please visit the Aris Water Solutions Inc (ARIS) Forecast page.

Brokerage consensus, based on input from 13 firms, rates Aris Water Solutions Inc (ARIS, Financial) at an average of 2.2, translating to an "Outperform" recommendation. This rating scale ranges from 1 to 5, where 1 indicates a Strong Buy, and 5 signals a Sell.

According to GuruFocus's proprietary metrics, the GF Value estimate for Aris Water Solutions Inc (ARIS, Financial) over the next year is $17.73. This suggests a potential downside of 30.33% from the present price of $25.45. The GF Value represents GuruFocus's assessment of the stock's fair market value, which considers historical trading multiples, past growth, and projected business performance. For additional detailed data, visit the Aris Water Solutions Inc (ARIS) Summary page.