Jamf (JAMF, Financial) reported first-quarter revenue of $167.6 million, exceeding market expectations of $166.22 million. This reflects the company's strong execution on growth and profitability strategies. CEO John Strosahl expressed satisfaction with these outcomes, reaffirming Jamf's commitment to achieving the Rule of 40, a popular SaaS growth metric.

On April 1st, Jamf expanded its capabilities by acquiring Identity Automation, a move expected to bolster the company's key growth drivers in security and mobile sectors. The integration of Identity Automation's identity and access management features into Jamf's platform is anticipated to enhance its appeal and functionality, further driving expansion in these strategic areas.

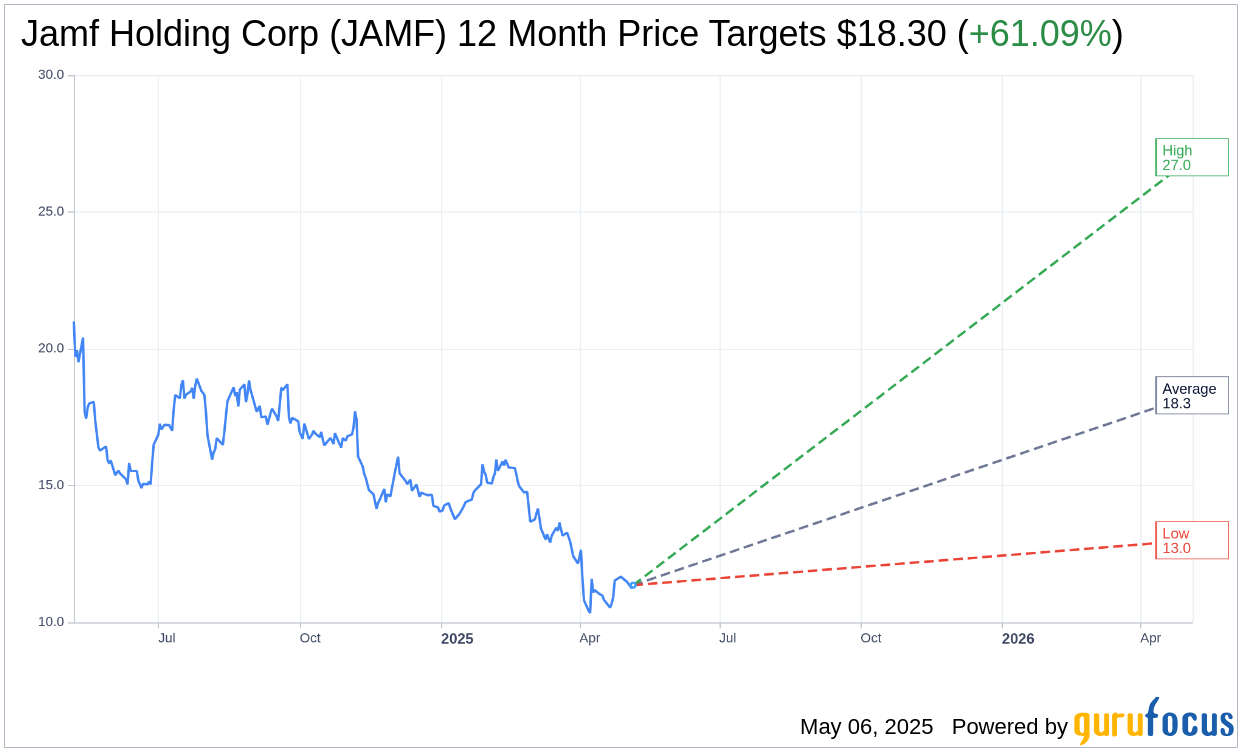

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Jamf Holding Corp (JAMF, Financial) is $18.30 with a high estimate of $27.00 and a low estimate of $13.00. The average target implies an upside of 61.09% from the current price of $11.36. More detailed estimate data can be found on the Jamf Holding Corp (JAMF) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Jamf Holding Corp's (JAMF, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Jamf Holding Corp (JAMF, Financial) in one year is $23.90, suggesting a upside of 110.39% from the current price of $11.36. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Jamf Holding Corp (JAMF) Summary page.

JAMF Key Business Developments

Release Date: February 27, 2025

- Q4 Revenue Growth: 8% year-over-year.

- Full Year Revenue Growth: 12% year-over-year.

- Non-GAAP Operating Income Margin (Q4): 18%.

- Non-GAAP Operating Income Margin (Full Year): 16%.

- Annual Recurring Revenue (ARR): $646 million, 10% year-over-year growth.

- Security ARR Growth: 17% year-over-year to $156 million.

- Net Retention Rate: 104% in Q4.

- Unlevered Free Cash Flow Margin: 12%, up from 10% in the prior year.

- Device Support: Approximately 33.2 million devices.

- Customer Count: 76,500 customers.

- 2025 Revenue Outlook (Q1): $165.5 to $167.5 million, 9-10% growth.

- 2025 Revenue Outlook (Full Year): $675.5 to $680.5 million, 8.1% growth at midpoint.

- 2025 Non-GAAP Operating Income Margin Outlook: 21% at midpoint.

- Unlevered Free Cash Flow Growth Outlook: At least 75% for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Jamf Holding Corp (JAMF, Financial) achieved strong Q4 results with an 8% year-over-year revenue growth and a non-GAAP operating income margin of 18%, exceeding their outlook.

- The company reported a full-year revenue growth of 12% and a non-GAAP operating income margin of 16%, meeting their financial targets for all four quarters of 2024.

- Annual Recurring Revenue (ARR) grew 10% year-over-year to $646 million, with security ARR growing 17% to $156 million.

- International revenue grew 17% in 2024, now representing over a third of total revenue, with expectations for continued growth as they invest in strategic geographies.

- Jamf Holding Corp (JAMF) launched a new partner program and system updates, showing significant uptick in partner-led deal registrations, indicating strong channel growth potential.

Negative Points

- Net retention rate decreased slightly to 104% in Q4, indicating some challenges in maintaining customer retention.

- Less strategic sources of revenue, such as services and licenses, continue to experience year-over-year declines.

- Trailing 12-month unlevered free cash flow margin was lower than expected at 12% due to delayed billings and collections.

- The company faced minor data reconfiguration issues that impacted ARR, customer count, and device count metrics.

- There is ongoing uncertainty in the selling environment due to layoffs and budget constraints, impacting future revenue growth projections.