On May 6, 2025, Atomera Inc (ATOM, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. Atomera Inc, a company focused on developing and licensing semiconductor technologies, reported a net loss of $5.2 million, or $0.17 per share, which is below the analyst estimate of a $0.12 loss per share. The company's revenue for the quarter was $4,000, significantly lower than the estimated $0.10 million.

Company Overview and Strategic Initiatives

Atomera Inc is engaged in the development and commercialization of Mears Silicon Technology (MST), a proprietary process that enhances the performance of semiconductor transistors. The company recently signed a strategic marketing agreement with a leading chip fabrication equipment vendor and expanded its engagements with ST Microelectronics and RFSOI customers to new applications. Additionally, Atomera built its first MST-enabled GaN devices at Sandia and began electrical testing.

Financial Results and Analysis

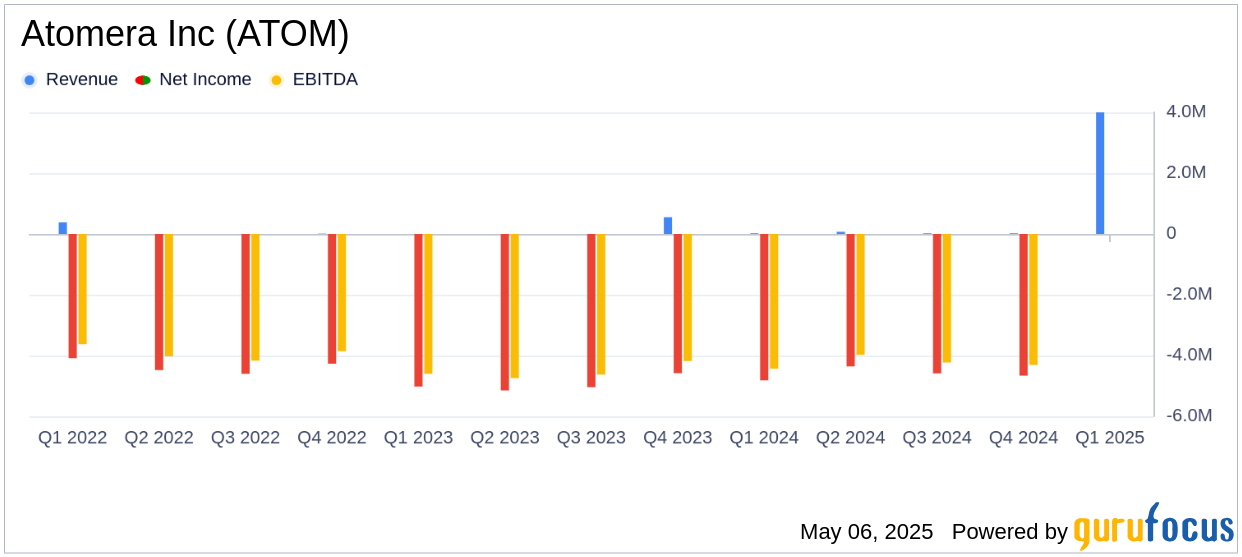

For the first quarter of 2025, Atomera Inc reported a net loss of $5.2 million, or $0.17 per share, compared to a net loss of $4.8 million, or $0.19 per share, in the same period last year. The adjusted EBITDA loss was $4.4 million, compared to a loss of $4.0 million in the first quarter of 2024. The company had $24.1 million in cash, cash equivalents, and short-term investments as of March 31, 2025, down from $26.8 million at the end of 2024.

Balance Sheet and Cash Flow

Atomera's balance sheet shows total assets of $26.3 million, a decrease from $29.1 million at the end of 2024. Current liabilities decreased to $2.9 million from $3.6 million, while stockholders' equity fell to $23.3 million from $25.1 million. The company's cash position remains a critical metric, reflecting its ability to fund ongoing operations and strategic initiatives.

Management Commentary

“Our recently announced collaboration with a leading capital equipment company will strengthen Atomera’s deal execution on many different levels. We believe the collaboration will drive our license revenues while growing our partner’s capital equipment tool sales giving incentives for both of us to make it a success,” said Scott Bibaud, President and CEO.

Conclusion and Outlook

Atomera Inc's first quarter results highlight the challenges faced by the company in achieving revenue growth and profitability. The strategic agreements and technological advancements indicate potential future opportunities, but the financial performance underscores the need for continued focus on commercialization and revenue generation. Investors will be keen to see how these strategic initiatives translate into financial performance in the coming quarters.

Explore the complete 8-K earnings release (here) from Atomera Inc for further details.