Service Properties Trust (SVC, Financial) reported its first-quarter revenue of $435.179 million, surpassing the anticipated $430.71 million. The company experienced a 2.6% growth in comparable hotel RevPAR, even as the hotel renovation program caused some revenue disruption. In addition to its strong financial performance, SVC successfully sold four hotels and three net lease properties, generating net proceeds exceeding $20 million. By the end of the quarter, the company maintained liquidity of over $680 million.

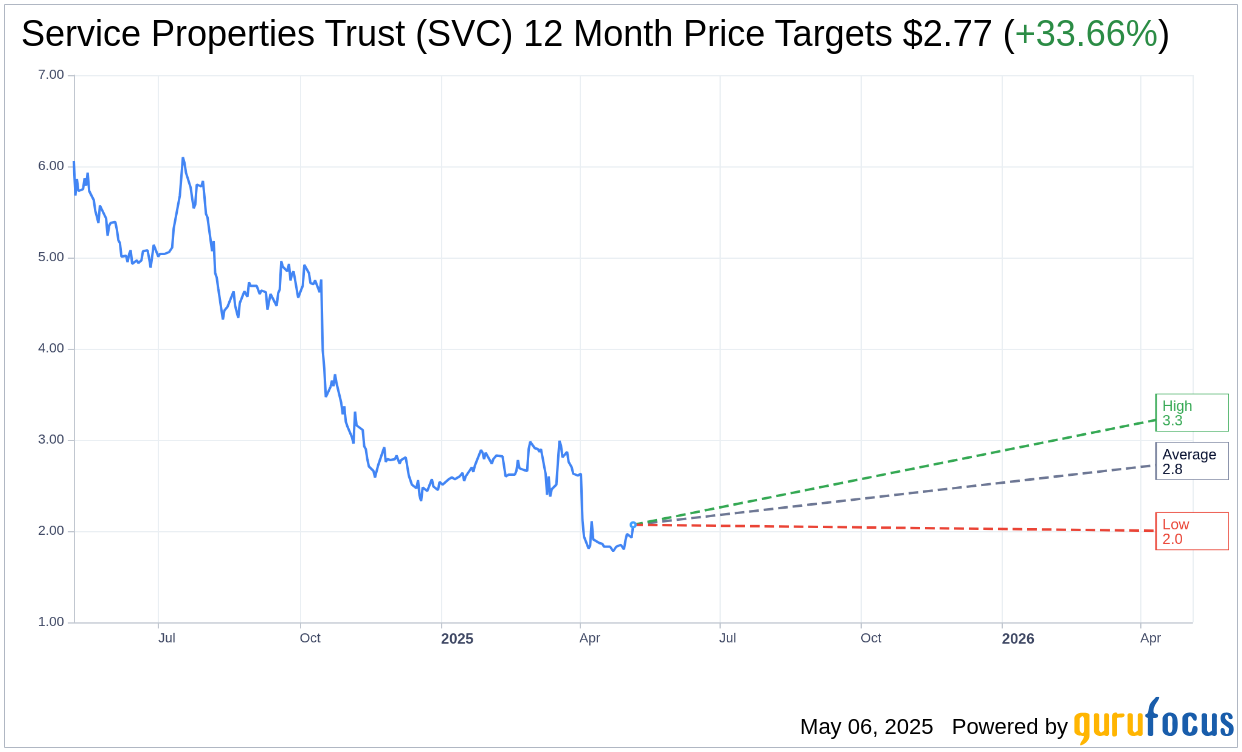

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Service Properties Trust (SVC, Financial) is $2.77 with a high estimate of $3.30 and a low estimate of $2.00. The average target implies an upside of 33.66% from the current price of $2.07. More detailed estimate data can be found on the Service Properties Trust (SVC) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Service Properties Trust's (SVC, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Service Properties Trust (SVC, Financial) in one year is $6.86, suggesting a upside of 231.4% from the current price of $2.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Service Properties Trust (SVC) Summary page.

SVC Key Business Developments

Release Date: February 27, 2025

- Comparable Hotel RevPAR Growth: 4.2% year over year.

- Excluding Renovations RevPAR Growth: 6.8% year over year.

- Full-Service Hotels RevPAR Growth: 4.3% year over year.

- Select Service Portfolio RevPAR Growth: 9.6% year over year.

- Extended Stay Portfolio RevPAR Growth: 1.2% year over year.

- Normalized FFO: $28.6 million or $0.17 per share.

- Adjusted EBITDAre: $130.6 million, a decline of 7.4% year over year.

- Interest Expense Increase: $9.4 million.

- Interest Income Decline: $8.4 million.

- Gross Operating Profit Margin: Declined by 160 basis points to 25.3%.

- Adjusted Hotel EBITDA: $43.1 million, a decline of 2.4% year over year.

- Debt Outstanding: $5.8 billion with a weighted average interest rate of 6.4%.

- Cash on Hand: $61 million.

- Capital Improvements: $85 million in Q4, $303 million for the full year 2024.

- Projected Q1 RevPAR: $82 to $84.

- Projected Q1 Adjusted Hotel EBITDA: $20 million to $24 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Service Properties Trust (SVC, Financial) reported its strongest hotel revenue growth in almost two years, with comparable hotel RevPAR growing 4.2% year over year.

- The company is successfully executing its strategy to sell 114 Sonesta hotels, expecting to net sales proceeds of at least $1 billion.

- SVC's net lease portfolio remains stable, with a 97.6% lease rate and a weighted average lease term of eight years, providing reliable cash flows.

- The select service portfolio showed exceptional growth, with RevPAR up 9.6% year over year, driven by occupancy growth.

- SVC is focusing on strengthening its balance sheet through asset sales and reinvesting in hotels with the highest opportunity for upside.

Negative Points

- Adjusted hotel EBITDA declined 2.4% year over year, impacted by renovation activities and pressures on expenses such as labor and real estate taxes.

- Normalized FFO decreased to $0.17 per share from $0.30 per share in the prior year quarter.

- Interest expense increased by $9.4 million, and interest income declined by $8.4 million, impacting financial results.

- The extended stay portfolio experienced a decline in ADR, with RevPAR growth of only 1.2%.

- The company faces continued disruption from hotel renovations, with 14 hotels expected to be under renovation in 2025.